Ripple Broadens Its Global Reach, Enhancing Investor Trust

Ripple is steadily broadening its financial network, continually strengthening XRP’s position in global transactions and compliance-focused payment systems. Their continuous collaborations highlight a thoughtful approach, fostering institutional confidence and promoting wider acceptance in the ever-changing landscape of global cross-border payment pathways.

Ripple’s latest partnerships highlight the importance of compliance and liquidity, closely aligning with recognized financial standards and long-term utility objectives. This strategic positioning bolsters market confidence, prompting investors to uphold optimistic expectations even in light of XRP’s recent stable price movements.

Strategic Partnerships Strengthen Ripple Regulatory Ambitions

Ripple has formed partnerships with DTCC, Franklin Templeton, and DBS, pushing forward the advancements in tokenization and the development of innovative stablecoins within its ecosystem. These partnerships seek to influence structured payment systems, incorporating blockchain efficiencies while ensuring reliable supervision among international financial entities.

The launch of RLUSD and Confidential Multi-Purpose Tokens showcases Ripple’s creative approach to addressing the growing issues of privacy and auditability. These developments underscore a dedication to institutional integration, bolstering XRP’s enduring stance within the framework of regulated financial environments worldwide.

XRP Price Predictions Highlight Optimistic and Cautious Views

By October 2025, XRP is trading close to three dollars, indicating stable market conditions supported by significant institutional interest. Analysts continue to show differing opinions, offering projections that span from moderate growth scenarios to ambitious double-digit targets under optimal conditions.

Certain analysts predict that XRP could reach five dollars if adoption continues to grow consistently, bolstered by clear regulations and technological progress. Some advise caution regarding overly optimistic views, highlighting the unpredictable nature of macroeconomic factors and the competitive challenges present in digital payment systems.

Recommended Article: Layer Brett Targets $1 As XRP Eyes $10 Price Milestone

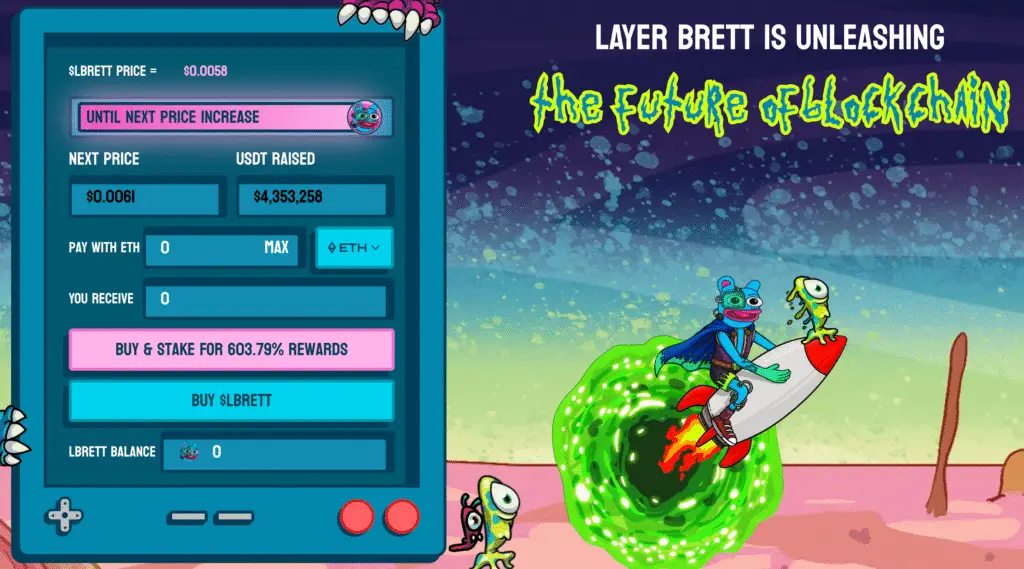

Layer Brett Presale Gains Momentum as Meme Coins Shape Market Sentiment Globally

Meme coins continue to play a significant role in shaping crypto sentiment, drawing in communities with their viral branding and speculative excitement. Investors are progressively perceiving these tokens as high-risk, high-reward prospects that can yield swift profits in favorable market conditions.

Layer Brett embodies this trend, merging meme culture with technological ambitions to develop Ethereum Layer 2 scaling infrastructure. The presale showcases impressive momentum, generating millions and attracting thousands of early participants from various digital communities around the globe.

Layer Brett Presale Showcases Bold Technical Aspirations

Layer Brett’s whitepaper outlines that the project aims for transaction throughput surpassing ten thousand per second while maintaining minimal fees. While these assertions are certainly bold, they remain unverified until the mainnet is launched, leaving investors in anticipation of tangible proof of the expected performance.

The presale has reportedly generated nearly four million dollars, showcasing robust community backing and an increasing interest from investors overall. Nonetheless, seasoned analysts stress the importance of assessing transparency, adherence to regulations, and the effectiveness of development efforts prior to concluding sustainable long-term success.

Layer Brett Brings High Upside Potential While XRP Offers Stability and Real Utility

XRP presents a solid utility, aligns with regulatory standards, and showcases moderate growth potential that attracts long-term institutional investors. Its role in the global payments infrastructure sets it apart notably from speculative meme tokens that do not have practical real-world applications at this time.

Meme coins such as Layer Brett offer the potential for significant returns, accompanied by increased volatility and unpredictable development paths. Achieving success can lead to significant rewards, but historically, failures in projects are frequent in the early-stage speculative cryptocurrency markets.

XRP Stability Balances Meme Coin Speculation as Investors Refine Crypto Strategies

Investors are progressively finding a balance in their portfolios, weighing the stability of established payment networks such as XRP against the allure of speculative meme coins that offer the potential for significant growth. This duality captures the prevailing market sentiment, blending a sense of cautious regulatory optimism with bold endeavors aimed at identifying potential breakout performers.

Effective allocation necessitates a grasp of risk profiles, technological principles, and the current regulatory environments that influence the future trajectories of the crypto market. Striking a balance between embracing innovation and maintaining stability enables investors to adeptly manage uncertainty while effectively seizing emerging opportunities.