Major Bitcoin Holders Move Massive Amounts to Exchanges

Two of the largest and oldest Bitcoin holders have recently transferred massive amounts of BTC to major exchanges, raising eyebrows across the crypto trading community. According to on-chain data, the entities known as BitcoinOG (1011short) and Owen Gunden deposited billions worth of Bitcoin into Kraken and other exchanges since early October. Traders are closely monitoring these movements for signs of profit-taking or market repositioning as Bitcoin hovers near the $108,000 mark.

BitcoinOG Revives Shorting Strategy With Major Transfers

BitcoinOG, a pseudonymous whale famous for predicting and profiting from past downturns, is once again in the spotlight. This trader, known for making $197 million from well-timed short positions during the October 11 crash, has now transferred over 13,000 BTC—worth roughly $1.48 billion—to Kraken, Binance, Coinbase, and Hyperliquid. Analysts suggest these transfers could be preparation for leveraged shorts or portfolio rebalancing, both of which typically precede periods of heavy volatility.

Exchange Deposits Reflect Bearish Trading Sentiment

Recent blockchain activity shows that BitcoinOG’s wallets have continued to make incremental deposits, including 500 BTC to Kraken on November 2. These smaller but consistent transfers mirror trading patterns seen in previous bearish cycles, where whales gradually accumulate short exposure after bullish rallies. The market is now bracing for potential downward pressure if these deposits translate into active sell orders.

Recommended Article: Elon Musk’s Bankruptcy Warning Reignites Debate About Debt, Bitcoin And U.S. Trajectory

Satoshi-Era Holder Owen Gunden Reactivates Dormant Wallets

Meanwhile, early Bitcoin adopter Owen Gunden has also re-emerged after years of inactivity. Known as one of the few remaining Satoshi-era holders, Gunden reportedly amassed more than 15,000 BTC during Bitcoin’s infancy. Between October 21 and November 3, he transferred 3,265 BTC—valued at $364.5 million—to Kraken through multiple transactions. These include 364 BTC on October 22, 1,448 BTC on October 29, and 483 BTC on November 3, marking his most active exchange inflow in years.

Old Bitcoin Wallets Awaken as Market Consolidates Near $110K

Blockchain intelligence firm Arkham has confirmed that several of Gunden’s decade-old wallets have been reactivated. The reactivation coincides with Bitcoin’s stabilization between $110,000 and $115,000 following October’s volatility. This activity has fueled speculation that long-term holders may be taking advantage of current prices to realize partial gains or restructure holdings before the next market leg.

Analysts Caution Against Panic, But Warn of Short-Term Turbulence

While analysts acknowledge that large inflows to exchanges often precede selling activity, they caution against assuming immediate liquidation. Depositing BTC into exchanges can serve multiple purposes—from collateralizing leveraged trades to facilitating portfolio adjustments. However, historical data suggests that whale movements of this magnitude frequently trigger 5% to 10% pullbacks before stabilizing.

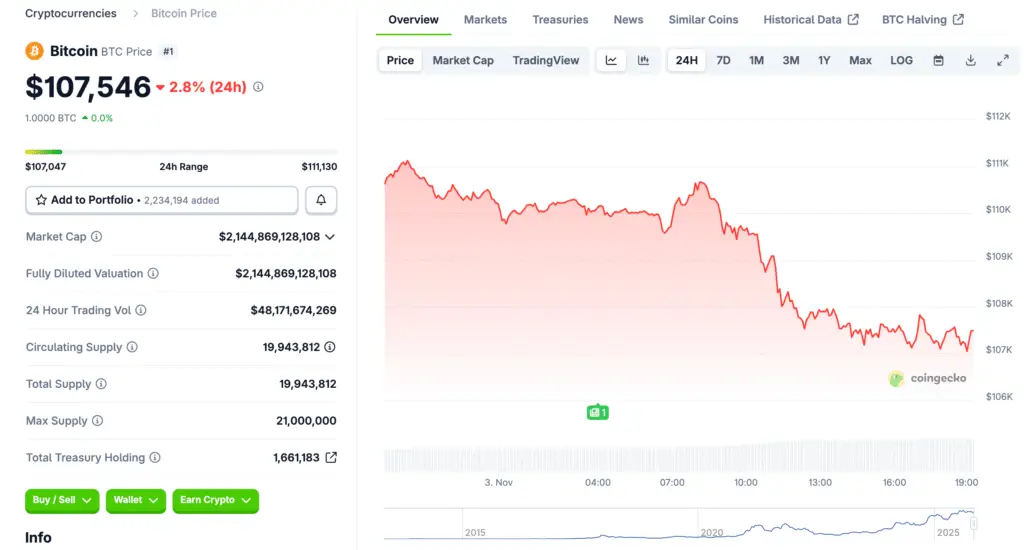

Traders Eye $108K Support as a Key Technical Level

Technical traders are closely watching Bitcoin’s $108,000 support level. A breach could open the door to a sharper correction toward $103,000, while a strong defense might signal renewed accumulation. Market participants remain divided: some see the whale deposits as bearish indicators, while others interpret them as strategic positioning ahead of future volatility.

Outlook: Volatility Looms as Whales Return to Action

As long-dormant Bitcoin veterans re-enter the trading arena, volatility seems inevitable. Whether these moves signify profit-taking or preparation for another leg up remains uncertain. Still, their reactivation underscores a critical shift in sentiment among early adopters, reminding traders that even in mature markets, old whales still have the power to make waves.