SEC Poised to Make Decision on Grayscale’s XRP ETF

The U.S. Securities and Exchange Commission (SEC) is poised to reveal its decision regarding Grayscale’s proposed spot XRP ETF, a crucial development that may impact not just XRP’s valuation but also the overall direction of regulated cryptocurrency offerings in the United States.

Analysts suggest that this ruling signifies more than just a solitary decision; it has the potential to shape the SEC’s future approach to digital asset ETFs. Approval would represent a pivotal moment for the embrace of digital currencies by institutions, whereas rejection might indicate ongoing regulatory hesitance.

The Distinctive Features of a Spot XRP ETF

An exchange-traded fund (ETF) provides a way for investors to engage with cryptocurrencies without the need to possess them directly. Grayscale’s proposed product aims to monitor the spot price of XRP, delivering real-time value that reflects the token’s current market rate instead of relying on derivatives or futures.

Proponents contend that these ETFs offer a more secure and accessible option for investment, especially for conventional investors looking for regulated exposure. A spot XRP ETF has the potential to seamlessly incorporate digital assets into traditional financial portfolios, creating a connection between established finance and blockchain markets.

The Significance of the SEC’s Decision

The SEC is under pressure to make a timely decision regarding Grayscale’s application, whether that be an approval, rejection, or postponement of its verdict. Observers of the market suggest that the ruling issued today may set a significant benchmark for the way regulatory bodies assess future submissions for spot crypto ETFs.

If sanctioned, this move would reflect an increasing regulatory acceptance of crypto investment instruments and potentially enhance XRP’s market valuation as institutional involvement escalates. Nonetheless, a denial might momentarily dampen investor enthusiasm and indicate the SEC’s ongoing reluctance regarding direct involvement in cryptocurrency.

Recommended Article: Is XRP’s Current Struggle a Warning Sign for Crypto Startups?

Market Prepares for Uncertainty Ahead of Decision

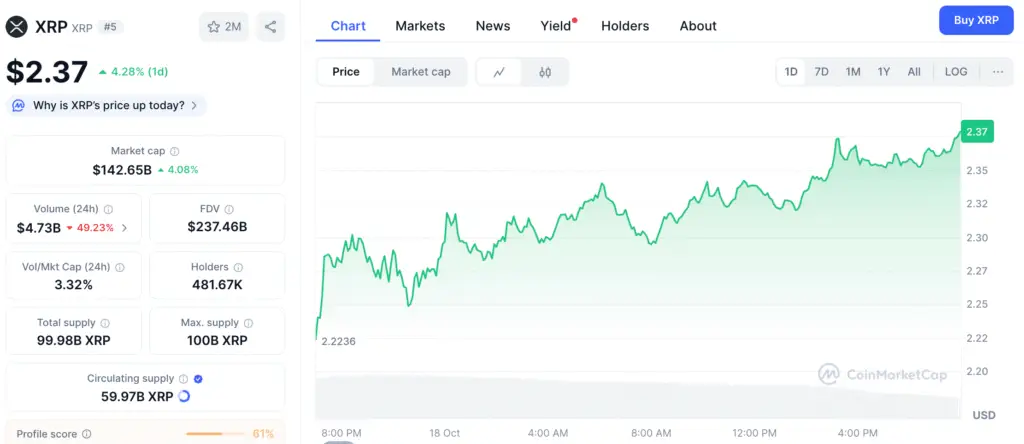

As the decision approaches, there has been a notable increase in XRP’s trading volume, indicating a rise in speculation from both retail and institutional investors. Online discussions and community forums are lively with forecasts regarding possible price movements in response to the SEC’s announcement.

Proponents are confident that Grayscale’s history of adhering to regulations will work in its favor for approval, particularly with the increasing interest from institutions in assets connected to blockchain. Critics, however, highlight that the SEC’s persistent worries regarding market manipulation and safeguarding investors may result in further postponements or a complete rejection.

The Implications of Approval for XRP

A favorable decision has the potential to rapidly enhance market confidence. By permitting regulated involvement via an ETF, the SEC would essentially recognize XRP as a credible investment category for both institutional and individual investors. This has the potential to draw significant investments from conventional financial institutions looking for varied opportunities in the digital asset landscape.

Furthermore, gaining approval would bolster XRP’s standing as one of the rare cryptocurrencies to receive such regulatory acknowledgment—possibly establishing a standard for other tokens such as Cardano (ADA) and Solana (SOL) that are pursuing comparable ETF frameworks.

The XRP ETF Effort Will Persist Despite Rejection

Should the SEC decide against Grayscale’s proposal, experts suggest it would not signify the conclusion of the XRP ETF initiative. Grayscale may opt to amend and resubmit its application after tackling the regulatory issues surrounding custody, transparency, and liquidity.

Previous denials of spot Bitcoin ETFs ultimately led to their eventual approval after extensive adjustments, indicating that XRP might experience a comparable journey. Despite the likelihood of short-term fluctuations, the outlook for regulated crypto funds in the long run appears to be encouraging.

XRP Ruling Could Accelerate Spot ETF Launches for Ethereum and Solana

The implications of today’s ruling extend well beyond XRP. An endorsement could hasten the launch of more spot crypto ETFs, setting the stage for regulated funds linked to Ethereum, Solana, and other prominent assets.

This decision highlights the significant presence of cryptocurrency in contemporary investment discussions, irrespective of the outcome. The convergence of established financial systems and cutting-edge blockchain technology is progressing, and the outcome of today’s decision may influence the ways in which investors engage with this emerging landscape.