Bitcoin Poised for Strong October Recovery Momentum

Bitcoin seems poised for a recovery after its recent dip that saw prices momentarily fall below $102,000 last week. Economist Timothy Peterson anticipates that the world’s largest cryptocurrency could rise by as much as 21% in the upcoming week. The analysis is based on historical performance trends observed in October, which have reliably indicated positive returns throughout previous cycles.

Since 2013, October has seen an average gain of 20.1%, making it Bitcoin’s second-best month, following November’s impressive average of 46%. Peterson observed that declines of more than 5% in October are uncommon, having happened only four times over the past ten years. In three of those cases, Bitcoin quickly bounced back with impressive double-digit gains, boosting investor confidence today.

Market Stabilizes After Trump Tariff Announcement Shock

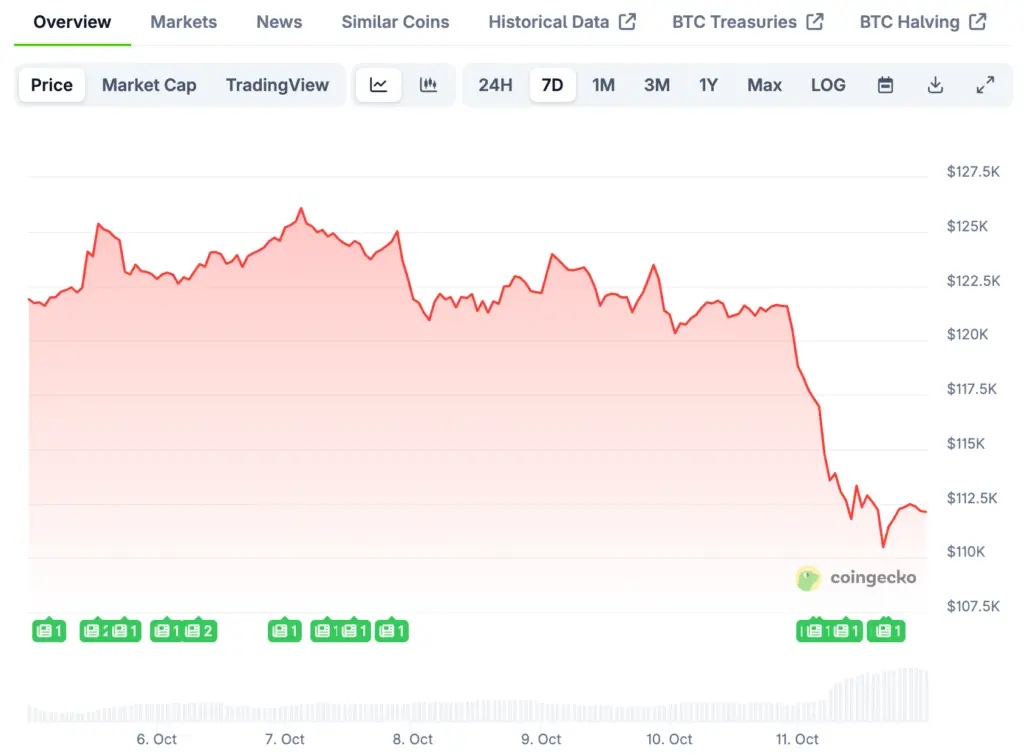

The recent market downturn, induced by President Trump’s 100% tariff on Chinese imports, led to investor unease and a temporary drop in Bitcoin to below $102,000. However, it quickly recovered to around $111,700, showcasing strong investor confidence against macroeconomic uncertainties.

Market data shows Bitcoin peaked at about $125,100 earlier in the week. Historically, a 21% rebound from Friday’s low could push prices to approximately $124,000, bringing Bitcoin close to its recent peak.

Historical Trends Reinforce ‘Uptober’ Seasonal Optimism

October’s consistent performance has led to it being dubbed “Uptober” among crypto trading communities globally. Throughout various cycles, October reliably brings forth positive momentum, bolstered by enhanced liquidity and increased institutional inflows. The current seasonal optimism is impacting trading behaviors and setting Bitcoin up for possible short-term gains.

Peterson highlighted that the chances of additional declines are constrained under these circumstances. The analysis indicates that repeated autumn rallies frequently serve as catalysts for year-end uptrends. Market participants analyzing these patterns anticipate that sentiment will continue to be positive for the rest of October.

Recommended Article: Trump Becomes Major Bitcoin Investor With $870 Million Holdings

Bitcoin Analysts Stay Bullish As Samson Mow And Van De Poppe Predict Uptober Gains

In spite of the volatility, numerous prominent analysts continue to express a positive long-term perspective for Bitcoin. Samson Mow, the founder of Jan3, reminded his followers that “there are still 21 days left in Uptober.” His statement highlights the strength of the market and the conviction that the upward trend of the cycle is still in place.

In a similar vein, Michael van de Poppe, CEO of MN Trading Capital, characterized the recent pullback as “the bottom of the current cycle.” Both analysts perceive the correction as a crucial phase of recalibration prior to subsequent growth. Their comments reflect a wider anticipation of reduced volatility before a fresh surge in prices.

Technical Indicators Suggest Critical Compression Phase

Trader Tony “The Bull” Severino observed a significant tightening of Bitcoin’s Bollinger Bands on the weekly chart. In the past, these contractions have often come before significant directional shifts, indicating that the market is poised for a breakout. He is convinced that the upcoming 100 days will determine if Bitcoin maintains its upward trajectory or faces a downturn.

Severino warned that “head fakes” frequently emerge under these circumstances, leading to misleading breakouts prior to validated rallies. He observed that Bitcoin’s fleeting rise to $126,000 did not sustain momentum, suggesting possible short-term weakness. The constricting bands indicate that a significant shift could be on the horizon.

Bitcoin Cycles Show Lengthening Growth Patterns

Certain analysts suggest that the structural cycles of Bitcoin have lengthened over time, prolonging both accumulation and growth phases. Extended cycles could lead to a decrease in the frequency of volatility, all the while maintaining a steady progression in prices. The theory indicates that Bitcoin may undergo more consistent rallies, bolstered by increased involvement from institutions and broader acceptance among retail investors.

The present trading levels hovering around $122,700 indicate a period of consolidation close to the upper range limits. If history is any guide, we may soon witness a resurgence in upward momentum following a period of compression. Investors view this as a positive adjustment period ahead of Bitcoin’s next possible upward movement in the current bull market.

Bitcoin Targets $124K Resistance as Uptober Momentum Builds Across Global Markets

The outlook for Bitcoin in October appears positive, with historical data indicating the possibility of a recovery. A 21% rise from recent lows would solidify October’s status as a crucial month for performance in the cryptocurrency markets. Experts anticipate that renewed accumulation pressure will bolster ongoing price strength in the upcoming sessions.

With Bitcoin finding stability, attention now turns to the important resistance levels around $124,000 and further. A consistent breakthrough beyond these levels may draw in wider market investments as we approach November. Traders are staying vigilant to signs of volatility and seasonal momentum as Uptober progresses in global markets.