Avalanche Holds Strong at $30 Amidst Renewed Optimism

Avalanche is maintaining its position above the crucial $28 support level, drawing renewed interest from traders who are closely monitoring the market structure. This vital area has emerged as the main arena, where price movements offer significant clues about short-term momentum and investor confidence.

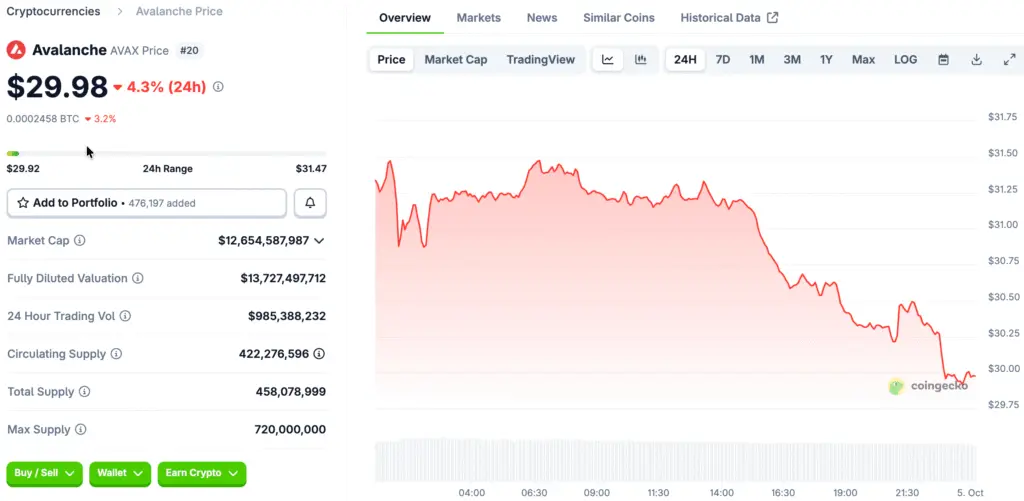

Avalanche is currently priced at $29.98, showing a modest daily rise of 0.13% as a sense of cautious optimism permeates the wider cryptocurrency market. The altcoin’s capacity to uphold stability above key psychological levels frequently influences the atmosphere for future breakout efforts and directional tendencies.

Technical Indicators Signal Gradual Momentum Recovery

Recent price dips for Avalanche have been followed by a stabilization phase, with technical indicators showcasing an improvement in momentum conditions. The Rank Correlation Index is currently at 32.12, suggesting an early bullish recovery and the possibility of continuation in the upcoming sessions.

An RCI reading above zero often indicates that buyers are slowly reclaiming control, which could lead to the formation of a stable short-term floor. Traders keep a vigilant eye on these developments, interpreting shifts in indicators as signals that could lead to significant price movements in volatile markets.

Avalanche Traders Monitor Key Zones to Navigate Uncertain Consolidation

Avalanche encounters significant resistance around $30.97, marking the next essential threshold to overcome for a confirmation of sustained upward momentum. A significant move above this zone may open the door to higher targets, including the often-mentioned $32.00 resistance level noted by analysts.

At this point, support is firmly positioned around $29.97, serving as the final barrier before potential drops toward the $26.00 area. The resistance and support zones serve as key reference points for market participants as they adapt their strategies during periods of uncertain consolidation.

Recommended Article: Avalanche Reclaims $30 as Treasury Support Fuels Breakout

Volume Dynamics Reveal Market Sentiment Shifts

Volume candles provide important insights into the current sentiment as Avalanche fluctuates between accumulation and distribution phases. Earlier upward movements towards $36 were backed by notable increases in green volume, reflecting robust involvement during breakout phases.

On the other hand, there were noticeable spikes in red volume as Avalanche pulled back to $28, indicating a strong selling pressure and a responsive market reaction. Market participants are currently observing for the emergence of fresh green volume candles, which generally indicate strong bullish sentiment and a willingness to retake elevated resistance levels.

Avalanche Active Addresses Jump 98%, Signaling Rising Global Adoption

Avalanche’s performance in September highlighted significant growth within its ecosystem, emphasizing the underlying strength despite recent price stabilization trends. The volume of decentralized exchanges experienced a remarkable increase of 45.2%, reaching $17.43 billion, while the total value locked saw a rise of 15.%, totaling $2.17 billion.

Furthermore, the average daily active addresses surged by almost 98.2%, reaching 16.8 million, indicating a significant level of adoption among network participants worldwide. The metrics indicate that Avalanche is solidifying its market stance, likely fostering ongoing bullish sentiment as we approach the final quarter.

Forecasts Indicate Range-Bound Price Movement in October

According to Changelly’s analysts, Avalanche’s price is expected to vary between $30 and $32.37 throughout October 2025 as market conditions begin to stabilize. The forecasts indicate a cautious outlook, urging traders to keep an eye on volume, sentiment, and macroeconomic indicators for more definitive directional guidance.

Forecasted technical levels indicate a potential minimum decline near $26.41 and a possible maximum increase around $32.37 within the projected timeframe. These range-bound forecasts highlight the significance of strategic positioning, especially in unpredictable settings where breakouts are not guaranteed.

Avalanche Battles to Hold $30 Support While Eyeing $30.97 Resistance

Avalanche faces the pressing task of sustaining support above $30, all while striving to gain the momentum needed to surpass the $30.97 resistance level. Accomplishing this would bolster bullish confidence, setting the stage for elevated price targets and increasing speculative engagement.

On the other hand, not defending support might lead to increased selling pressure, which could quickly shift the current sentiment and test lower consolidation areas. Traders are closely monitoring technical signals, volume spikes, and on-chain developments that together influence Avalanche’s path as we approach Q4.