Bitcoin Encounters Scalability Issues During Significant Wealth Transition

Bitcoin continues to hold its position as the top cryptocurrency worldwide, renowned for its unparalleled security and status as digital gold. Nonetheless, its transaction speed remains slower than current financial requirements, restricting its effectiveness for significant wealth transfers.

As $72 trillion is anticipated to be transferred between generations in the coming decade, the urgency for efficient infrastructure is paramount. Experts highlight that Bitcoin’s one-dimensional transaction approach faces challenges in accommodating the swift settlement demands of this impending transition.

Kaspa Unveils an Enhanced Framework via BlockDAG Innovation

Kaspa addresses the speed challenge of Bitcoin through the innovative use of blockDAG technology, allowing for the simultaneous confirmation of multiple blocks, which facilitates swift processing. This turns crowded single-lane confirmation queues into expansive multi-lane highways, allowing transactions to flow with remarkable efficiency.

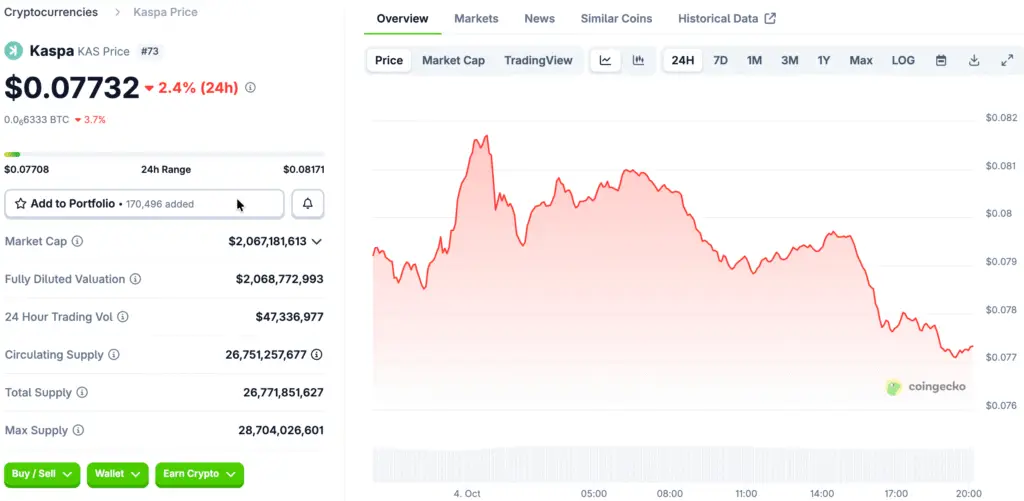

The network is currently validating 10 blocks every second, providing near-instant confirmations and settlements that average around 10 seconds. In contrast to Bitcoin’s slow speed, Kaspa showcases clear performance benefits that meet the demands of real-world finance.

Equitable Introduction and Distribution of Power Fortify the Core of Kaspa

Kaspa’s credibility is strengthened by its fair launch model, completely steering clear of pre-mines, pre-sales, or insider token allocations. All KAS tokens were mined transparently, closely aligning the project with the principles of decentralization that are frequently lacking in contemporary launches.

This clear distribution framework has struck a chord with supporters looking for blockchain initiatives that uphold ideological integrity. Experts see this sense of fairness as a sustainable edge that fosters trust among both retail and institutional sectors.

Recommended Article: Kaspa Gains Strength as Q4’s Top Crypto for Long-Term ROI

Academic Pedigree Elevates Kaspa’s Technological Legitimacy

The technological foundations of Kaspa originate from Dr. Yonatan Sompolinsky, the innovator behind the Ghost Protocol, which was later cited in Ethereum’s whitepaper. His participation lends significant academic authority, indicating that Kaspa is not merely a speculative endeavor but a meticulously crafted system.

This foundation guarantees that Kaspa’s architecture can adapt to future financial applications while maintaining optimal performance and security. As networks evolve, reliable academic foundations frequently distinguish enduring innovations from fleeting market trends in the history of cryptocurrency.

Smart Contract Integration Expands Kaspa’s Financial Utility

Kaspa’s roadmap unveils the introduction of smart contracts via layer-2 solutions such as Kasplex, greatly enhancing the network’s capabilities. This integration allows developers to build DeFi platforms, enterprise applications, and decentralized tools while keeping the base chain free from congestion.

By merging rapid performance with adaptability, Kaspa establishes itself as a transactional network and a versatile center for innovation. Experts assert that this dual capability is crucial for seizing substantial shares of the forthcoming $72 trillion wealth transfer.

Bitcoin and Kaspa May Serve Complementary Global Roles

Bitcoin is anticipated to uphold its position as a reliable store of value, akin to the monetary function of digital gold. Kaspa focuses on the medium-of-exchange role, demonstrating outstanding transaction speed and impressive network scalability.

Experts draw parallels between this relationship and the historical dynamics of gold and silver, where one serves to safeguard wealth while the other enables everyday transactions. This synergistic relationship may influence the coexistence of both networks as the global financial infrastructure transforms over the coming decade.

Kaspa’s Positioning Aligns With Generational Wealth Transfer Trends

The upcoming $72 trillion intergenerational wealth transfer poses a significant challenge for global financial settlement networks. Kaspa’s swift, decentralized, and research-based framework makes it a strong contender to navigate this economic wave successfully.

Bitcoin might continue to serve as the emblematic store of value, while Kaspa has the potential to evolve into the essential framework for daily financial transactions. This strategic alignment clarifies why numerous analysts are progressively considering Kaspa as the future of extensive digital wealth transfer.