XRP Adoption Fuels Rapid Price Acceleration in 2025

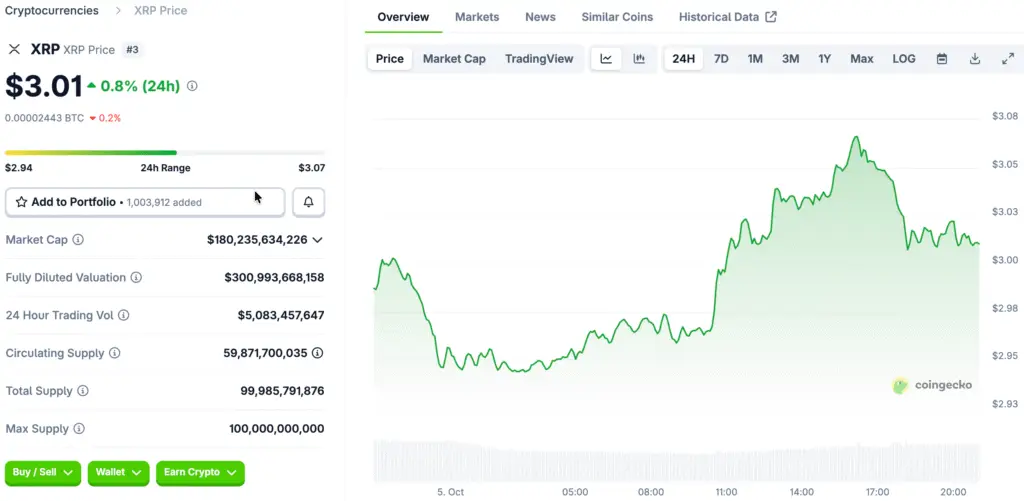

XRP has experienced a remarkable increase of 349% over the last year, surpassing Bitcoin’s 74% rise and catching many analysts off guard. This impressive surge is driven by speculation regarding potential ETF approvals and a resurgence of institutional interest, significantly enhancing XRP’s market visibility.

Traders highlight that XRP’s distinct cross-border payment capabilities set it apart from speculative meme tokens in a significant way. The appeal of low transaction costs and rapid settlement speed attracts financial institutions in search of efficient payment solutions across international corridors.

Bitcoin Continues to Lead the Market with Unwavering Strength

Bitcoin continues to hold its position as the largest cryptocurrency in the world, boasting an impressive market capitalization of $2.3 trillion, which underscores its lasting dominance on a global scale. It consistently sets the pace for overall market trends, bouncing back time and again from various bear markets while upholding robust investor confidence throughout the years.

The strength of Bitcoin stems from its decentralized framework, limited supply of 21 million, and robust support from a worldwide community. As institutions keep amassing Bitcoin, its status as the premier digital store of value seems increasingly hard to contest in any significant way.

XRP Utility for Global Payments Stands Apart From Bitcoin Store Value

Bitcoin serves mainly as a limited store of value, frequently likened to digital gold due to its reliable supply system. The process of settling a transaction typically requires about 10 minutes and incurs a cost of roughly $1, though it can occasionally rise during times of network congestion.

XRP, created by Ripple, focuses on facilitating cross-border payments that can be completed in just 3–5 seconds, usually at a cost of less than $0.01. XRP’s efficiency makes it a practical utility token for global transfers, highlighting a fundamental contrast with Bitcoin’s slower settlement design.

Recommended Article: XRP Price To Rocket To $6 In One Week? Legendary Analyst Says Paydax (PDP) Will Trigger 15,000% Gains Faster

Regulatory Developments Could Shape XRP’s Future Adoption

The recent surge in XRP’s value gained momentum after Donald Trump’s election, paving the way for a more favorable regulatory environment for cryptocurrencies in the financial markets. Moreover, experts expect that upcoming SEC rulings on spot XRP ETFs may significantly impact investor sentiment in the near future.

Nonetheless, doubts persist as the majority of RippleNet users steer clear of XRP’s On-Demand Liquidity features, which restricts the practical transactional utility at this time. As Ripple ventures into the realm of stablecoins via acquisitions, questions surrounding the exact function of XRP within its ecosystem remain unresolved.

Bitcoin’s Historical Performance Strengthens Investor Confidence

Bitcoin has a 15-year history marked by cycles of rapid growth, followed by significant downturns, ultimately leading to new peaks. The historical capacity to recover from downturns bolsters investor confidence, enhancing its reputation as a robust long-term asset consistently.

More and more institutional investors are directing funds into Bitcoin due to its clear regulatory framework and the liquidity benefits it offers on international exchanges. The participation of institutions contributes to the stabilization of Bitcoin’s market dynamics, positioning it as a comparatively safer option amid the fluctuating landscape of cryptocurrencies.

Portfolio Diversification Encourages Balanced Exposure to Both

Investors often choose to diversify their cryptocurrency holdings by maintaining positions in both Bitcoin and XRP, aiming to balance risk while maximizing potential gains. Bitcoin delivers reliability and established results, whereas XRP presents opportunities for speculative growth driven by the rising trends in cross-border payment adoption.

Investing more heavily in Bitcoin strengthens portfolio stability, while keeping smaller amounts in XRP allows for engagement in possible swift surges. This well-rounded approach attracts those looking for a variety of investment opportunities without depending too heavily on any one asset class.

XRP Faces Legal Uncertainty as Bitcoin Benefits From Halving Cycles

The power of Bitcoin is rooted in its limited supply, decentralized nature, and growing acceptance by regulators, positioning it as a dependable investment for preserving value. The consistent halving cycles and network effects persist in fostering ongoing growth, even in the face of occasional market corrections and regulatory challenges.

XRP encounters potential through its growing payment utility, yet it continues to be susceptible to uncertainties surrounding adoption and significant legal outcomes. Investors should thoughtfully assess their risk tolerance prior to strategically distributing capital between these two uniquely positioned cryptocurrencies.