Floki Upholds Positive Momentum Amid Growing Market Optimism

Floki is drawing significant investor interest as it establishes a clear bullish pattern on both its daily and weekly price charts. The meme token is currently trading above the important $0.0000109 level, reflecting ongoing buying interest after a series of accumulation sessions.

Pentoshi, the analyst, pointed out that Floki’s structure shows a pattern of consistent higher highs and higher lows, which strengthens the bullish dominance in the ongoing trend. A confirmed weekly close above support would affirm market acceptance and initiate an expansion into higher ranges.

Essential Support Area Underpins Current Accumulation Stage

The $0.0000109 support zone has consistently attracted new buying inflows in recent weeks. The repeated rebounds from this zone highlight an increasing sense of investor assurance as short-term fluctuations diminish.

A strong close on a 3-day or weekly candle above the breakout range may set the stage for a definitive reversal foundation. The confirmation would indicate acceptance into the previous trading corridor and pave the way for higher resistance levels.

Analysts Predict 2× Price Move Toward Upper Range

Experts anticipate that maintaining levels above $0.0000109 could propel Floki to $0.0000200, indicating a possible 2-fold increase. This pattern reflects an inverse head and shoulders formation often seen before significant trend reversals in cryptocurrency markets.

If Floki keeps up its momentum and breaks through resistance at approximately $0.0000120, traders anticipate a move toward the prior supply zone near $0.0000200. Robust volume confirmation is essential for affirming this structure prior to the potential emergence of a wider rally.

Recommended Article: Floki Holds $0.000102 as Breakout Rally Targets 3x Price

Market Conditions Support Cautious Yet Growing Optimism

The present state of the meme coin landscape indicates a shift towards projects that boast robust liquidity and engaged communities. The rotation brings advantages to Floki, as fresh capital influx enhances engagement from both short-term and long-term investors.

Pentoshi warned that not maintaining the neckline might postpone the confirmation of a breakout. Nonetheless, the overall sentiment continues to be positive, as on-chain data indicates a rising number of holders and stable funding rates across key exchanges.

Floki Breaks Descending Trend Line as Volume and RSI Signal Start of Bullish Phase

Market analyst Bluntz noted a significant breakout above the descending trend line, supported by increased trading volume. This pattern indicates the conclusion of an extended period of consolidation and the potential beginning of a new bullish trend for Floki.

Bluntz notes that the Relative Strength Index around 51 shows momentum without significant overheating, suggesting a strong potential for continued growth. Consistent purchasing momentum may propel Floki towards its previous range peaks, situated between $0.000018 and $0.000022.

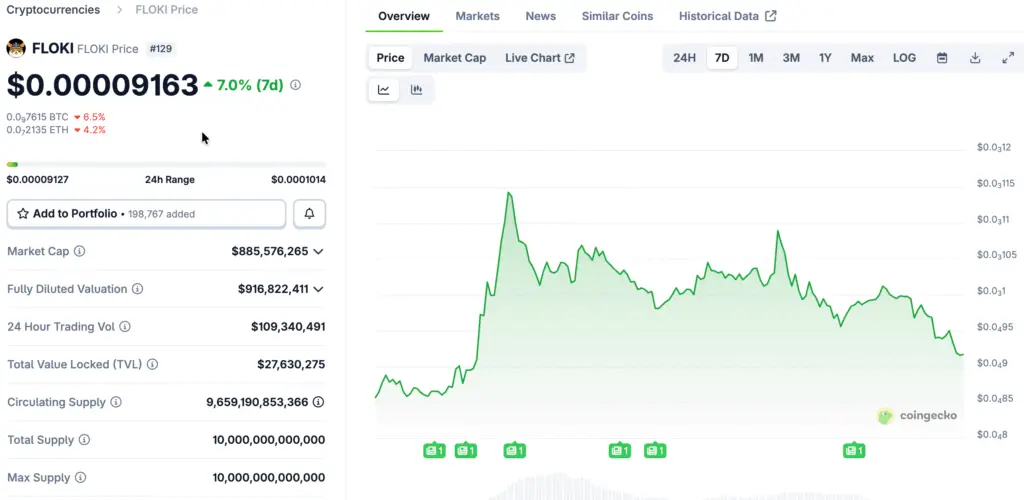

Trading Volume and Market Performance Strengthen Rapidly

Floki’s trading activity experienced a notable uptick as the token rose from $0.000098 to $0.000102, marking a daily increase of 4.12%. The shift aligned with a significant increase in trading volume, soaring to $193 million, indicating robust market participation.

The current market capitalization is nearing $987.4 million, positioning Floki as one of the most dynamic mid-cap meme tokens this October. The steady growth in volume and liquidity indicates a resurgence of confidence in the wider meme coin landscape.

Floki Holds Above $0.000100 as Analysts Eye Breakout Toward $0.000200 Resistance

If buyers keep their grip above the $0.000100 mark, experts anticipate another effort to test the upper resistance levels around $0.0000200. The correlation between technical indicators and on-chain activity establishes a basis for this continuation setup.

Floki’s growing ecosystem involvement and consistent accumulation position it as a key meme asset to watch closely. Consistent closes above resistance levels may pave the way for a significant breakout phase, aiming for a 2-fold price recovery by the end of the year.