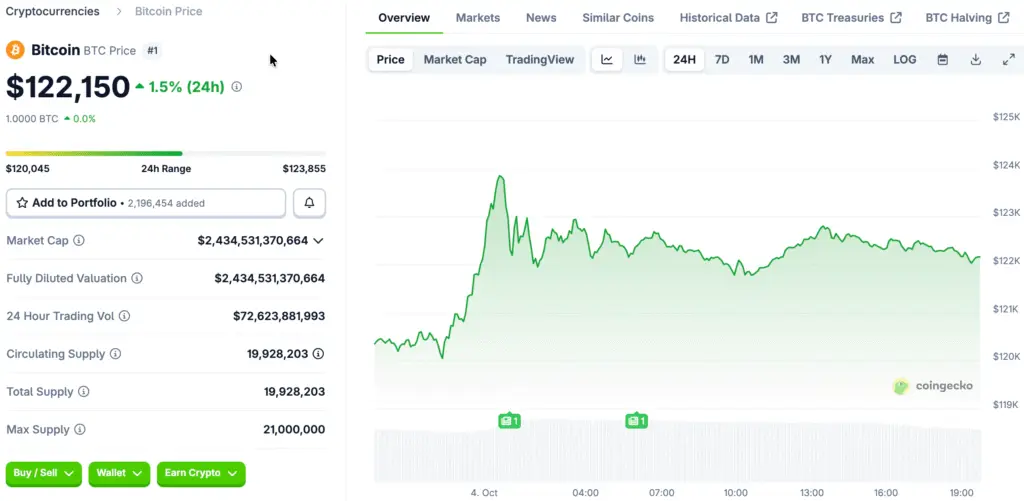

Bitcoin Soars to $120,000 as Investor Optimism Grows

Bitcoin has climbed to $120,000, marking its first return to record highs in seven weeks. This achievement highlights increasing investor confidence, fueled by ETF inflows and favorable macroeconomic conditions that are sparking a resurgence in demand.

The cryptocurrency has experienced a remarkable rally over the past six days, surging nearly 10% since the market session last Friday. Traders emphasize a notable rise in accumulation as both institutions and retail investors become more active in Bitcoin’s robust market framework.

Macroeconomic Shifts Push Bitcoin Into Safe-Haven Territory

Heightened speculation regarding the current U.S. government shutdown is driving up interest in safe-haven assets. Bitcoin, commonly known as “digital gold,” is gaining traction as investors employ hedging strategies in response to financial uncertainty.

Experts observe that Bitcoin ETF inflows have hit $1.5 billion this week, indicating a notable shift of capital into the cryptocurrency markets. This trend reflects gold’s recent performance, but Bitcoin seems to be gaining ground with a more robust upward momentum.

ETF Inflows and Market Structure Drive Breakout Momentum

This October, the ETF market has been crucial in bolstering Bitcoin’s breakout trajectory. Order book data indicates a consistent reduction in sell-side pressure, setting the stage for a swift increase in price levels.

Researchers at FalconX characterize Bitcoin’s configuration as a “coiled spring,” suggesting that a reduction in overhead supply can lead to significant price surges. This situation is currently developing as rapid surges propel Bitcoin past crucial resistance points, surprising those who were betting against it.

Recommended Article: Bitcoin Price Today Shows Key Market Drivers in Action

Less Prominent Cryptocurrencies Track Bitcoin’s Upward Trend

With Bitcoin on the rise, smaller cryptocurrencies such as Solana, Litecoin, and Dogecoin are seeing significant increases in value. Solana experienced a notable increase of 5.7%, Litecoin saw a rise of 6.7%, and Dogecoin advanced by 4.7%, contributing to a wave of optimism in the altcoin markets.

Stocks related to cryptocurrency saw gains thanks to Bitcoin’s robust performance, as Coinbase shares increased by 7.8% in the most recent trading session. Strategy Inc., a Bitcoin treasury firm, saw a rise of 3.5%, while MARA Holdings increased by 2.1%, bolstering confidence in the wider crypto ecosystem.

Seasonal Trends Enhance Bitcoin’s Uptober Performance

October has traditionally been one of Bitcoin’s most robust months, earning the moniker “Uptober” among traders. The token has experienced growth in nine out of the last ten Octobers, influenced by seasonal trends and an optimistic market mindset.

Traditionally, September has been seen as Bitcoin’s least favorable month, often leading into strong rallies in the fourth quarter that reignite optimism among investors. Ryan Watkins from Syncracy Capital highlights that these seasonal trends frequently turn into self-fulfilling cycles that boost participation levels.

Market Sentiment Revived by Historical Highs for Q4

On August 14, Bitcoin reached its all-time high of $124,514 amid growing anticipation for ETFs. The recent rally has sparked renewed optimism for another breakout, as Q4 has a history of showcasing robust performance in the crypto market.

As ETF inflows continue to surge, traders are now pondering the possibility of Bitcoin exceeding its former peak within this quarter. Numerous analysts suggest that enhanced liquidity and strategic institutional positioning could set the stage for achieving new record highs.

Bitcoin Rally Momentum Builds as Market Structure Remains Supportive

Current momentum indicators indicate that Bitcoin’s rally could persist, provided the market structure continues to be favorable. Increasing volumes, optimistic changes in the order book, and past seasonal trends come together to bolster Bitcoin’s upward movement.

Critical resistance levels around $124,500 will play a pivotal role in determining if Bitcoin can achieve a lasting breakout into new record territory. If it achieves success, the momentum of Uptober could ignite a significant rally, establishing Bitcoin as a key market influencer in the 4th quarter of 2025.