Rising On-Chain Metrics Highlight Avalanche’s Growing Strength

Avalanche’s blockchain data still shows that more people are using it and that the ecosystem is growing naturally across its primary network components. The total fees that have been recorded are over 4.9 million AVAX, while C-Chain has contributed more than 4.8 million AVAX in user activity. These numbers show that there is a steady need for network resources and significant community involvement, even though the market as a whole is calm right now.

Analysts say that Avalanche’s charge structure shows real use instead of surges in speculative trading. This consistency shows that there is a solid base that can support future growth as the need for scalable and low-latency solutions grows.

Avalanche Eyes Breakout as Higher Lows Signal Strength Above $25 Zone

Recent chart patterns show that Avalanche may soon break out of its present consolidation pattern and go up a lot. Analysts say that higher lows are starting to form around the important support zone, which makes people more confident in the market. Once the price breaks through resistance around $25, momentum could quickly take AVAX toward the $50 area.

This setup seems like a common bullish accumulation pattern, when buyers wait for the right time to buy before a big breakout. For the expected rising trend to continue in the next weeks, there must be sustained volume and technical confirmation.

Momentum Returns as Buyers Defend Key Support Levels

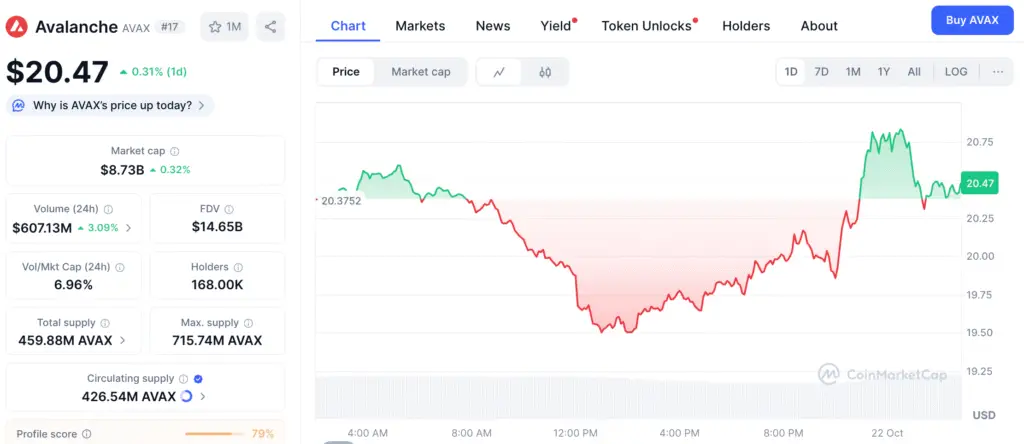

Avalanche’s market structure is still good since buyers are still defending support between the $19 and $21 zones with more and more confidence. Analysts say that momentum indicators like RSI and moving averages are starting to move in a good direction again.

If this trend keeps up, AVAX might hit the $25 to $27 level by the conclusion of the current quarter. The technical strength of Avalanche shows that optimistic investors are getting ready early for any macro-driven swings in the fourth quarter.

Recommended Article: Avalanche Eyes $30 Breakout as Q4 Momentum Builds Rapidly

Historical Q4 Performance Strengthens Bullish Sentiment

Avalanche’s success in the fourth quarter of last year is a strong reminder of how quickly it may return in comparable market conditions. AVAX went from $9 to $50 in just two months in 2023, making it one of the biggest reversals in crypto history.

Investors are hopeful about a similar breakout in 2025 because of how well this one did in the past. If more liquidity comes back to cryptocurrencies, Avalanche might once again lead the market’s recovery, showing that it is still a strong layer-1 network.

Fundamental Strength Supports Avalanche’s Market Position

Avalanche’s basic ecosystem is growing beyond chart patterns, with more developers working on it and more decentralized apps being built. The network’s scalable consensus design makes it possible to quickly finalize transactions and move assets between chains at a cheap cost.

The fact that its fees are going up shows that it is being used a lot in the real world, in DeFi protocols, gaming initiatives, and business integrations. These factors provide a strong case for possible price increases as blockchain use grows throughout the world.

Accumulation Near Support Zones Suggests Avalanche May Be Bottoming

Experts say that extended periods of consolidation generally come before big price changes in assets that have been known to be quite volatile, like AVAX. The current accumulation near support zones demonstrates that both institutional and individual investors are slowly getting back into their holdings.

This accumulating base creates a technical floor that lowers the danger of a drop while raising the chances of a quick rise if volume picks up. People who trade in the market and watch liquidity patterns want to see proof before a long-term bullish period starts.

Q4 Outlook: Avalanche Poised for a Resilient Comeback

As we get into the fourth quarter of 2025, Avalanche is at a crucial turning point because of strong fundamentals and a good technical structure. The currency is trading close to $21, and it has gone up 5% in the last 24 hours as trust steadily returns.

Avalanche may follow the same path of recovery as before if on-chain growth keeps going and macro signals are strong. AVAX might break out toward the $50 goal by the end of the year if there is definite demand, disciplined accumulation, and a positive mood.