Solana Faces Pressure After Failure to Break $250 Resistance

Investors are worried about Solana since it recently failed to break over the $250 resistance zone and is now getting close to a key technical level. The price is testing its lower limit after months of steady rises in an ascending parallel channel. This is a crucial area that has traditionally supported positive rebounds.

Analysts, on the other hand, say that the recent price movements look more like corrections than impulses, which might mean that the uptrend is losing momentum. If the channel breaks down, it would probably mean that a deeper corrective phase is about to begin.

Technical Patterns Indicate a Potential Breakdown Scenario

The weekly chart reveals that Solana is trading close to the lower edge of its ascending parallel channel, which has been in place since April. Earlier moves suggested a possible breakout, but the fact that it couldn’t stay over $250 shows how strong the barrier is.

Right now, SOL is about $135, and bears are looking at the $125 area as the next big support level. If this level fails to hold, experts forecast a probable slide toward $95, representing a complete retracement of the April surge.

Solana Momentum Weakens as RSI and MACD Turn Bearish in Q4 2025

The momentum indicators have changed to a negative tilt. The Relative Strength Index (RSI) has gone below the neutral fifty threshold, which means that purchasing momentum is slowing down. Also, the Moving Average Convergence Divergence (MACD) indicator has crossed over to the negative side, which has traditionally been a sign of deeper pullbacks.

These signs point to the fact that Solana’s recent rises may have run out of steam. If the asset doesn’t immediately get back to the middle of the channel, traders might see more downward pressure in Q4 2025.

Recommended Article: Solana Price Eyes Rally as Double Bottom Pattern Takes Shape

Wave Structure Suggests Continuation of Corrective Phase

Elliott Wave research supports the bearish view, suggesting that Solana may be finishing wave C as part of a wider A-B-C corrective pattern that started after its high in December 2024. This pattern fits with a long-term correction that comes after the two-year, five-wave rise that marked Solana’s last bull phase.

If wave C keeps going, Fibonacci estimates say the price might drop to about $59, which is well below the 0.786 retracement line. Analysts say that even if this is a long-term prognosis, there might be short-term bounces near $125 or $150 before the market goes down again.

Key Support and Resistance Levels to Watch for Solana

The lowest level of the existing structure is $125, which is the most immediate support. The next important area is about $95, where a lot of purchasing happened earlier this year to build a strong basis.

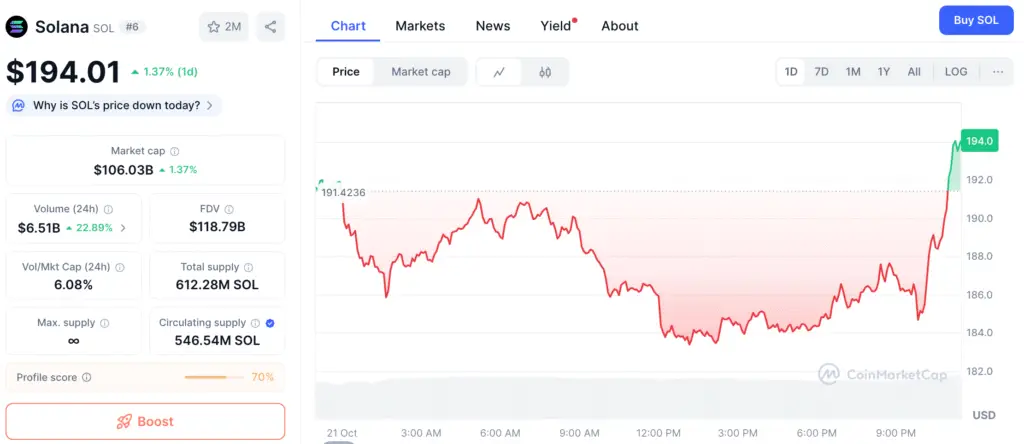

Resistance is still strong at $185, and then there is the $250 barrier that stopped Solana’s last breakthrough effort. To prove the present bearish story wrong, volume would have to stay above those levels for a long time.

Market Sentiment Turns Cautious Among Traders

Traders on key exchanges are taking fewer long positions, which shows that they are becoming more cautious as the technical picture weakens. Funding rates have returned to normal from their bullish highs, which means there is less interest in speculation.

This cooling off of emotion generally comes before bigger market corrections, especially when liquidity drops and fewer people shop. Institutional investors are mostly on the sidelines until Solana breaks through a critical barrier and sets a clear trend direction.

Solana at a Make-or-Break Moment in Q4 2025

As the fourth quarter goes on, Solana is at a key point between recovery and a longer correction. If it stays over $125, the structure will stay the same, and there is still a chance that it might bounce back to $185 or higher.

But if it breaks down below that support level, it might start a chain reaction that takes it down to $95 or possibly the long-term objective of $59 set by wave predictions. Both the RSI and MACD are showing signs of danger, so traders should be careful as Solana moves through one of its most important levels of 2025.