XRP Does Better Than Its Main Rivals in September

This September, XRP has grown in price more than Bitcoin and Ethereum. Bitcoin and Ethereum both saw small gains, but XRP did much better. As October gets closer, people are starting to talk about XRP’s potential because it has been able to hold its value. Market experts think that this early momentum could set the stage for longer rallies that last into the last quarter of the year.

Bitcoin’s price momentum in the middle of September was hurt by its sensitivity to inflation data. Ethereum, on the other hand, saw a lot of money leave early in the month before bouncing back a little, putting XRP ahead. In the eyes of market participants going into the last quarter, this relative strength gives XRP a clear edge. People think that XRP’s ability to bounce back shows that it might be better prepared than its competitors for changes in the economy as a whole.

Technical Patterns Indicate Stronger Outlook

The way XRP’s price moved in September shows a bullish falling wedge breakout pattern. Analysts think this is a good sign that the market is going to go up. A lot of traders say that the setup shows that bullish conditions are building up under the surface, making the short-term environment better.

The recent wedge pattern started in July and reached its peak in September, when the trendlines began to come together. This setup confirmed a bullish breakout, which made investors more hopeful about making money in October. Chartists say that this wedge’s completion makes XRP more likely to move decisively higher in the fourth quarter.

Falling Wedge History Suggests Gains Ahead

The most recent falling wedge is like one that formed earlier this year and made a lot of money. That pattern came before a long rally that lasted almost 100 days. These kinds of patterns happening over and over again make investors more sure that XRP could do well again and reward holders again.

XRP went up 93% from $1.79 to $3.46 between January and April. Based on past events, the wedge breakout in September could have similar effects. A lot of technical analysts think that these repeating patterns show the rhythm of bullish cycles in XRP’s longer trading history.

Recommended Article: XRP Surpasses Bitcoin on Upbit as ETFs and Futures Fuel Historic Market Shift

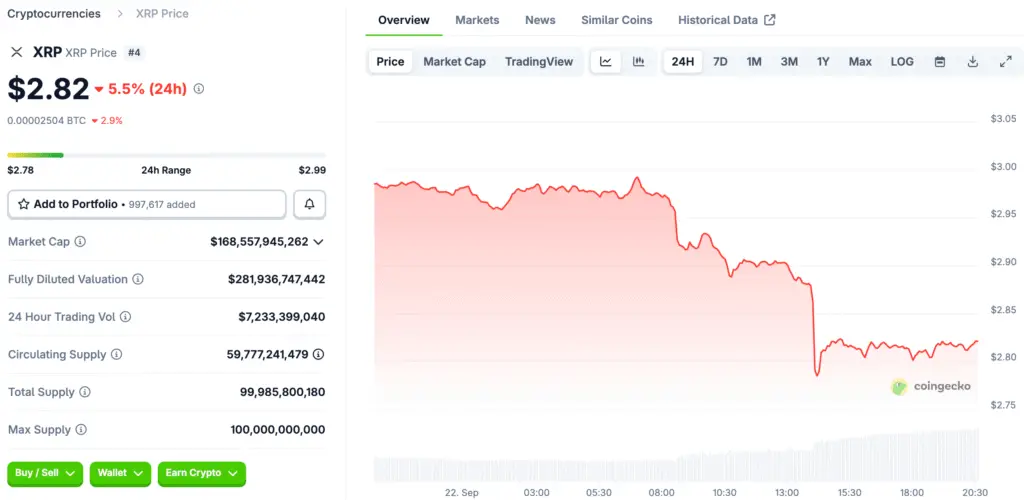

Psychological Resistance Close to $3

XRP has also had a lot of trouble getting past the three-dollar mark. Markets see round numbers as natural barriers that stop people from buying and selling. These areas act as checkpoints for investors to reevaluate and get ready for possible continuation or reversal signals.

On September 13, the price broke through the $3 mark, which showed bullish momentum. This important move showed that investors were very interested and that prices could go up even more above psychological levels. Traders now think this breakthrough is very important for proving that the upward trend will continue for the next few weeks.

Market Psychology Reinforces Price Action

Psychological price levels show how the market works because traders tend to do business around round numbers. Analysts say these areas are very important for showing how investors as a whole feel. The way prices cluster around these levels helps confirm market conviction and shows where support and resistance might be in the future.

Fidelity’s analysts and other trading desks show how these thresholds affect the balance of supply and demand. XRP’s activity above $3 for a long time shows that the market is becoming more confident and bullish. Sticking to these psychological milestones makes the case for a long-lasting rally into the last months of 2025 even stronger.

Macro Conditions Favor Risky Assets

In addition to technical signals, the state of the economy is also good for altcoins. The Federal Reserve’s recent rate cut has made markets more liquid, which has helped riskier assets. When the money supply is loosened like this, investors tend to move toward risky assets, which increases demand in cryptocurrency markets.

This influx of money could be good for altcoins like XRP. As traders look for other options besides Bitcoin, XRP could see a lot of money coming in through October and beyond. Analysts say that these positive macro factors could speed up price rises and keep higher valuations over the next few quarters.

XRP Set Up for Possible October Rally

XRP looks like it’s ready for a big jump up in October when you look at both technical and macroeconomic signals. This story is based on historical trends, psychological levels, and changes in liquidity. These factors that support each other give investors more than one reason to expect XRP to do better than other top assets.

There is no guarantee of an outcome, but the combination of signals makes me feel hopeful. If the momentum keeps going, XRP could be one of the best-performing cryptocurrencies by the end of 2025. This kind of momentum would also improve XRP’s reputation as one of the best digital assets for payments in the world.