BitMine’s $961M Ethereum Acquisition Bolsters Market Assurance

BitMine has recently acquired more than $961 million in Ethereum, reinforcing its status as the largest corporate holder with a total of 2.65 million ETH. This calculated acquisition is seen as a purposeful effort to enhance influence and solidify long-term investment standing within Ethereum.

By taking advantage of market downturns, BitMine demonstrates increasing institutional confidence and promotes wider engagement from traditional finance sectors. Experts suggest that these actions greatly enhance positive momentum, paving the way for Ethereum’s possible surge towards elevated price levels.

ETF Inflows Provide Powerful Catalysts for Ethereum’s Bullish Trend

September was a significant turning point as Ethereum ETF net inflows surged to $171M, greatly enhancing investor confidence and market excitement. The recent inflows have bolstered Ethereum’s position above $4,400, contributing to the development of a bullish flag pattern that suggests ongoing upward momentum.

Experts in technical analysis suggest that ongoing accumulation of ETFs could drive price growth, possibly propelling Ethereum past the $4,800 resistance mark by the fourth quarter. The influx of institutional capital frequently serves as a catalyst, strengthening structural support zones and igniting speculative movements across the wider crypto markets.

Ethereum Consolidates in a Strong Range with Key Resistance Levels

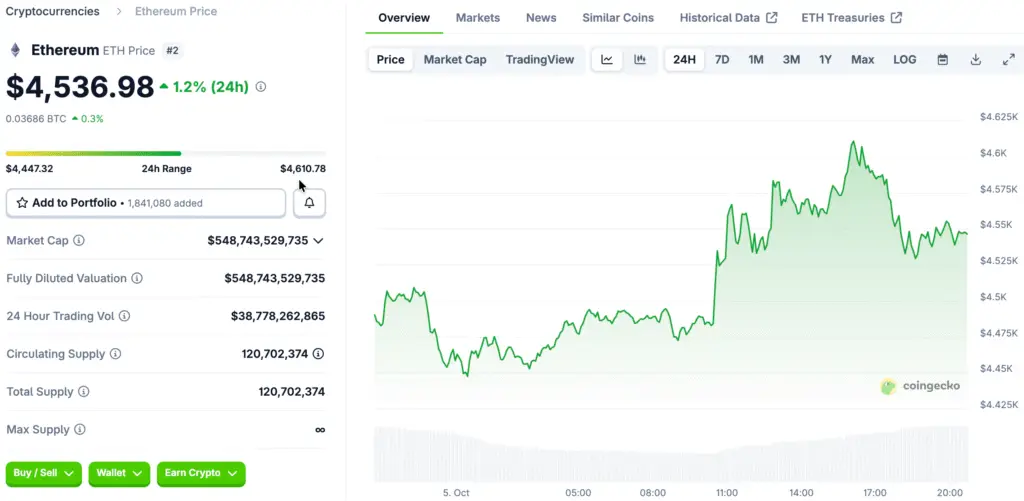

Ethereum is presently trading in a consistent range between $4,460 and $4,575, showcasing its strength even amid ongoing global market volatility. The $4,700 level stands as a pivotal resistance area, where successful breakouts may pave the way for significant upward continuation patterns for Ethereum.

On the other hand, a decline in support around $4,430 could lead the price movement down to $4,160, highlighting the importance of this range for traders’ risk management approaches. Analysts highlight the importance of strategic positioning as Ethereum gears up for possible fluctuations influenced by institutional involvement and technical indicators.

Recommended Article: Ethereum Price Prediction & Top 4 Cryptos Trending This October

MAGACOIN FINANCE Emerges As Notable Altcoin Amid Ethereum Optimism

As Ethereum continues to make waves in the news, MAGACOIN FINANCE is drawing in investors with its cutting-edge deflationary tokenomics and strategic whale accumulation. The initiative has successfully secured $16M, establishing itself as an intriguing speculative prospect in tandem with Ethereum’s narrative driven by institutional interest.

Investors are progressively broadening their portfolios by merging well-established assets like Ethereum with promising altcoins such as MAGACOIN FINANCE. This combination of stability and speculation mirrors the present market dynamics, where capital flows are simultaneously pursuing security and rapid growth.

Technical Indicators Support Ethereum’s Bullish Continuation Potential

The technical landscape of Ethereum continues to show promise, with bullish flag patterns and ETF activity strongly supporting its medium-term upward trend. The alignment of moving averages is favorable, and the MACD and RSI indicators reflect a growing momentum that supports a lasting bullish price trend.

Surpassing the $4,700 mark could ignite a surge in buying activity, propelling Ethereum towards key psychological milestones such as $5,000 and ultimately $6,000. Traders are paying close attention to breakout confirmations, considering them essential indicators for entering positions in this Q4 rally phase.

Institutional Accumulation Fuels Broader Altcoin Market Momentum

BitMine’s substantial acquisition of Ethereum has created a wave of positive sentiment, boosting interest in various altcoins such as MAGACOIN FINANCE, Solana, and Cardano. When institutions accumulate assets, it frequently leads to secondary rallies as investors shift their capital towards thriving ecosystems that capitalize on Ethereum’s robust performance.

The current dynamics reflect earlier bull cycles, where movements led by Ethereum sparked a wave of growth throughout DeFi, Layer-2 platforms, and speculative meme coins. As ETFs gain momentum, experts suggest that this influx of institutional investment may help maintain market stability amid the anticipated volatility of late 2025.

Weighing Opportunities and Risks as Ethereum Approaches $6K

The ascent of Ethereum presents remarkable prospects, yet it also necessitates well-structured approaches to navigate the fluctuations and speculative tendencies with precision. Support from institutions offers a sense of stability; however, swift inflows can lead to short-term volatility, necessitating meticulous portfolio management by those involved.

Altcoins such as MAGACOIN FINANCE present considerable potential for growth, yet they also entail greater risks, highlighting the importance of a diversified approach in changing market environments. As investors approach Q4, it’s essential to blend the dependability of Ethereum with a careful selection of altcoins to enhance potential gains while reducing risks.