Mutuum Finance Challenges Polygon in the Race for Investors

Things are changing quickly in the world of decentralized finance. There are a lot of projects that want your attention. Two competitors are Mutuum Finance (MUTM) and Polygon. Both want to get investors from both institutions and the general public.

But if you look more closely, you’ll see some big differences. Their features and strategies are different. This article looks at why Mutuum Finance is likely to do better than Polygon. It is a very strong candidate.

Layer Two Scalability vs. Hybrid Lending

The way Mutuum Finance lends money is different from other companies. It is a mix of different methods. It includes both peer-to-contract lending and peer-to-peer lending. It also uses lending between peers.

Polygon has taken a different route. It has been focused on scalability at Layer 2. Polygon lets you make transactions quickly. Users also pay less in fees.

The Unique Lending Model of Mutuum Finance

The model from Mutuum Finance fills a big need. It works for both assets that are stable and those that are risky. Peer-to-contract deals with stable assets. This protects lenders’ returns.

Peer-to-peer deals with assets that change more often. It can even lend meme coins. This two-pronged approach draws in different types of users. It adds to the pool of available cash.

Recommended Article: Mutuum Finance: Redefining Decentralized Lending & Payroll

Long-Term Value with Strategic Tokenomics

The tokenomics of Mutuum Finance are very good. They are made to last a long time. A lot of tokens are for liquidity. This makes sure that demand stays high.

There is also a deflationary model for the project. Token buybacks help to lower the amount of tokens available. This structure is very helpful. It makes the coin worth more in the long run.

Mutuum Finance vs. Polygon: A Tale of Two Price Forecasts

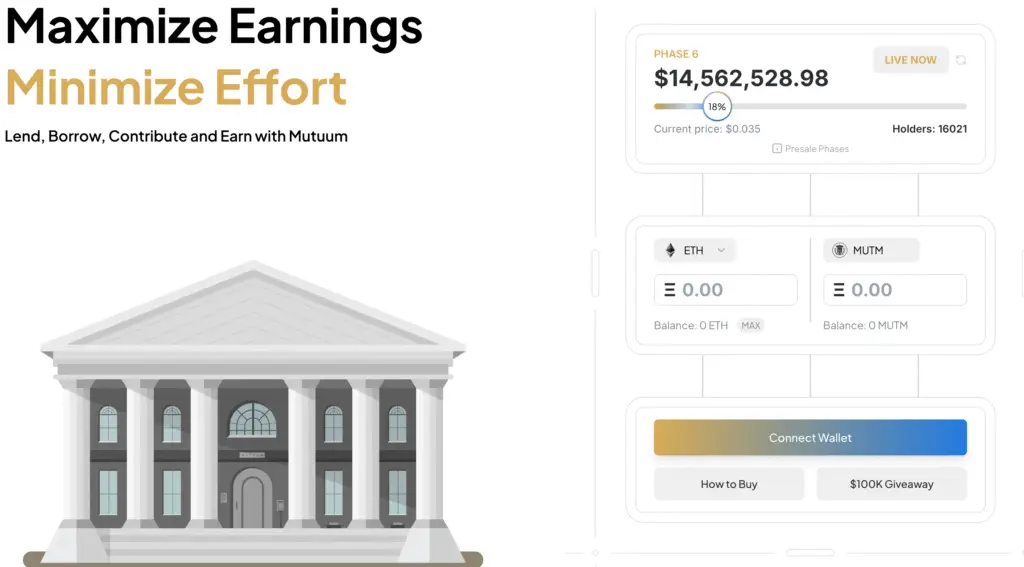

Analysts have clear plans for Mutuum Finance. They think the price will go up to fifty cents by next year. It has a good chance of making money. People think this is a likely outcome.

Polygon’s price predictions are not certain. Its worth depends on how well Ethereum does. It is also linked to how people feel about the market as a whole. This makes it a lot harder to guess what will happen with it.

Institutional Trust and Security Measures

Security is a top priority for Mutuum Finance. It got a high score on the CertiK audit. There is a program that pays people to find bugs. These steps help build trust in the institution.

The project has also helped the community grow faster. It gave away a lot of tokens. This was a reward for people who got in early. These efforts build a strong and trustworthy community.

Why Mutuum Is Better for Investors Than Polygon

MUTM has a strong reason to exist. It has a DeFi model that is a mix of both. It also has structured tokenomics. It also has security that is good enough for institutions.

These things make it easier to predict what will happen with it. Its clear plan for the future helps it grow. This gives you a big edge over Polygon. For many investors, it is the best choice.