Cardano Price Stabilizes Near Key Resistance Levels

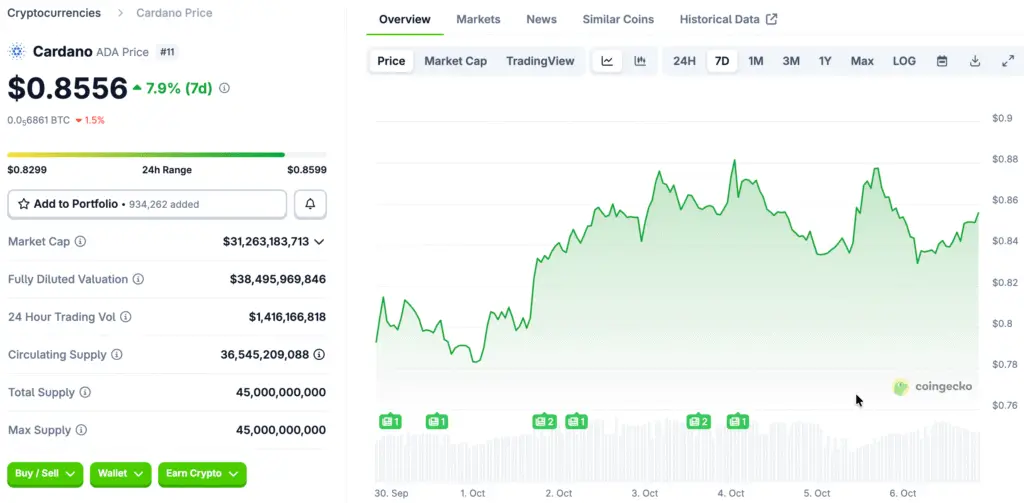

Cardano is currently trading around $0.85, showing signs of consolidation after a period of sideways movement, with no significant directional changes taking place lately. The price of the cryptocurrency is currently limited within a narrowing technical framework, indicating a careful market attitude as traders anticipate a significant shift.

The recent consolidation comes after several weeks of mixed signals, where bullish and bearish pressures have resulted in a balanced yet tense market atmosphere. Experts emphasize that the $0.86–$0.89 resistance zone is vital for determining if Cardano can embark on a lasting breakout in the near future.

Whale Accumulation Adds Substantial Upward Pressure

Major investors have started to accumulate once again, indicating a resurgence of confidence in Cardano’s long-term market potential, even in the face of recent stagnation. Wallets containing between 100 million and 1 billion ADA saw their balances rise from 4.22 billion to 4.25 billion tokens.

In a similar vein, mid-tier wallets holding between 10 and 100 million ADA increased from 13.02 billion to 13.06 billion coins over the course of several days. In total, whales contributed around 70 million ADA—valued at nearly $59 million—suggesting a careful yet intentional accumulation at the present market levels.

Cardano’s CMF Turns Positive at 0.12 as Bullish Capital Inflows Build

The Chaikin Money Flow indicator has recently shifted to a positive stance, rising towards 0.12, indicating net capital inflows into Cardano. A CMF reading exceeding zero generally suggests heightened buying activity and a strengthening presence of bullish participants in the market.

Experts observe that a robust CMF exceeding 0.20 would indicate significant accumulation akin to past rallies. Current readings indicate a sense of measured optimism, as larger investors are slowly positioning themselves in anticipation of a potential breakout, rather than rushing into sharp buying frenzies right away.

Recommended Article: Cardano Bulls Target $1 as Key Support Holds Firm

Cardano Faces Uncertainty as Whale Accumulation Meets Retail Caution

As whales continue to build their positions, smaller retail traders are exercising caution, which adds to the prevailing uncertainty in the market around resistance levels. The Money Flow Index, which gauges retail buying and selling momentum, has begun to decline, creating lower highs in recent sessions.

The contrast between whale accumulation and retail reluctance clarifies Cardano’s subdued price response, even in the face of considerable inflows. In the absence of retail involvement, any upward trends encounter obstacles, as the overall market confidence is divided among various investor factions.

Symmetrical Triangle Shapes in ADA Price Structure

Cardano is presently positioned within a symmetrical triangle pattern, showcasing a balance between bullish accumulation and cautious selling pressure. The upper limit ranging from $0.86 to $0.89 acts as a key resistance point, whereas the lower levels establish significant support areas in the near term.

A breakout above the upper boundary of the triangle may lead to a bullish continuation, aiming for targets around $0.93 and possibly $0.95. On the other hand, ongoing weakness could result in a drop below $0.80, undermining the existing bullish framework and possibly intensifying negative sentiment.

The Breakout Level at $0.89 Is Crucial for Market Direction

Market analysts highlight that a strong daily close above $0.89 may convincingly validate Cardano’s breakout attempt. This action could draw in those who have been on the sidelines, creating robust momentum and possibly leading to new short-term peaks.

On the other hand, if resistance is not broken, consolidation may continue, putting ADA at risk of testing lower levels around $0.82 and $0.78. Market participants see this threshold as the crucial boundary that distinguishes between ongoing lateral movement and the onset of a bullish rally phase.

Cardano’s $0.89 Level Becomes Key Battleground

The ongoing struggle between major institutional players and cautious retail investors could greatly influence Cardano’s future price movements. If the conviction of major investors leads to wider involvement, momentum may accelerate quickly, overcoming technical obstacles and drawing fresh speculative interest.

Nonetheless, ongoing retail indifference could hinder breakout efforts, prolonging ADA’s consolidation phase until mid-October. Market observers anticipate significant fluctuations as either party establishes a clear advantage, positioning the $0.89 mark as a vital point in assessing upcoming trends.