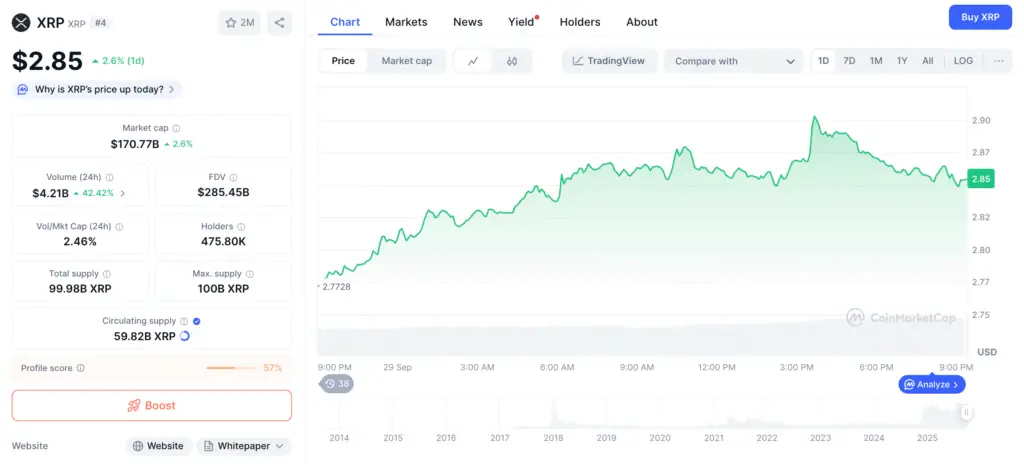

XRP Tests Key $2.70 Floor After 10% Weekly Drop

XRP has entered a critical trading zone following a sharp 10% decline over the past week, now hovering near $2.85. The $2.70 level remains a crucial support line that has held since early September, acting as a battleground between buyers and sellers.

Chart structures show a descending triangle forming, signaling tightening volatility. A successful defense of $2.70 could trigger a bullish rebound toward $3.20–$3.60, while a breakdown risks exposing deeper losses in the $2.48–$2.20 range.

Technical Compression Builds as Volume Stays Muted

XRP’s chart reveals strong seller pressure below $2.97 and buyer defense near $2.70, narrowing into a wedge formation. A liquidity gap between $2.73 and $2.51 may act as a price magnet if momentum falters.

Key moving averages reinforce these levels: the 200-day MA near $2.54 supports the floor, while the 50-day MA at $2.97 caps upside. RSI hovers at 40, hinting at accumulation, but subdued trading volumes suggest caution as volatility builds.

ETF Flows Offer Potential Catalysts for XRP

Institutional activity is playing a larger role in shaping sentiment. The REX/Osprey Spot XRP ETF saw over $38 million in inflows, underscoring early adoption momentum. Meanwhile, Franklin Templeton’s ETF decision postponed to November 14 could become a pivotal liquidity event.

Analysts believe further ETF approvals could elevate XRP’s status in traditional finance, attracting new capital inflows and legitimizing its role as a bridge asset. Futures open interest near $1 billion shows that speculative positioning remains active despite price weakness.

Recommended Article: Why XRP Price Is Dropping as Bitcoin Forecasts Gain Attention

Macro Headwinds Pressure Broader Crypto Markets

Macro conditions have amplified XRP’s recent weakness. Bitcoin slipped below $110,000 during a $22 billion options expiry, triggering $275 million in long liquidations. Ethereum also hit a seven-week low, adding systemic pressure.

U.S. PCE inflation stayed at 2.9% year-over-year, keeping hopes for Fed rate cuts alive. A dovish pivot could boost market liquidity and support a crypto rebound, but for now, risk-off flows are dominating investor behavior.

Remittix Emerges as Growing Competitive Threat

As XRP defends its critical floor, emerging PayFi rival Remittix (RTX) is gaining momentum. With $26.7 million raised at $0.1130 per token, upcoming BitMart and LBank listings, and a beta wallet supporting 40 cryptos and 30 fiat currencies, RTX is positioning itself as a direct payments competitor.

Its staking rewards and 15% USDT referral program have drawn investor attention during XRP’s consolidation. Some analysts label RTX “XRP 2.0,” noting investor rotation toward early-stage growth opportunities in the cross-border payments sector.

XRP/BTC Pair Shows Relative Technical Strength

Despite USD weakness, XRP has shown resilience against Bitcoin. A golden cross on the XRP/BTC chart, where the 100-day MA crossed above the 200-day MA, supports the 2,400 SAT level structurally.

A breakout above 2,800 SAT could reignite bullish momentum, potentially targeting 3,000 SAT. Losing this floor, however, risks a retracement toward 2,000 SAT. This divergence highlights XRP’s underlying strength relative to Bitcoin even amid broader market pressure.

Ripple Fundamentals Remain Structurally Strong

Ripple’s core payments network continues to grow, with on-demand liquidity volumes increasing steadily. Regulatory clarity with the SEC is improving, with settlement talks easing classification uncertainty. DeFi integrations via FXRP on Flare and staking opportunities through mXRP offer yields up to 10%.

These developments reinforce Ripple’s long-term relevance in global payments and DeFi. Expanded utility, compliance progress, and liquidity growth provide a fundamental foundation even as short-term price volatility persists.

Bullish Rebound or Bearish Breakdown Ahead

Price scenarios hinge on the $2.70 level. A strong defense could send XRP to $2.95–$3.25, with a breakout above $3.25 confirming bullish continuation toward $3.60–$5 in 2025.

Failure to hold this floor risks a drop toward $2.45–$2.20, where on-chain buyer clusters may intervene. With ETF decisions, macro liquidity trends, and new competition in play, XRP’s next major move is likely to be sharp and decisive.