Bitcoin Rebounds Sharply Ahead of October Rally

Bitcoin started the week with renewed strength, climbing above $114,000 amid growing optimism about October’s historical performance. Traders and analysts pointed to the familiar “Uptober” trend as a key driver behind the rally.

The world’s largest cryptocurrency rose 2.1% to $114,007.8 in early Tuesday trading, hitting a 24-hour high of $114,776. This comeback follows last week’s dip below $109,000, triggered by heavy liquidations and a large quarterly options expiry.

Seasonal “Uptober” Trend Lifts Market Sentiment

Crypto traders often refer to October as “Uptober” because of Bitcoin’s consistent historical gains during this month. On average, Bitcoin has delivered more than 20% returns each October over the past decade.

This seasonal optimism, combined with improving technical setups, has encouraged bullish traders to re-enter the market. Many are now eyeing resistance levels near $116,000–$118,000 as potential breakout zones for further upside.

Whale Accumulation Adds Fuel to Bitcoin Rally

On-chain data revealed renewed buying activity from whales—large holders known for influencing market momentum. Their accumulation often signals confidence and can act as a strong support during volatile phases.

This wave of whale buying helped stabilize prices after September’s turbulence. It also reassured retail traders that institutional interest remains active despite recent profit-taking.

Political Uncertainty Keeps Investors Cautious

While Bitcoin’s rally sparked optimism, broader sentiment remains cautious as U.S. lawmakers race to avoid a government shutdown. Political deadlock could delay crucial economic data, including the upcoming nonfarm payrolls report.

Such delays may inject short-term uncertainty into financial markets, potentially influencing risk assets like cryptocurrencies if volatility spikes.

Recommended Article: Bitcoin Staking Launches on Ethereum Layer-2 Starknet With 100M STRK Incentives

Vanguard Considers Allowing Crypto ETFs on Platform

In a development closely watched by traditional investors, Vanguard Group is reportedly considering allowing cryptocurrency ETFs on its platform. Bloomberg reports the firm is evaluating investor preferences and regulatory clarity before making a decision.

If approved, Vanguard’s 50 million clients could gain access to Bitcoin and Ethereum ETFs managed by third-party issuers, potentially unlocking new inflows into the crypto market.

Ethereum, XRP, and Solana Show Modest Gains

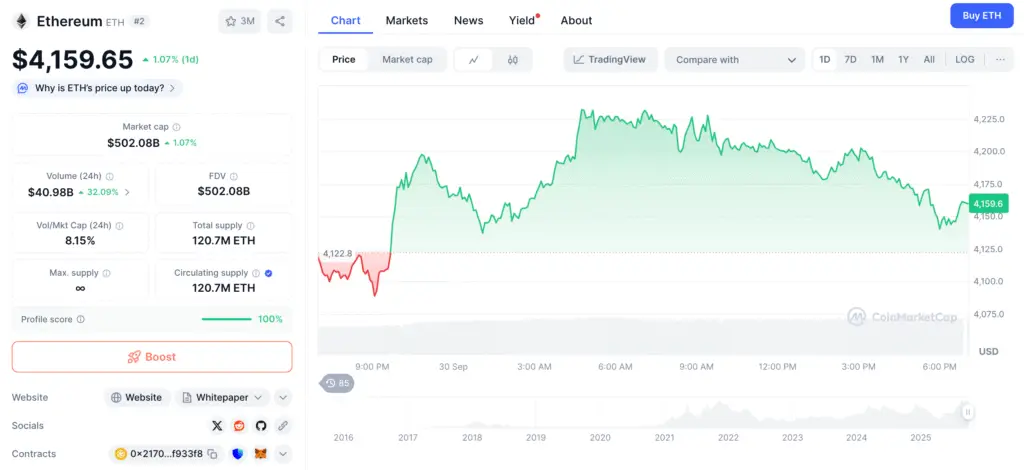

Altcoins followed Bitcoin’s positive momentum, though gains remained moderate. Ethereum climbed 2% to $4,159.65, supported by strong network activity and staking demand.

XRP added 1% to trade at $2.90, while Solana gained 0.8% and Cardano rose 0.6%. Polygon was the only major altcoin in the red, slipping 1% amid profit-taking.

Memecoins Struggle to Maintain Momentum

Meme tokens showed weakness despite the broader market recovery. Dogecoin fell 0.6%, while the TRUMP token dropped 1.5%. Traders appear to be rotating capital into more established assets as Bitcoin leads market direction.

Outlook: Key Levels to Watch for Bitcoin

Analysts are closely monitoring the $116,000 resistance as the next critical hurdle for Bitcoin. A decisive breakout could open the path toward $120,000, reinforcing bullish momentum heading into mid-October.

Conversely, failure to hold above $112,000 may invite short-term pullbacks, particularly if macroeconomic uncertainty intensifies. With whale accumulation underway and Uptober sentiment building, the market appears poised for a potentially pivotal month.