Bernstein’s Bold Bitcoin Projection

Wall Street broking firm Bernstein has doubled down on its bullish stance for the cryptocurrency market, declaring that Bitcoin could soar to $200,000 in the current cycle. The analysts called this their “highest conviction view”, reinforcing Bitcoin’s role as the digital anchor of the ecosystem. However, the report also made it clear that while Bitcoin will grab headlines, Ethereum and Solana may be the real drivers of long-term adoption and innovation.

Ethereum and Solana Take the Spotlight

While Bitcoin remains the face of crypto, Bernstein argued that Ethereum and Solana are poised to outperform in areas beyond price speculation. Ethereum continues to dominate decentralised finance (DeFi), NFTs, and smart contract activity, while Solana has built significant momentum in developer adoption and transaction throughput. Both networks, according to the firm, are set to lead the next stage of decentralised application growth.

Ethereum’s Scaling Roadmap Gains Momentum

Ethereum’s importance lies in its ongoing scaling upgrades. From the successful transition to proof-of-stake under the Merge to the rollout of Layer-2 scaling solutions like Optimism, Arbitrum, and zkSync, Ethereum has shown steady progress in tackling its biggest challenges: speed and cost.

Bernstein analysts pointed to Ethereum’s roadmap as evidence that it is preparing to support mainstream adoption in ways smaller speculative tokens cannot. As more enterprises and institutions experiment with blockchain applications, Ethereum stands to be their first choice due to its established developer base and robust ecosystem.

Institutional Adoption Expands Beyond Bitcoin

The Bernstein note emphasised that institutional players are no longer focused solely on Bitcoin. Increasingly, major funds, payment platforms, and banks are looking at Ethereum and Solana as strategic assets. Ethereum’s versatility makes it a natural fit for decentralised applications that mirror traditional finance, from lending platforms to tokenised real-world assets. This shift indicates that institutions are preparing for a multi-chain world where Ethereum plays a central role.

Crypto-Exposed Equities Join the Thesis

Bernstein’s bullish call extended beyond tokens to include equities tied to crypto growth. Robinhood, Coinbase, and Circle were highlighted as key beneficiaries of rising institutional participation. Robinhood’s rising crypto trading volumes signal retail re-engagement, while Coinbase continues to serve as the primary institutional on-ramp in the U.S.

Meanwhile, Circle’s USDC stablecoin remains a vital infrastructure layer for global payments. Together, these companies represent a broader trend of traditional finance converging with blockchain-native platforms, a shift that directly supports Ethereum’s long-term value proposition.

Ethereum’s Role in the Path to $200K Bitcoin

Bernstein noted that Bitcoin’s road to $200,000 does not exist in isolation. Instead, the growth of Ethereum and Solana ecosystems is complementary to Bitcoin’s rise. As institutions treat Bitcoin as a treasury asset, they are also deploying capital into real-world use cases built on Ethereum.

Smart contracts, tokenisation, and DeFi protocols are providing tangible reasons for capital inflows, demonstrating why Ethereum is expected to lead the next phase of adoption. For investors, this signals that Bitcoin’s success is intertwined with Ethereum’s ability to scale and deliver practical applications.

Why Ethereum Could Outperform in the Next Cycle

Ultimately, Ethereum’s combination of scalability, developer dominance, and institutional traction makes it a strong candidate to outperform Bitcoin on a percentage basis, even if Bitcoin reaches $200,000. Bernstein’s report underscored that Ethereum is no longer just a speculative asset; it is evolving into the backbone of decentralised applications that could reshape finance, commerce, and digital ownership.

With Solana accelerating innovation in speed and cost, Ethereum remains the primary platform trusted by developers and institutions alike. The cycle ahead could see Ethereum transform from a secondary player into the market’s structural leader, ensuring that while Bitcoin sets the tone, Ethereum defines the future.

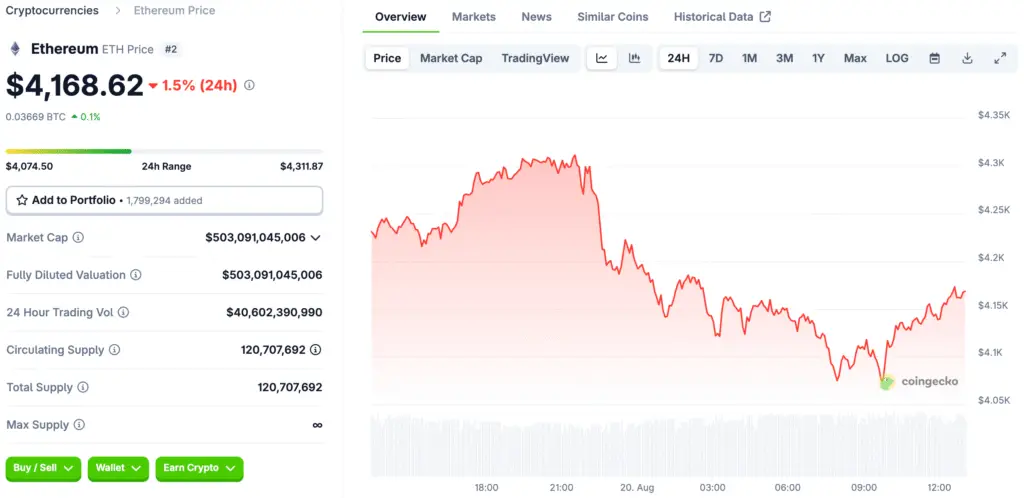

Read More: Ethereum Price Decline A Look at Recent Crypto Volatility