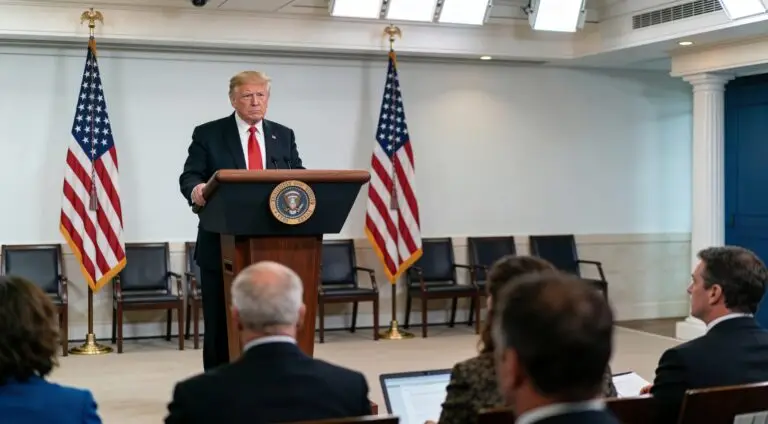

The US policies of high tariffs set out by President Donald Trump are set to put a dent on the Japanese automobile industry, which is one of the core building blocks of the Japanese economy, owing to the primary concern of ever-growing Tokyo’s uneasiness. The automobile industry is the core building block on which the Japanese economy functions. The ongoing US tax policies are a matter of concern for Tokyo.

Latest forecasts suggest that the expected consequence of the tariff will not only impact car manufacturers but also the suppliers of the parts, which could end up hurting the economy of Japan as a whole.

Tankan Survey: A Warning Sign

The confidence that the manufacturers are set to improve their production over a prolonged time has come down flat. This reduction in optimism happened for the first time over the last one year. Because of the survey, the Bank of Japan might have to rethink their interest rate drop plans—an outcome that feels unchangeable. Most likely, they will be left in an uncertain position regarding whether or not they deploy new cash into the system. Like pointed out previously, by the end of this year major Japanese manufacturers were set to claim—just to remain on the safer side.

Parts Suppliers on the Edge: A Chain Reaction

The effect of the tariffs received particular attention from smaller piece companies, which supply parts to bigger manufacturers, such as Ueda Manufacturing Ltd., and commercial vehicle parts makers in Ota Ward, Tokyo. Ueda Manufacturing has had steady business owing to increased demand for sightseeing buses, but the increased tariffs planned on foreign-made cars are creating tension. Daisuke Ueda, the company president, had the following to say: “If the auto tariff is raised, it will damage our business partners’ sales of commercial vehicles. In that case, we may receive fewer orders for auto parts.” This exposes the fragility of the supply chain; the imposition of tariffs on finished vehicles can set off a domino effect of adverse outcomes for parts producers.

Automakers and Beyond: A Widespread Impact

The automobile region is one of the strongest industrial activities in Japan and serves as the mainstay for a large number of producers. The presence of automakers and related industries is pronounced from the observation of the Tankan survey. Although there was some positive movement in the business confidence index from major automakers, there was a sharp drop in sentiment from smaller and mid-tier automakers, which fell seven points from plus 1 in December’s poll. This disparity shows the impact the tariff threat has been dealing to the economy, with smaller firms more adversely impacted by the uncertainty. Any contraction in the automobile industry, which is a pillar of the Japanese economy, is likely to trigger a chain reaction domino effect across multiple industries, which will stifle economic development.

The Service Sector: A Temporary Refuge?

The service industry in Japan, unlike the country’s manufacturing sector, appears to be doing better. The sentiment index for large nonmanufacturers reached its highest level in approximately 33 and a half years. Despite this optimism, businesses in the service sector are also pessimistic about the future. There is a forecasted dip in sentiment deterioration for the next 3 months and the index is expected to drop seven points. Businesses are under pressure from rising input costs, like raw materials, and the extent to which these can be passed on to consumers is a big question.

Labor Shortages: A Growing Challenge

According to the Tankan survey, labor shortages are a worrying problem in Japan and are presenting additional challenges for the economy. The labor supply index, which reflects the gap between hiring companies and applying businesses, stood at -38, a decline of 1 from the previous quarter. In small and mid-sized nonmanufacturing sectors, the index fell 4 points to -52. When an economy is unable to secure the necessary labor, they restrict their chance of outgrowing and expanding, which, when not done, prevents the economy from growing.

Small Businesses at Risk: A Cascade of Closures?

The president of Shinwa Kogyo, an intercom installer based in Shinjuku Ward, Tokyo, stressed the increasing wage spending on their employees. According to him, in an attempt to retain talent, the company increased wages by almost 8% on average last year. “We do not intend to make any further recruitments going forward,” he concedes. “Without enhancing employee welfare, it is impossible for us to maintain the required workforce.” Mid- and small-sized companies are likely to face a wave of closures and consolidations, shrinking the market, as there is unsustainable competition to recruit and pay sufficient wages, notes researcher Takeshi Minami from the Norinchukin Research Institute Co.

Summary: Economic Volatility and Need for Change

The situation for Japan’s economy is quite multi-layered. With the service industry exhibiting some vitality, the manufacturing industry, and more specifically the auto industry, seems to be contending with the possible consequences of U.S. tariffs on Japan. The ever-lasting labor shortage paints a grim picture and raises additional concerns regarding the future sustainability of the Japanese economy. There are calls for government action to help alleviate the growing challenges these economic headwinds pose to Japanese industries.