Mutuum Finance Gains Momentum Amid Market Uncertainty

Mutuum Finance (MUTM) continues to progress steadily through its presale, reaching the halfway mark of Phase 6 despite broader crypto market turbulence. This milestone underscores growing investor confidence in the project’s innovative DeFi vision and lending architecture.

The Ethereum-based platform aims to reshape decentralized finance by introducing flexible lending and borrowing structures. Its recent achievements highlight increasing demand for real utility within a crowded DeFi landscape.

Dual Lending Model Drives Investor Interest

At the core of Mutuum Finance’s appeal is its dual-market lending system. The Peer-to-Contract model lets users deposit assets into shared pools and earn interest through tokenized receipts.

In parallel, the Peer-to-Peer marketplace connects lenders and borrowers directly, allowing customized terms and collateral options. This flexible structure creates multiple pathways for generating yield while improving borrowing accessibility.

Strategic Presale Structure Encourages Early Participation

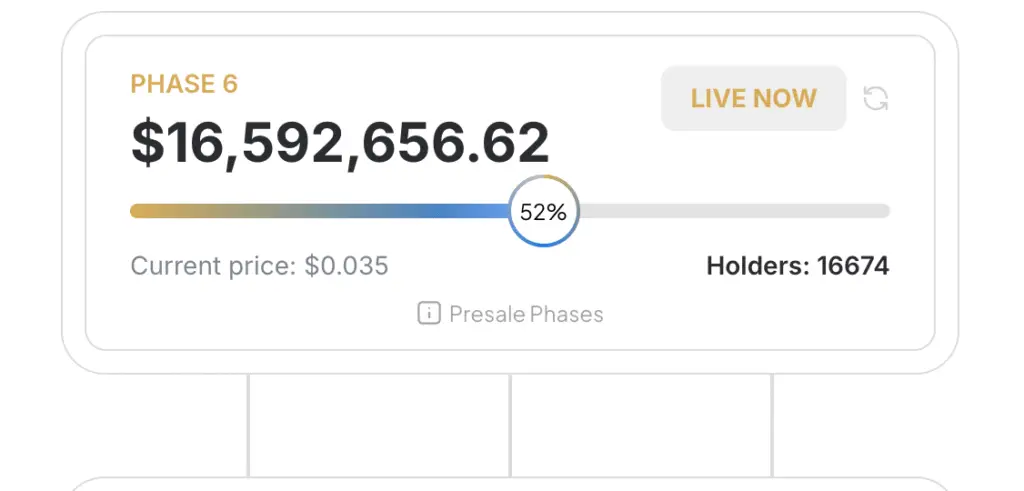

Mutuum Finance’s presale follows a step-based pricing model that rewards early investors with lower entry points. Starting at $0.01, the token has climbed to $0.035 by Phase 6, marking a 250% increase so far.

The launch price is set at $0.06, offering potential near-term upside for current buyers. This predictable growth structure has proven effective in maintaining investor momentum across multiple phases.

Community Initiatives Strengthen Early Ecosystem

Beyond pricing incentives, Mutuum Finance has launched several engagement programs to build a strong community foundation. Its live dashboard enables investors to track holdings and estimate returns in real time.

Additionally, a Top 50 leaderboard rewards leading contributors with bonus MUTM tokens at launch. A $100,000 giveaway further boosts participation, offering investors ten $10,000 token prizes and increasing project visibility.

Recommended Article: Cardano Price Struggles as Mutuum Finance Gains “ADA 2.0” Hype

Fundraising Figures Reflect Growing Market Traction

As of now, Mutuum Finance has raised over $16.6 million in presale funding. More than 730 million tokens have been sold, and the project has attracted over 16,650 holders globally.

These figures signal strong traction within the DeFi investor community, positioning MUTM as one of the more successful Ethereum-based presales of 2025 so far.

Security Audits and Incentives Build Trust

To ensure trust and resilience, Mutuum Finance completed a comprehensive CertiK audit, achieving a Token Scan score of 90/100. This places the project among top-rated DeFi platforms for security.

The team also launched a $50,000 bug bounty program to incentivize developers to uncover vulnerabilities before launch. These measures strengthen confidence among both retail and institutional participants.

Upcoming Roadmap Updates Fuel Anticipation

Mutuum Finance recently teased new development milestones and roadmap updates on X (formerly Twitter). According to its existing roadmap, the platform’s launch will align with its exchange listing, boosting liquidity and market exposure from day one.

This synchronized rollout strategy could amplify price discovery during early trading, especially as Phase 7 nears with a projected 20% price increase.

Mutuum Finance Positions for Strong 2025 Performance

With Phase 6 now half completed and momentum accelerating, Mutuum Finance stands out as a promising DeFi contender. Its dual lending model, structured presale, and transparent security practices position it for sustained growth.

As decentralized finance evolves, projects delivering tangible utility and community trust are gaining market share — and Mutuum Finance is clearly tapping into that trend at the right time.