Solana’s Potential Role in European Finance

The European Union is reportedly exploring the use of public blockchain networks like Solana and Ethereum for the design and implementation of its digital euro. This marks a significant shift from the more traditional, private blockchain models often favored by central banks, such as the one used for China’s central bank digital currency (CBDC). Public blockchains are open and accessible to everyone, which stands in stark contrast to private blockchains, where data and access are strictly limited to authorized entities.

If the European Central Bank (ECB) officially moves forward with this direction, it would be a major milestone in the digital euro’s development and could set a new precedent for how major global economies approach digital currency. This exploration highlights a growing willingness among European officials to embrace decentralized, open-source technology for a major financial project.

A Public Model vs. Private CBDCs

The EU’s exploration of a public blockchain model for its digital euro is a deliberate choice that differentiates its approach from others. A private digital euro would look “much more like what the Chinese central bank is doing,” as one source noted. China’s CBDC is deployed on a private, permissioned network, giving the central bank full control over its operation and data. In contrast, the public model being considered by the EU would align more with how private companies in the U.S. have developed public-run stablecoins like Circle’s.

This approach suggests a desire for a more open and transparent system that could potentially foster greater innovation and interoperability. It also reflects a growing concern in Europe about the push by the U.S. for dollar-pegged stablecoins, which currently dominate the stablecoin market at 98%, and their potential implications for the autonomy of the European financial system.

The Move to Counter US Stablecoins

A key driver behind the push for a digital euro is Europe’s concern over the dominance of U.S. dollar-pegged stablecoins. In April, ECB executive board member Piero Cipollone publicly called for a reduction in stablecoin usage in Europe, citing the risks associated with the widespread adoption of dollar-denominated digital assets. This move to create its own digital currency is seen as a strategic effort to regain control and ensure the autonomy of the European financial system.

By exploring public blockchains like Solana and Ethereum, the ECB is not only seeking to create an efficient digital currency but also to build a system that is robust, transparent, and resilient to foreign influence. It’s a move that ties monetary policy directly to the technological infrastructure of the future, with the goal of strengthening Europe’s position in the global digital economy.

Why Solana and Ethereum Are Being Considered

The fact that the ECB is looking at Solana and Ethereum is not a coincidence. These networks are two of the largest and most robust public blockchains, each with unique technical advantages. Ethereum, with its large developer community and a proven track record, offers a secure and battle-tested environment for smart contracts. Its recent transition to a proof-of-stake system has made it far more energy-efficient, a factor that aligns with Europe’s sustainability goals.

Solana, on the other hand, is known for its incredibly high transaction speeds and low fees, thanks to its unique architecture. These features are essential for a digital currency that needs to handle high volumes of everyday transactions quickly and cost-effectively. The consideration of both networks suggests a thorough and pragmatic approach to finding the right technological fit for the digital euro, balancing security and decentralization with performance and efficiency.

The Role of Parallel Execution and Scalability

One of the main reasons for considering a blockchain like Solana is its ability to handle immense scale. Solana is built on the Move programming language, which enables it to use parallel execution. This means that multiple transactions can be processed simultaneously, which drastically increases the network’s throughput. For a project as large and demanding as a digital euro, which would need to support billions of users and countless daily transactions, this level of scalability is crucial.

The ability to handle transactions quickly and at a low cost is a significant advantage over other networks. While the ECB has not yet publicly confirmed which technology it will ultimately choose, its exploration of platforms with such advanced scalability features highlights the importance it places on building a system that can meet the needs of a modern, fast-paced economy.

The EU Explores a Public Digital Euro

The EU’s exploration of public blockchains for its digital euro signals a future where central bank digital currencies are not confined to private, centralized systems. The move towards open, permissionless networks like Solana and Ethereum could lead to a more innovative and interoperable financial ecosystem.

The decision to partner with a public blockchain would not only be a technological choice but also a powerful political and economic statement. It would show that the EU is committed to creating a digital currency that reflects its values of transparency, openness, and financial autonomy. The outcome of these discussions will be a major indicator of the future direction of global finance, and it is a development that the entire cryptocurrency community will be watching closely.

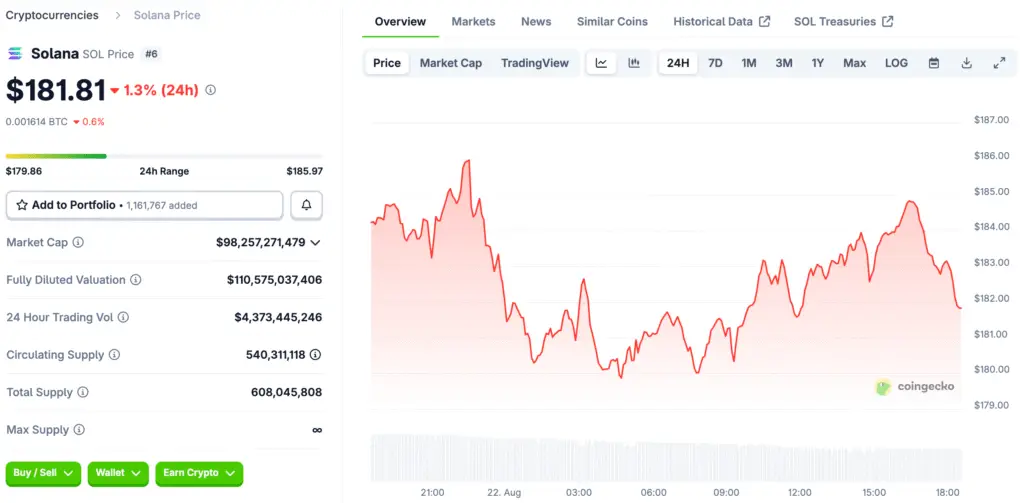

Read More: Solana (SOL) Price Climbs Despite Market Downturn as Coinbase Derivatives Fuel Optimism