Ethereum Maintains Bullish Momentum Near Key Resistance

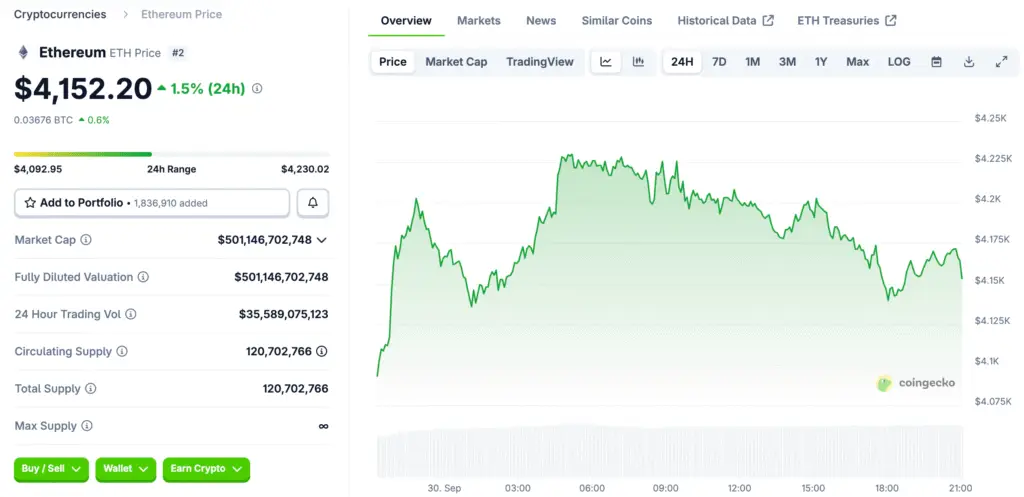

Ethereum continues trading close to $4,152, signaling a cautiously bullish stance for the coming months. The current price action shows strength, supported by growing institutional participation and network upgrades that improve scalability and efficiency.

A breakout above $4,200 remains crucial for ETH’s short-term trajectory. Traders are closely watching this level because surpassing it could unlock further upside potential, setting the stage for a strong fourth quarter rally.

Technical Levels Shape Ethereum’s Short-Term Direction

Ethereum’s price sits between critical moving averages, creating a battleground for bulls and bears. The 20-day EMA at $4,263 and 50-day EMA at $4,212 act as resistance, while the 100-day EMA at $3,865 provides reliable support beneath.

If ETH manages to close decisively above these moving averages, momentum could accelerate toward $4,600–$4,800. Conversely, a failure to hold the $3,865 support zone might trigger renewed consolidation or deeper corrections into the $3,400 area.

Fusaka Upgrade Could Ignite Next DeFi Boom

Ethereum developers are preparing for the Fusaka upgrade scheduled for November 2025, marking a significant leap in network capacity. This update includes increased data throughput and gas limit refinements, enabling faster and cheaper transactions.

Lower costs and improved scalability could reignite decentralized finance activity, attracting builders and users back to Ethereum-based applications. Analysts believe this upgrade could be a key catalyst for renewed price momentum heading into 2026.

Recommended Article: Bitcoin Staking Launches on Ethereum Layer-2 Starknet With 100M STRK Incentives

Institutional Interest Continues to Strengthen ETH Demand

Ethereum remains a top choice among institutional investors, thanks to ETF inflows and staking rewards. Recent filings for diversified crypto products featuring ETH indicate rising regulatory acceptance and growing comfort among traditional finance participants.

Large-scale institutional allocations reduce circulating supply, tightening liquidity and applying upward pressure on prices. If this trend persists, Ethereum may achieve sustained growth over the next five years, potentially setting new all-time highs.

Long-Term Price Projections Show Strong Growth Potential

Forecasts between 2025 and 2030 suggest Ethereum could rise significantly as adoption expands. Projections see ETH reaching between $4,800 and $5,250 by late 2025, with targets of $7,000–$8,000 in 2026 if momentum accelerates.

By 2030, analysts estimate Ethereum could trade between $13,500 and $16,500, depending on regulatory developments, staking participation, and ecosystem growth. Such appreciation would mark a substantial increase from current levels, rewarding long-term holders.

Macro and Regulatory Shifts Pose Key Risks

Despite bullish forecasts, Ethereum faces several external challenges that could affect price performance. The U.S. Treasury’s GENIUS Act proposal raises questions about stablecoin reserves, which could impact on-chain transaction volumes.

Additionally, macroeconomic volatility—such as interest rate shifts or geopolitical events—may influence investor behavior and short-term capital flows into crypto markets. Traders must monitor these factors closely to anticipate potential headwinds.

Key Levels to Watch for the Next Breakout

In the near term, Ethereum must clear resistance at $4,260–$4,600 to sustain bullish momentum. A daily close above this range could open the path toward $4,800–$5,000 by year-end.

Support remains firm around $3,865 and $3,420. As long as these zones hold, analysts expect upward continuation. Traders view the $5,000 mark as both a psychological and technical milestone that could define Ethereum’s trajectory into 2026 and beyond.

Ethereum’s Road to $5K Looks Increasingly Promising

Ethereum’s strong fundamentals, upcoming network upgrades, and institutional inflows make a compelling case for long-term growth. While short-term volatility remains likely, the medium- to long-term outlook continues to favor gradual appreciation.

With decisive resistance breaks and successful Fusaka implementation, ETH could soon test the $5,000 level, positioning itself as a dominant force in the next crypto cycle.