XRP Falls 20% in October as Whale Transfers to Binance Trigger Sell-Off

XRP from Ripple saw a significant 20% drop in price after a notable increase in whale inflows to Binance. Major holders transferred substantial quantities of XRP to the exchange, indicating a clear intention to sell and prompting a rapid decline.

On-chain analysts noted that this abrupt surge in activity signified a departure from the tranquil trading environment of September. The significant surge of tokens exerted considerable downward pressure, wiping out the majority of the month’s initial gains and unsettling investor confidence.

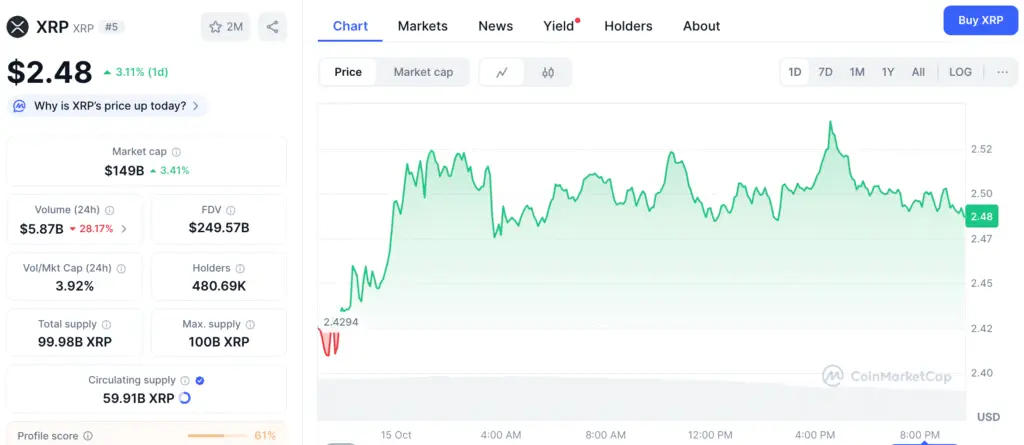

XRP Price Drops From $3.10 to $2.40 Within Days

CryptoQuant analyst Arab Chain noted that the most significant wave of inflows took place between October 10 and 12, causing XRP’s price to drop from $3.10 to $2.40. The significant decline occurred alongside extensive liquidations and profit-taking by major holders.

Arab Chain clarified that these inflow patterns frequently indicate “whale exits,” where tokens are transferred to exchanges prior to significant sell-offs. Historically, each wave of inflows has been linked to a subsequent decline in price momentum.

Profit-Taking by Major Investors Indicates Market Instability

The surge in tokens probably indicates that large investors are securing profits following XRP’s earlier recovery from the $1.00 mark. Experts observed that these calculated actions indicate a sense of prudence among major investors in light of the recent fluctuations across the market.

Following the slowdown of inflows after October 11, XRP established a brief period of stability around $2.60. The recent phase of consolidation indicated that the short-term liquidation pressure was subsiding, enabling the market to achieve a state of equilibrium.

Recommended Article: Pundit Says the XRP Price Will Unlock its True Value Soon but PDP Is Heading for Higher

Whales Have Sold More Than $5.5 Billion in XRP

Market analyst Ali Martinez disclosed that whales offloaded approximately 2.23 billion XRP from October 10 to 14, amounting to nearly $5.5 billion in value. This divestment decreased whale ownership to approximately 12% of the circulating supply.

Large-scale selling often leads to significant supply increases that smaller investors find difficult to manage. The outcome is heightened volatility, reduced liquidity, and an increasing sense of caution among retail participants.

XRP Tries to Bounce Back Following Significant Sell-Off

In the face of significant selling pressure, XRP demonstrated resilience by bouncing back 3% within a 24-hour period, trading close to $2.52 at the time of this report. Nonetheless, it is still down 11% for the week and 17% for the month, based on data from CoinGecko.

The recent price movement reflects a significant 160% recovery from previous lows around $1.00, which took place following a $19 billion liquidation event that impacted the crypto market. Experts indicate that this fluctuation signifies a wider uncertainty instead of a singular weakness.

Experts Point Out Discrepancies in Data Among Exchanges

EGRAG CRYPTO highlighted inconsistencies in the reported prices of XRP between Binance and Coinbase. The analyst asserted that discrepancies in data and inconsistent order books have amplified recent volatility, making precise market evaluations more challenging.

EGRAG has announced its commitment to utilizing a unified “Crypto Data Set” to enhance the clarity of its analysis. The analysis pinpointed $1.40 as the new long-term baseline for XRP, while $2.65 was highlighted as a key resistance level for breakout potential.

XRP Must Hold $2.40 Support as Bulls Target Breakout Above $2.65 Level

Experts suggest that staying above $2.40 is crucial for XRP to ensure short-term stability. A confirmed breakout above $2.65 may indicate a resurgence of bullish momentum and entice institutional investors to re-enter the market.

On the other hand, a drop below $2.40 could lead to additional decreases, potentially reaching $2.00. The current technical sentiment is varied, as traders are attentively observing whale activity and exchange inflow metrics for potential signals ahead.