A Major Step for Dogecoin Institutional Adoption

In a significant development for the cryptocurrency market, Grayscale Investments has submitted a formal application to the U.S. Securities and Exchange Commission (SEC) to convert its existing Grayscale Dogecoin Trust into a spot exchange-traded fund (ETF). The proposed ETF, which would trade on NYSE Arca under the ticker symbol “GDOG,” is structured as a passive investment vehicle that directly holds Dogecoin.

This application marks a major step in the institutional adoption of Dogecoin (DOGE) and is a powerful signal that the world’s leading meme coin is being taken seriously as an investment asset. The proposed fund, which will not use derivatives or leverage, aligns with Grayscale’s commitment to institutional-grade infrastructure, with Coinbase Custody Trust managing the custody of the ETF’s assets.

Grayscale Proposal Reflects Open Regulation

The Grayscale application is the latest in a series of regulatory developments that are reshaping the crypto space. This move follows the SEC’s recent approvals of spot ETFs for Bitcoin and Ethereum, which significantly boosted market activity and institutional participation for those assets. Grayscale’s prior success in converting its trusts for these cryptocurrencies into ETFs suggests a potential playbook for the Dogecoin application.

The firm’s move with DOGE could have similar effects, especially as the crypto market continues to evolve and more institutional players enter the space. The SEC’s recent rule changes on in-kind redemptions and favourable court decisions suggest a more open regulatory environment for digital assets, which could increase the likelihood of approval for Grayscale’s proposal.

Dogecoin’s Price Reaction and Market Resilience

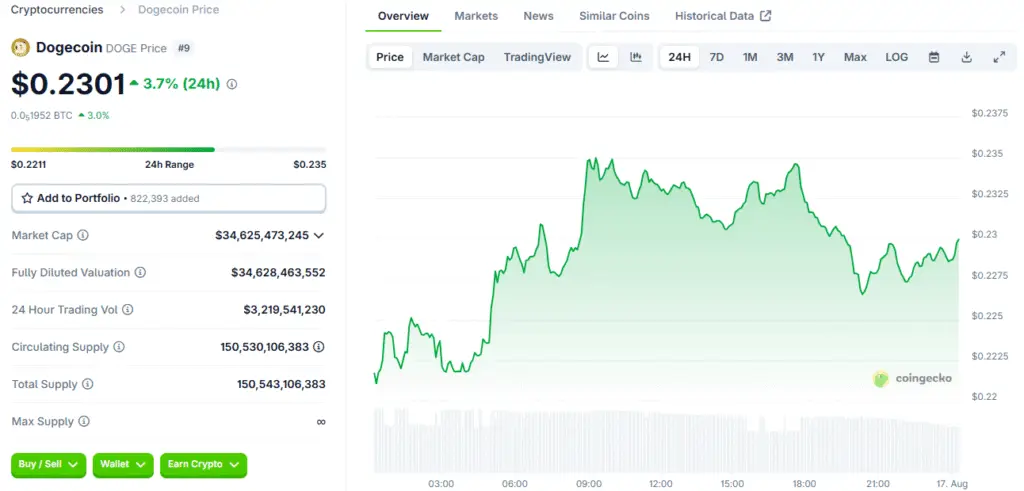

Following the filing, Dogecoin’s price saw a modest but notable increase, rising nearly 2% within 24 hours. This price action reflects investor optimism about the potential listing and a new sense of legitimacy for the token. While the 24-hour trading volume of DOGE dropped by 23.90% in the same period, the asset has shown resilience, posting a 33.44% gain over the past 60 days, despite a minor weekly decline.

This resilience is a key factor that analysts are watching, as it suggests that the asset has a strong base of holders who are not deterred by short-term volatility. The potential approval of the GDOG ETF could mirror the success of other crypto ETFs, increasing liquidity and institutional participation and providing a new source of structural demand for the token.

Grayscale’s Strategy and Market Impact

Grayscale’s strategy with Dogecoin is to position it as a legitimate investment vehicle for institutional and retail investors. The proposed ETF will provide a regulated and secure way to gain exposure to DOGE without the complexities of direct ownership. If approved, the ETF would be renamed the Grayscale Dogecoin Trust ETF and begin trading on NYSE Arca.

This would make it easier for a wider range of investors, from individuals with a brokerage account to large financial institutions, to buy into the asset. This increased accessibility would be a major catalyst for the token, potentially increasing its liquidity and leading to new price appreciation. The filing is part of a broader trend of institutional interest in crypto ETFs, with several other firms also submitting applications for Dogecoin-related ETFs.

Read More: Solana and Dogecoin Surge as Bitcoin Nears New All-Time Highs

Cautious Optimism for a Dogecoin ETF

While the potential for a Dogecoin ETF offers cautious optimism for long-term adoption, analysts still caution that volatility persists. The Coincu research team has noted that while DOGE remains a volatile asset, its potential alignment with SEC expectations offers a more positive long-term outlook. The regulatory landscape for digital assets remains dynamic, and the approval of the GDOG ETF could serve as a pivotal moment in the broader acceptance of cryptocurrencies as investment vehicles.

Investors will be closely watching the SEC’s decision, as the outcome could influence future applications and shape the trajectory of the crypto market. The approval would not only provide a new level of legitimacy for Dogecoin but would also send a strong signal to the market that a wider range of altcoins are now being considered for institutional adoption.

A PIVOTAL Moment for the Meme Coin Sector

The filing of a spot Dogecoin ETF is a pivotal moment for the entire meme coin sector. Historically, meme coins have been seen as speculative, high-risk assets with little to no utility. However, the Grayscale application challenges this perception, as it is a direct endorsement of the asset by a major institutional player. This move could pave the way for other meme coins to be considered for similar financial products, creating a new era of institutional adoption for the sector.

The success of the GDOG ETF would be a powerful proof of concept, demonstrating that even a cryptocurrency that started as a joke can mature into a legitimate investment vehicle. This could fundamentally change how investors view meme coins and their role in a diversified portfolio.

Grayscale Filing Could Solidify Dogecoin

The path ahead for Dogecoin is now clearer than ever, with a major institutional player backing it. While the SEC’s decision is not a foregone conclusion, the filing itself is a significant step forward. The potential for a spot ETF, combined with the token’s existing resilience and its strong community, creates a compelling case for its long-term future.

The approval would not only provide a new level of liquidity and institutional participation but would also solidify Dogecoin’s position as a permanent fixture in the crypto landscape. The market will be watching closely to see if Grayscale’s success with Bitcoin and Ethereum can be replicated with the world’s leading meme coin. The outcome could have a lasting impact on the trajectory of the crypto market and the future of institutional adoption.