Bonk Whale Accumulation Ignites New Market Speculation

Bonk is once more drawing the interest of traders as notable whale accumulation stirs speculation regarding a possible breakout rally. Market analysts are noting significant purchasing activity from a prominent wallet, suggesting a resurgence of confidence in Bonk’s short-term price trajectory.

Recent reports indicate that this whale has been steadily amassing around $139,500 in Bonk tokens at well-timed intervals. This steady accumulation frequently indicates insider assurance or strategic positioning in anticipation of forthcoming bullish trends in the crypto markets.

Experts Emphasize Notable Trends in Q4 Performance History

Experts are highlighting Bonk’s past performance, noting its tendency to excel in the fourth quarter, particularly after periods of accumulation. In past years, Bonk has consistently shown an upward trend in Q4, in line with the general seasonal patterns observed in the cryptocurrency market.

The recurring pattern has bolstered optimistic feelings among seasoned traders who are on the lookout for familiar breakout situations as we approach the fourth quarter of this year. There is a growing belief that the current accumulation may reflect past trends, possibly setting the stage for a notable rally for Bonk in the near future.

Bonk Whale Accumulation Signals Strategic Moves Before Price Surges

Data from Stalkchain reveals that the whale’s wallet has been actively acquiring Bonk at an impressive rate of $2,150 every minute. The consistent buy orders have generated significant ripples across trading platforms, capturing the interest of both retail participants and analysts.

This behavior indicates a purposeful gathering rather than haphazard purchasing, often seen before significant price increases in speculative tokens. The observed buying pattern has sparked discussions among the Bonk community about possible catalysts that could be influencing the whale’s strategy.

Recommended Article: Bonk Rises as PEPE Investors Shift Focus to Remittix

Traders Shift Attention to Key Resistance Levels

With the growing accumulation of whales, traders are honing in on Bonk’s critical resistance levels to pinpoint possible breakout opportunities. In the past, Bonk has faced challenges in sustaining momentum following short-lived rallies, unless there was significant buying pressure at key technical levels.

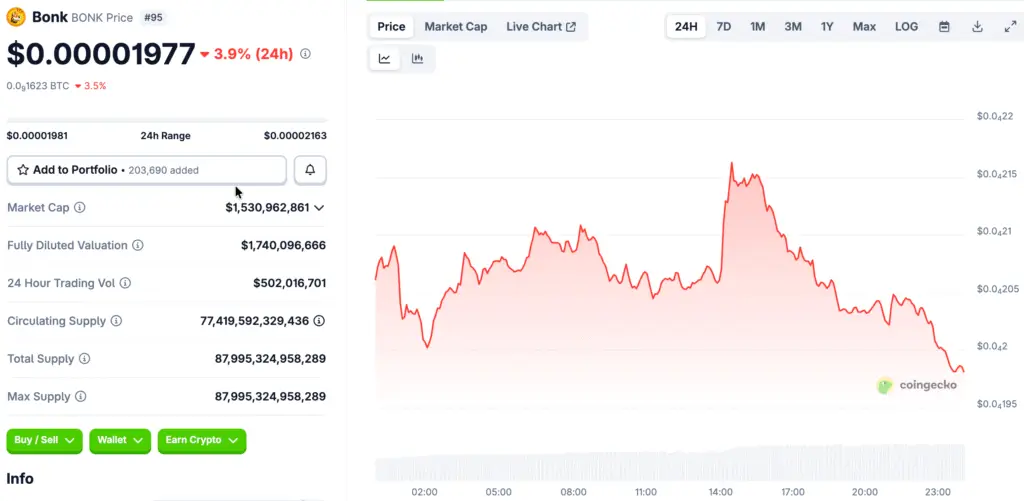

The token is presently valued at $0.00002028, boasting a market capitalization of $1.66 billion and a daily trading volume of $357.14 million. These metrics indicate that, even with slight price drops, trading activity and market engagement surrounding Bonk continue to be robust overall.

Bonk Traders Watch Q4 Patterns to See If Historical Rallies Repeat

Seasonal analysis shows that Bonk usually excels in Q4, whereas Q3 has consistently been its least favorable performance period. As Q4 begins, traders are keenly observing if past seasonal patterns will once more have a favorable impact on Bonk’s path.

Seasonal trends frequently lead to self-fulfilling expectations, as traders modify their strategies based on the anticipation of recurring historical performance patterns. If accumulation persists and sentiment aligns, Bonk could see a rapid upward surge, reminiscent of past end-of-year rallies.

Growing Enthusiasm Surrounds Potential Breakout

Conversations within online communities have surged, showcasing an increasing sense of optimism regarding Bonk’s upcoming price movements. Notable analyst Artski observed that effectively overcoming key resistance levels may trigger “a significant rally” for the token in the near future.

This observation has garnered attention within Bonk forums, as enthusiasts ponder possible positive developments in the weeks ahead. This shared excitement frequently leads to greater involvement from retailers, which in turn boosts momentum during critical breakout phases.

Bonk Investors Accumulate Ahead of Potential Q4 Breakout Opportunities

Market participants are positioning themselves strategically in anticipation of potential breakout efforts as the fourth quarter unfolds, with significant accumulation by large investors continuing to be a notable trend. A significant number of observers perceive the present stage as a possible accumulation area that may lead to increased volatility and more pronounced directional shifts in the near future.

Key technical levels and the actions of significant investors are expected to influence Bonk’s path in the upcoming weeks, especially around critical resistance points. When bullish patterns coincide with seasonal trends, Bonk could potentially achieve another impressive Q4 performance, further solidifying its reputation for remarkable rallies.