XRP Consolidates Near Key Resistance Levels

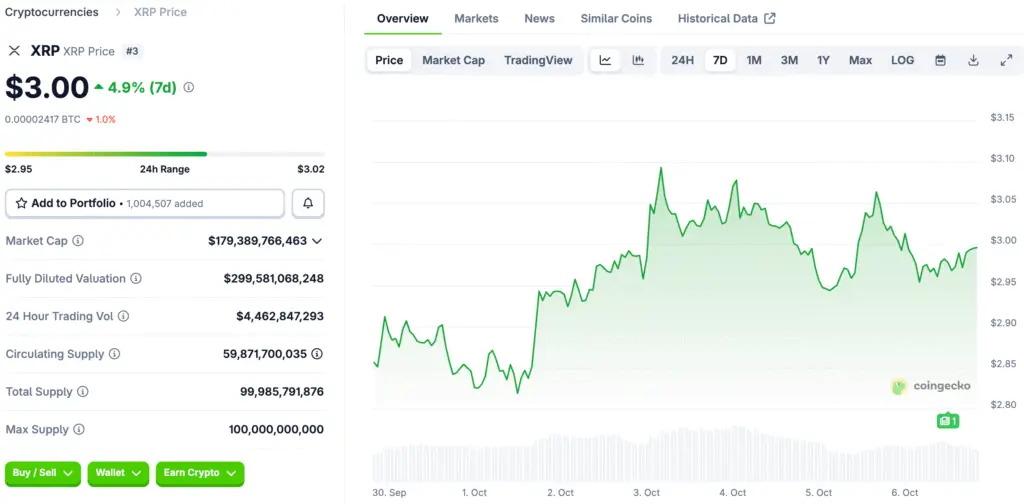

The price of XRP is currently stabilizing this week, remaining near its peak level since September 19. The token is presently valued at approximately $3, reflecting a 10% recovery from the lows observed in September. This consolidation occurs as several positive factors come together, creating an opportunity for a possible breakout if momentum picks up and surpasses resistance.

Market participants are keenly observing as XRP maintains its position above key technical levels, bolstered by favorable seasonal trends and increasing institutional interest via ETFs.

XRP Ledger Network Shows Strong DeFi and RWA Growth

The swift growth of the XRP Ledger (XRPL) ecosystem is a key factor contributing to the positive outlook for XRP. The total value locked (TVL) in XRPL’s DeFi sector has experienced a remarkable increase, now exceeding $107 million, which is almost double the $55 million recorded in January. XRPL is set to rank among the fastest-growing layer-1 networks in 2025.

OpenEden is at the forefront, boasting more than $172 million in assets, with Doppler Finance, XRPL DEX, and Ondo Finance trailing behind. The XRPL stablecoin supply has seen significant growth, increasing to $180 million from $72 million earlier this year, with Ripple USD (RLUSD) contributing $91 million to this total. The total assets of RLUSD, including Ethereum, have now surpassed $789 million, highlighting an increase in cross-chain traction.

Real-World Asset Tokenization Adds Momentum

XRPL is enhancing its role in the tokenization of real-world assets (RWA). The network’s RWA assets have seen an increase of 11% in the last 30 days, now totaling $361 million. This achievement positions XRPL as the tenth-largest chain in the RWA sector, underscoring its growing utility beyond mere payment functions.

The surge in growth is drawing the attention of institutions, as companies are progressively seeking to utilize blockchain for asset tokenization, settlement, and integration with decentralized finance.

Recommended Article: XRP and Bitcoin Battle for Top Investor Choice

ETF Inflows Showcase Strong Institutional Interest

ETF inflows are becoming a notable driver for XRP. The REX-Osprey XRP ETF (XRPR) has amassed over $87 million in assets, whereas the leveraged Teucrium 2x XRP ETF (XXRP) has collected more than $440 million.

The increase in ETF allocations reflects a rising confidence among U.S. institutional investors, who are progressively considering XRP and other leading cryptocurrencies as viable alternative assets. Excitement is growing as we await more inflows with the expected approval of additional XRP ETFs later this month.

Seasonal Boosts from the “Uptober” Surge

Traditionally, October has proven to be a robust month for cryptocurrency markets, frequently referred to as “Uptober.” The recent rise of Bitcoin to a new all-time high has positively influenced overall market sentiment. XRP is anticipated to gain from this seasonal trend, which usually stimulates renewed speculative interest in altcoins during the fourth quarter.

Historically, Uptober rallies have often served as triggers for XRP breakouts, especially when paired with robust network fundamentals and positive chart patterns.

Falling Wedge and Pennant Patterns Indicate Potential Breakout

The daily chart of XRP showcases multiple bullish patterns. The token has retraced from its annual high of $3.6638 and is currently establishing a falling wedge pattern, characterized by two converging downward trendlines that are approaching convergence.

This wedge is significant as it comes after a previous price rally, transforming into a bullish pennant continuation pattern. The price movement of XRP corresponds with a current Elliott Wave pattern, suggesting the possibility of a fifth wave surge should resistance levels be surpassed.

XRP Targets $3.6 Peak With 23% Upside as Breakout Setup Strengthens

The most probable outcome for XRP appears to be a surge towards its year-to-date peak of $3.6, indicating a 23% increase from the present levels. A significant breakthrough above this resistance may pave the way to the crucial $5 mark, fueled by ETF interest and network expansion.

On the other hand, a decline beneath the $2.70 support level would negate the bullish scenario and indicate a possible correction. Currently, momentum indicators and structural patterns suggest that the broader uptrend is likely to continue.

XRP Eyes Major Breakout as Bullish Patterns and DeFi Growth Align

With uncommon bullish patterns emerging and robust fundamental drivers at work ranging from DeFi expansion to ETF inflows, XRP is set for a potentially major breakout. Both traders and institutional investors are paying close attention to the unfolding rally in October, as $3.6 and $5 have become pivotal levels for the next upward movement.