ADA Consolidates After Steep Weekly Decline

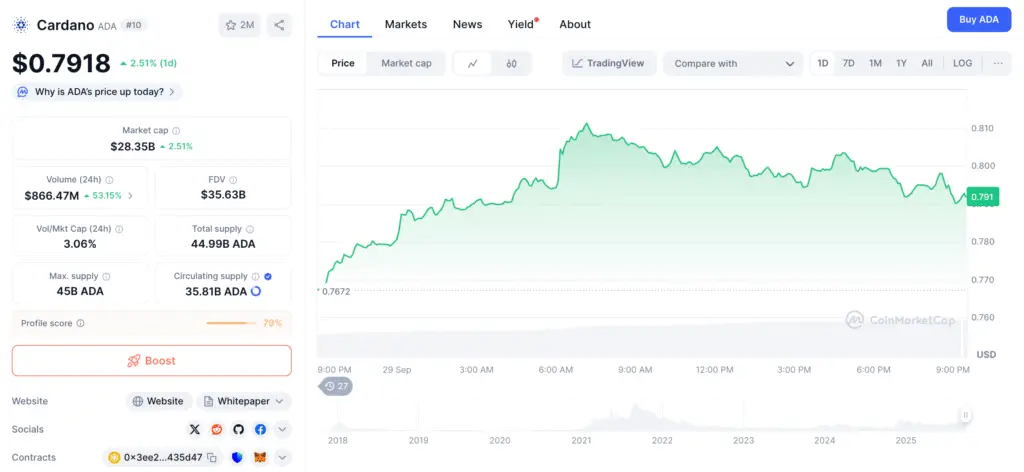

Cardano (ADA) is currently trading at $0.7918 after a 12.88% weekly drop, marking its lowest point since mid-August. The third-generation blockchain’s token has entered a consolidation phase within a narrow range as broader market sentiment weakens.

Market capitalization slipped to $27.52 billion, while trading volume plunged by over 45% in 24 hours. These declines highlight investor caution amid rising volatility across the cryptocurrency sector.

Technical Patterns Point to Bearish Breakdown

Cardano’s price chart shows concerning signals for bulls. A rising wedge pattern recently broke down, compounded by a completed head-and-shoulders formation below its neckline—two classically bearish structures.

ADA has also slipped beneath both its 50-day and 100-day moving averages. With the Average Directional Index rising to 22, downside momentum is accelerating, pointing toward potential further declines.

$0.5095 Support Level Becomes Key Bearish Target

Analysts are now watching ADA’s June lows around $0.5095 as the next critical support level. A move to this zone would represent roughly a 35% decline from current prices.

The technical setup suggests bears currently control momentum, and any break below $0.70 could accelerate selling pressure. Traders view this level as a “line in the sand” for ADA’s short-term outlook.

Recommended Article: Cardano Price Struggles as Mutuum Finance Gains “ADA 2.0” Hype

Cardano’s DeFi Ecosystem Struggles to Maintain Traction

Cardano’s decentralized finance ecosystem has weakened significantly in 2025. Total value locked (TVL) has crashed 53% to $320 million from $680 million earlier this year, reflecting rapid capital outflows.

The network hasn’t seen major new DeFi launches recently, relying on existing platforms like Minswap, Liqwid, and Indigo while rival chains continue to innovate and capture liquidity.

Stablecoin and Institutional Activity Remain Limited

Cardano’s stablecoin supply has fallen 4.4% to $37 million, lagging far behind competitors like Solana and newer chains. Daily DEX volumes are low at $1.4 million, reflecting decreased user activity.

Institutional interest is also muted, with only one ETF application (Grayscale) compared to multiple filings for Solana and Ripple. This gap signals less confidence from traditional finance toward ADA’s ecosystem.

Privacy Innovation Could Offer a Glimmer of Hope

The Midnight Foundation has donated USDM to Cardano’s Project Catalyst Fund 15, supporting privacy-focused development. These funds aim to enable secure, compliant, and confidential decentralized applications on the blockchain.

Privacy remains a core industry challenge. Midnight’s support may help Cardano differentiate itself through solutions like hidden finance applications and secure voting systems, which could attract developers and users over time.

Community Confidence Remains Surprisingly Resilient

Despite price declines and ecosystem headwinds, Cardano’s community sentiment remains overwhelmingly positive. Data indicates that 88% of participants expect a price recovery, reflecting long-term optimism about ADA’s technology and potential.

Some enthusiasts even maintain speculative targets of $10 in future cycles, citing Cardano’s evolution from an underestimated project to a mature blockchain with smart contracts and active developers.

Outlook: Bearish Technicals vs. Bullish Long-Term Faith

Cardano’s immediate outlook leans bearish due to technical breakdowns, shrinking DeFi liquidity, and weak institutional participation. A move toward $0.5095 remains possible if selling pressure intensifies.

However, resilient community support and ongoing innovation initiatives suggest longer-term potential. For now, traders are watching $0.70 closely as ADA navigates a critical support zone during heightened market uncertainty.