Kaspa Price Consolidates Amid Hotter Crypto Market Momentum

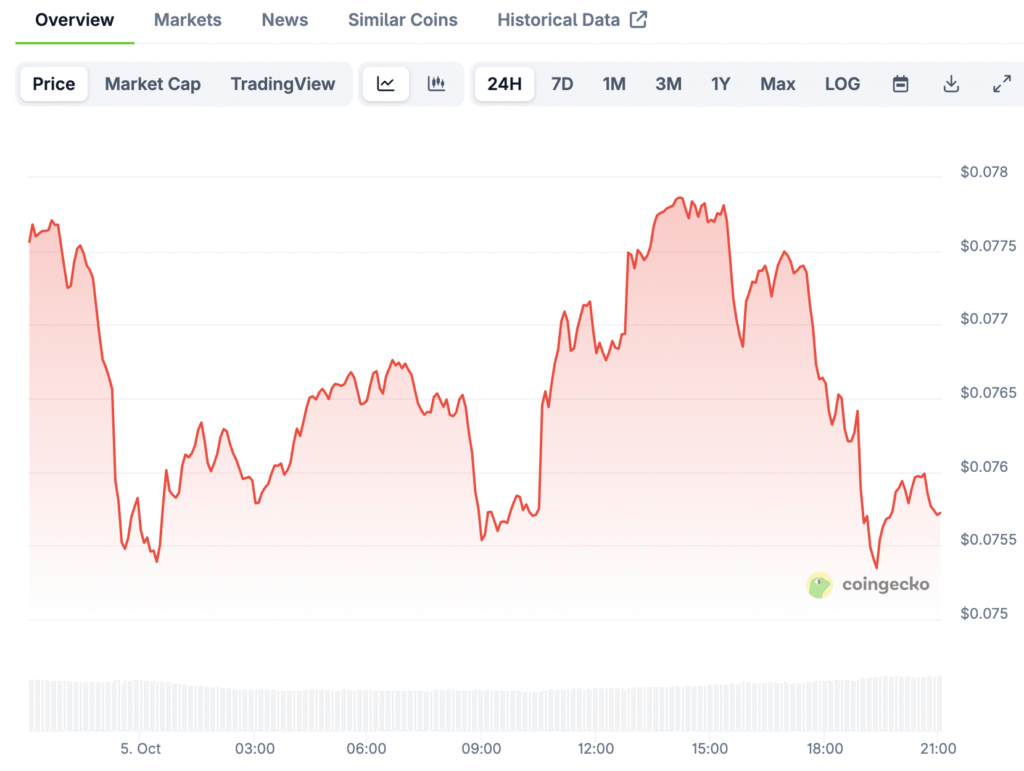

Kaspa is presently valued at approximately $0.077, showing slight weakness even in the face of Bitcoin’s record highs and robust altcoin surges worldwide. This lateral movement stands in stark contrast to the prevailing bullish sentiment in the market, as traders redirect their attention to assets that are currently exhibiting stronger momentum.

Earlier this year, Kaspa saw remarkable gains, but it has now entered a lengthy consolidation phase, which has temporarily subdued short-term enthusiasm. Historical patterns suggest that these periods of quiet accumulation frequently lead to explosive breakouts when sentiment shifts decisively upward.

Kaspa Coiled Spring Pattern Suggests Imminent Directional Breakout

The four-hour chart for Kaspa shows a period of consolidation within the range of $0.07 to $0.09, following a notable drop from $0.12 earlier. Buyers are steadfastly protecting lower support zones close to $0.07, while sellers are persistently unloading positions at the upper resistance levels.

This harmonious arrangement resembles a coiled spring, holding potential energy before a notable directional shift takes place in the forthcoming sessions. The RSI is currently around 35, indicating that there are no oversold conditions and that there is significant potential for a robust bullish rebound in the near future.

Market Indicators Reflect Neutral Sentiment Across Positions

The open interest holds steady at approximately $449 million, suggesting that traders have not yet made significant commitments to directional bets in a definitive manner. Net long positions stand at approximately –$380 million, whereas net shorts surpass $456 million, reflecting a careful yet balanced market dynamic.

This state of neutrality frequently comes before breakout phases, as participants hold back, waiting for confirmation signals before ramping up leverage or adopting aggressive positions. The MACD histogram also shows a flat pattern, which often suggests potential early momentum shifts that may impact short-term price movements in the near future.

Recommended Article: Kaspa Gains Strength as Q4’s Top Crypto for Long-Term ROI

Support and Resistance Levels Define Kaspa’s Weekly Outlook

Kaspa has established a key support level at $0.07, which traders closely watch for signs of bullish reversals and areas for accumulation. The immediate resistance lies within the range of $0.09 to $0.10, serving as a critical hurdle that the bulls need to surpass with significant volume.

A successful breakout above $0.09 would aim for $0.11 and $0.12, which are previous resistance levels that have historically indicated earlier rally phases. On the other hand, a drop below $0.07 might lead to retests around $0.06, a level where strong buyers had previously stepped in during past market corrections.

Historical Behavior Indicates Silent Intervals Prepare for Bold Actions

Kaspa has shown a consistent pattern of quietly consolidating before making significant upward movements when market sentiment experiences a notable improvement. Inattentive traders often find themselves caught off-guard during these accumulation phases, resulting in sudden rallies when technical levels coincide with volume expansion.

Considering the balanced positioning and stable open interest, we might see similar behavior if bullish catalysts arise during this consolidation phase. Historical patterns highlight that prolonged periods of sideways trading frequently set the stage for significant rallies, bolstering optimistic outlooks among long-term investors who are strategically positioned.

Fundamentals Support Kaspa’s Long-Term Network Growth

Kaspa’s network is effectively handling transactions, demonstrating impressive throughput abilities and a consistent increase in developer interest. The community is witnessing a steady increase in adoption, bolstered by continuous advancements in the ecosystem that improve network strength and transaction efficiency.

The fundamentals lay a solid foundation for possible bullish trends as market momentum is likely to realign favorably towards Kaspa in the future. The enduring positive sentiment among core supporters is still present, indicating a strong belief even in the face of a general absence of short-term enthusiasm.

Kaspa Setup Hints at Explosive Move as Low Volatility Nears an End

The market is currently in a state of anticipation, yet technical indicators point towards impending volatility as the consolidation approaches critical breakout levels. Market participants meticulously monitor volume surges, the strength of support levels, and the testing of resistance to forecast possible directional shifts in the week ahead.

Periods of low volatility in crypto markets seldom last forever, typically leading to explosive trends that benefit those who are strategically positioned. The present configuration of Kaspa suggests that this situation may develop shortly, rendering the forthcoming sessions vital for establishing its near-term direction.