Global Crypto Markets Experience a Slide

The cryptocurrency markets had a broad decline. This happened early on a Friday. It reflects a mix of several things. There were large-scale liquidations and options expiries. This is combined with ongoing risk-off sentiment.

Bitcoin, the largest cryptocurrency, fell. It dropped to $110,544. This was a 2.55% drop in 24 hours. A major whale transaction triggered this event. The whale sold 24,000 BTC.

Bitcoin Whale Sale Triggers Liquidations

The large whale transaction was very significant. The 24,000 BTC sold were worth about $2.7 billion. This event triggered forced liquidations. There was around $900 million in liquidations.

This amplified selling pressure across the whole market. It affected many different cryptocurrencies. It is a sign of market fragility. This can happen in very volatile markets.

XRP and Ethereum Suffer Sharp Declines

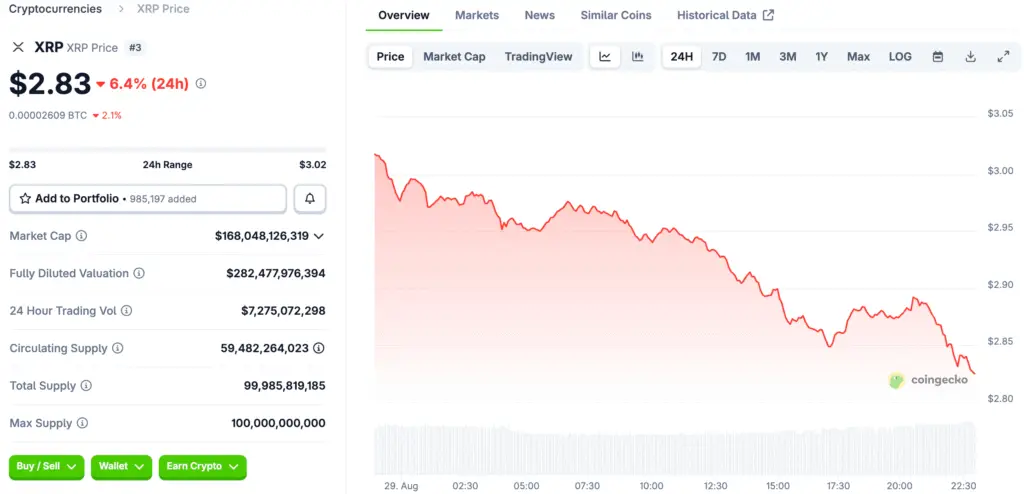

XRP and Ethereum both suffered steeper drops. XRP fell 4.63% to $2.87. Ethereum was down 4.83% to $4,390.65. This shows that altcoins were hit harder.

The selling pressure on XRP is significant. Its retracement aligns with market expectations. Analysts say it is approaching key support levels. This is near the $2.83 price point.

Trader Insights on Market Consolidation

Bitcoin’s struggle to reclaim higher zones is noted. Key support is at $110,000. Resistance is near $116,347. This is attracting a lot of attention. Traders suggest Bitcoin’s behavior signals consolidation.

This is not the start of a prolonged downtrend. It is a natural part of a cycle. Consolidation is good for a healthy market. It helps to shake out weak hands.

Recommended Article: Bold Forecast for XRP Sparks Debate Among Analysts

Market Capitalization and Trading Volume Fall

The total cryptocurrency market capitalization is down. It is trading at roughly $3.8 trillion. This is a 2.9% drop over 24 hours. The overall trading volume also fell. It dropped over 7%, indicating weaker participation.

Other coins experienced losses as well. Dogecoin was down 3.05%. Cardano was down 3.98%. BNB was down 1.61%. This shows a broad-based market drop.

Future Outlook and Potential Catalysts

Traders are monitoring today’s events. There is a $13.8 billion Bitcoin options expiry. This could drive short-term volatility. The outcome depends on how positions unwind. This can have a big impact.

Investors are remaining cautious right now. Some see this pullback as a natural reset. It could pave the way for a new rally. This would be later in Q4. It creates new buying opportunities.

A Time to Be Strategic in a Down Market

Dips like these can create opportunities. They are good for investors with a long-term view. Many altcoins are reaching key oversold levels. This is a time to be strategic.

Strategic market participants are advised to watch. They should watch support zones very carefully. They should assess potential entry points. This is for the most resilient assets.