The Resurgence of Bitcoin and Growing Institutional Confidence

Bitcoin, the original cryptocurrency, continues to hold its dominant position in the market. Over the last few months, its value has seen a significant increase, climbing more than 17%. This impressive growth is driven by a combination of positive fundamental factors, including favourable policy shifts, increasing global economic instability, and the rising possibility of a rate cut. On a technical level, the bullish momentum is also strong. One of the most powerful and enduring catalysts for Bitcoin’s recent success, however, has been the unwavering confidence of large institutions.

These entities have demonstrated a remarkable commitment to the asset, continuing to accumulate holdings even during periods of price volatility. A striking example of this trend is the surge in institutional Bitcoin holdings, which have grown by an impressive 65% in a short period, from approximately 600,000 at the start of the year to nearly a million today. This steadfast accumulation, even during a steep 30% sell-off, highlights a long-term bullish sentiment from some of the market’s most influential players.

DeepSeek’s Powerful Forecast for Bitcoin’s Price

In an effort to analyze this complex market behaviour and project future price movements, the provided data was fed into DeepSeek, one of the most advanced AI chatbots available. The analysis, which also took into account Bitcoin’s current technical setup, resulted in a compelling and ambitious price projection. By examining a classical measured move analysis, the AI identified a strikingly similar vertical depth in Bitcoin’s two most recent corrective ranges.

This suggests the market is operating within a harmonic rhythm. Projecting this same depth onto the latest breakout provides a logical price target for the current cycle. According to this analysis, Bitcoin could potentially mirror the previous rally’s leg, setting a lofty price target of around $175,000. While a nearly 50% gain from current levels is a solid profit opportunity, the analysis also points to a historical pattern where major Bitcoin rallies trigger even more explosive altcoin booms, offering far higher returns to savvy investors.

Addressing the Scalability Challenges of the Bitcoin Network

While Bitcoin remains a powerhouse as a store of value and an investment asset, it has long been hindered by a set of fundamental limitations. The network’s design, while robust and secure, is not built for speed or high throughput. Currently, the Bitcoin blockchain can only handle around seven transactions per second, which severely limits its potential for widespread, everyday use. This slow transaction speed often leads to network congestion and rising transaction fees, creating a barrier to entry for many users.

Furthermore, unlike more modern blockchains such as Ethereum and Solana, Bitcoin lacks native Web3 compatibility. This means it has been unable to support the development of smart contracts and decentralised applications (dApps), a crucial part of the modern crypto ecosystem. These limitations have confined Bitcoin primarily to its role as a digital store of value, while other networks have flourished in the dApp space.

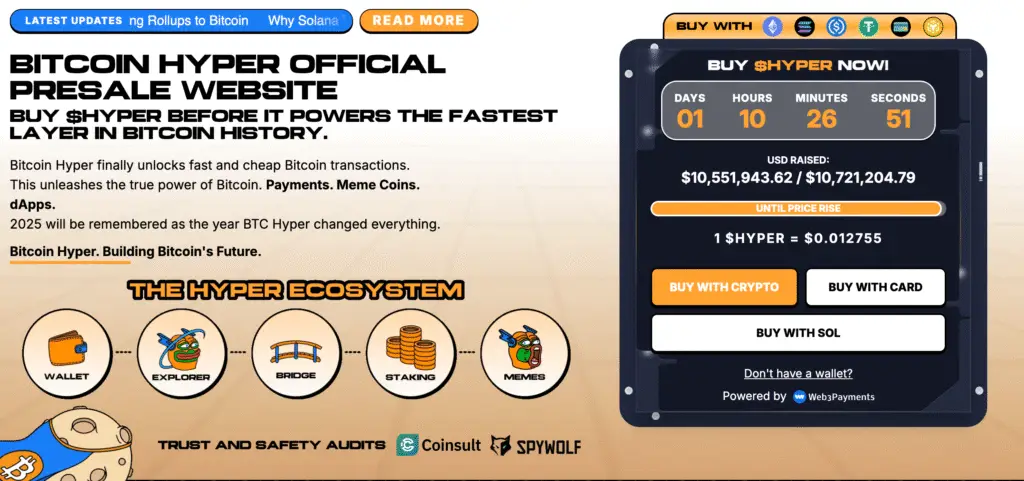

Read More: Bitcoin Hyper Hits $10M in Viral Presale

Introducing Bitcoin Hyper: A New Era of Utility

In a bold move to address these long-standing issues, Bitcoin Hyper, or $HYPER, has emerged as the world’s first Layer-2 solution specifically designed for the Bitcoin blockchain. The project’s core mission is to solve Bitcoin’s scalability problem by introducing high transaction speeds, significantly lower fees, and enhanced programmability.

By creating a Layer-2 that operates on top of Bitcoin’s main network, $HYPER aims to transform the OG crypto from a static investment asset into a dynamic, functional ecosystem capable of supporting the full range of Web3 activities. This innovation seeks to put Bitcoin on a level playing field with the most advanced blockchains, unlocking its massive potential for a new generation of users and developers.

How Bitcoin Hyper-Achieves Solana-Like Performance

Bitcoin Hyper achieves its impressive performance by leveraging two primary components: integration with the Solana Virtual Machine (SVM) and a decentralised, non-custodial canonical bridge. At its core, the SVM is a powerful engine known for its incredible transaction processing speed. While Bitcoin is limited to a handful of transactions per second, the SVM can handle up to 65,000 transactions per second under optimal conditions.

By integrating with the SVM, Bitcoin Hyper not only delivers lightning-fast transactions and ultra-low fees but also provides a robust environment for the development of smart contracts and decentralised applications. This integration gives developers the flexibility and speed they need to build innovative solutions on a network that inherits the security of Bitcoin itself.

The Role of the Canonical Bridge

The second crucial piece of Bitcoin Hyper’s infrastructure is its canonical bridge. This bridge serves as the vital link between Bitcoin’s native Layer-1 network and the new Layer-2 solution. The process is simple yet effective: users lock their Bitcoin on the Layer-1 blockchain through the bridge. In return, the bridge mints an equivalent amount of wrapped $BTC, which is a Layer-2 token. This wrapped token can then be used seamlessly across a vast range of Web3 ecosystems, including decentralised finance (DeFi) platforms, NFT marketplaces, staking protocols, lending services, gaming, and decentralised autonomous organisations (DAOs).

When the user is finished, they simply send the wrapped token back to the bridge, which then unlocks their original Bitcoin on the main Layer-1 network. This system ensures a secure and efficient transfer of value, maintaining the integrity of the underlying Bitcoin while enabling a new world of utility.

The Urgency and Opportunity of the $HYPER Presale

The Bitcoin Hyper presale is already gaining significant traction, having quickly surpassed a major funding milestone of $10 million. This momentum is being fueled by a mix of enthusiastic retail investors and large-scale institutional interest. A notable example is a recent transaction where a single whale purchased $15,000 worth of $HYPER tokens in one go. Beyond the potential for massive price growth, participating in the presale offers exclusive benefits, including early access to the platform’s features and dApps.

Moreover, investors have the opportunity to stake their tokens and earn dynamic rewards, with the current annual yield sitting at a chunky 105%. Priced at just $0.012745 per token, the presale offers a unique opportunity to get in on a potentially explosive Bitcoin-themed altcoin at a historically low price point. With the broader market anticipating a strong rally, projects like $HYPER are positioned to deliver outsized returns.