Bitcoin Slides to $108K as Ethereum ETFs Log Record Inflows

The crypto market’s bearish sentiment deepened on August 30, 2025, with Bitcoin leading a broad decline as investors reacted to persistent macroeconomic fears. While the overall market lost momentum, a stark divergence emerged as Ethereum continued to attract significant institutional capital. This dynamic suggests that a fundamental shift in investor preference may be taking shape, with capital flowing out of Bitcoin and into other major assets.

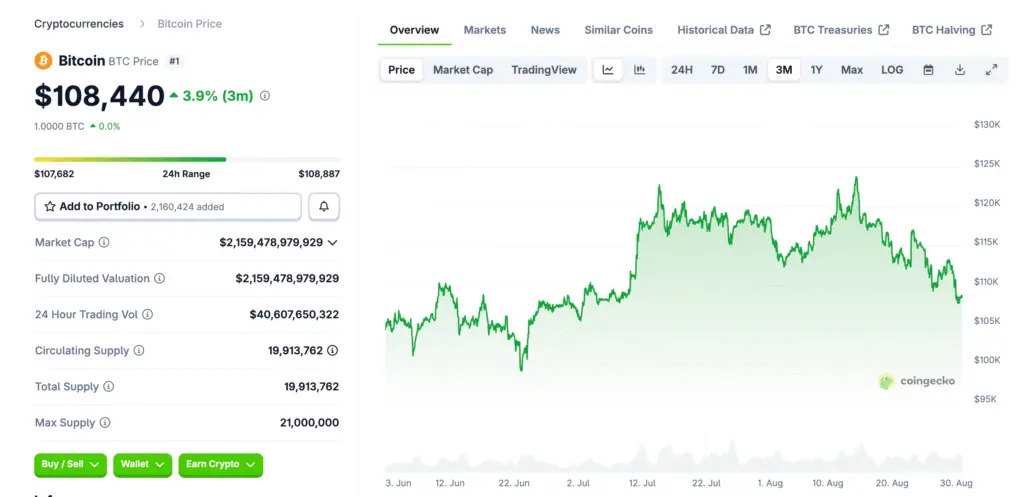

Bitcoin’s Downturn Deepens to $108K

Bitcoin’s price continued its slide, falling over 3% to trade near $108,000 by day’s end. This marked its lowest level since early July and its worst weekly performance since February. The downturn was fueled by profit-taking and lingering fears over persistent inflation data, which dampened risk appetite. A continued lack of buying volume suggests that a decisive rebound may not be imminent. The market’s inability to reclaim the $110,000 mark has raised concerns among traders about a potential deeper correction. Analysts are watching for signs of institutional capitulation, which could signal a further drop in price.

Ethereum Institutional Inflows Reach Record Highs

Ethereum was the clear outlier, with its ETFs poised to close August with more than $4 billion in net inflows. This impressive figure far surpassed the outflows seen in Bitcoin funds, highlighting a major rotation of institutional capital. Analysts are now closely watching whether this trend will continue, as it signals growing confidence in Ethereum’s ecosystem.

The strong performance provides a compelling counter-narrative to the broader market’s decline. This massive influx of institutional money is a powerful sign of confidence in Ethereum’s long-term utility and its role as a key player in the Web3 space. The growing institutional support has helped shield ETH from the worst of the market’s recent volatility.

XRP

XRP experienced a price dip, following the broader market’s negative sentiment and reversing its recent rally. However, on-chain data indicates that long-term holders are showing signs of accumulation. This suggests that some investors may see the current dip as a buying opportunity. The token’s movement remains highly correlated with major market shifts, highlighting its sensitivity to broader sentiment. The community is now looking for a new catalyst to push the price higher.

Cardano (ADA)

Cardano’s price also declined, falling alongside other major altcoins. Despite the short-term price action, the network’s fundamentals remain strong, with continued development and community engagement. This stability may help it weather the current volatility. Analysts believe that the pullback is a healthy consolidation phase before the next potential rally. Its strong fundamentals and ongoing development continue to attract long-term holders despite short-term volatility.

Shiba Inu (SHIB)

Shiba Inu’s price also saw a negative correction, unable to sustain its recent momentum. The token’s high volatility continues to make it a risky play in a challenging market environment. The correction wiped out some of the recent speculative gains, leaving the token vulnerable to further price swings. Its performance is heavily reliant on a positive shift in market sentiment and community-driven catalysts. Without new developments or a strong narrative, its price is likely to remain stagnant.

Dogecoin (DOGE)

Dogecoin’s price saw a dip, mirroring the broader market’s cautious sentiment. As a meme coin, its price is heavily influenced by market liquidity and is currently struggling to find a bullish catalyst. Analysts believe that without a new, compelling narrative, the coin may continue its sideways trading. The coin’s price movement is primarily tied to broader market trends rather than any unique fundamental developments.

Kaspa (KAS)

Kaspa, however, showed resilience and continued to gain attention as a potential new leader in the Layer-1 space. The network’s strength is tied to its upcoming technical upgrades, including the launch of smart contract functionality. This has positioned Kaspa as a project to watch in the coming weeks. Its recent resilience in the face of market-wide volatility highlights its potential to decouple from broader market trends. The upcoming upgrade is a major catalyst that could drive further price appreciation and developer interest.

A Major Test of Conviction Looms

The end of August presents a critical test for market conviction, with investors facing a clear choice between Bitcoin’s short-term bearishness and Ethereum’s long-term institutional momentum. The performance of these two assets in the coming days will likely set the tone for the market heading into Q4. Whether altcoins can capitalize on this narrative shift or remain tied to Bitcoin’s price will be the key story to watch.

Read more: Crypto Market Analysis (August 29, 2025): Bitcoin Tumbles Below $110K as Market Pulls Back