XRP Whales Increase Holdings Amid Market Pause

Large XRP investors have accumulated nearly $560 million worth of tokens over the past week, showing confidence despite ETF delays. The accumulation comes as the U.S. government shutdown has temporarily frozen the Securities and Exchange Commission’s review process. Despite the pause, investor optimism remains strong for eventual ETF approvals. The scale of whale activity demonstrates sustained institutional conviction in Ripple’s long-term growth.

Government Shutdown Stalls ETF Approvals

The ongoing U.S. government shutdown, now in its 27th day, has halted several financial regulatory operations. Among these are pending ETF applications for XRP, which have faced extended deadlines. However, analysts expect rapid progress once federal agencies resume normal operations. Many believe the resumption will unleash a wave of ETF approvals across multiple digital assets.

Analysts Predict Post-Shutdown ETF Acceleration

Andrew Jacobson, general counsel at Halliday, stated that ETF approvals are likely once new listing standards are met. He emphasized that regulatory clarity and compliance readiness are key for institutional adoption. Jacobson anticipates that fall will become an active season for ETF launches once the SEC returns to full function. This outlook reinforces investor optimism that the XRP market could see renewed liquidity inflows soon.

Recommended Article: XRP Breaks Key Resistance as Bulls Target a $2.80 Price Surge

Institutional Demand for XRP-Based Funds Grows

Despite the delay in approvals, institutional investors continue to increase their exposure through existing ETF products. Rex-Osprey’s XRP ETF surpassed $100 million in assets under management last week. Similarly, Teucrium’s leveraged XRP ETF reached $366 million in total net assets since its April debut. These growing figures highlight expanding institutional appetite for regulated XRP investment vehicles.

Ripple Ecosystem Attracts Corporate Treasuries

Several companies are adding XRP to their corporate treasuries as part of diversification strategies. Firms such as VivoPower, Webus, and Evernorth have made substantial acquisitions, signaling faith in Ripple’s ecosystem. Evernorth alone holds approximately $947 million in XRP on its balance sheet, making it one of the largest corporate holders. This trend illustrates how Ripple’s infrastructure continues to integrate into institutional finance.

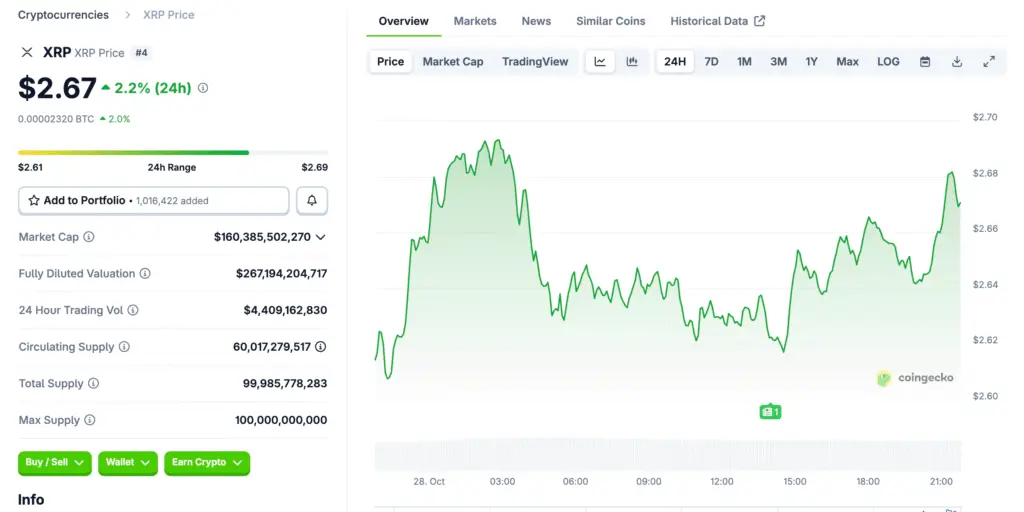

Market Activity Remains Resilient Despite Delays

XRP’s price and trading volume have remained stable throughout the ETF uncertainty. Analysts view this resilience as a reflection of strong underlying demand and long-term investor positioning. While speculative trading has slowed, consistent accumulation among whales suggests a strategic approach to capital deployment. This accumulation phase could lay the foundation for a major price breakout once regulatory clarity returns.

Institutional Confidence Strengthens Market Outlook

The scale of institutional participation in XRP ETFs underscores growing market confidence. Fund managers highlight Ripple’s expanding use cases in cross-border payments and tokenized assets. These fundamentals distinguish XRP from purely speculative tokens, providing a more stable foundation for price growth. The continued capital inflows also suggest that investors expect regulatory approval to eventually unlock greater market liquidity.

Outlook: XRP Positioned for Next Institutional Wave

With $560 million in whale accumulation and rising institutional exposure, XRP remains poised for renewed momentum. The eventual resolution of ETF applications could trigger a strong market revaluation. As more companies integrate Ripple’s solutions into financial systems, XRP’s long-term value proposition strengthens. Despite short-term uncertainty, whale accumulation signals sustained confidence in XRP’s institutional adoption trajectory.