Bitcoin Gains Momentum Before Inflation Data Release

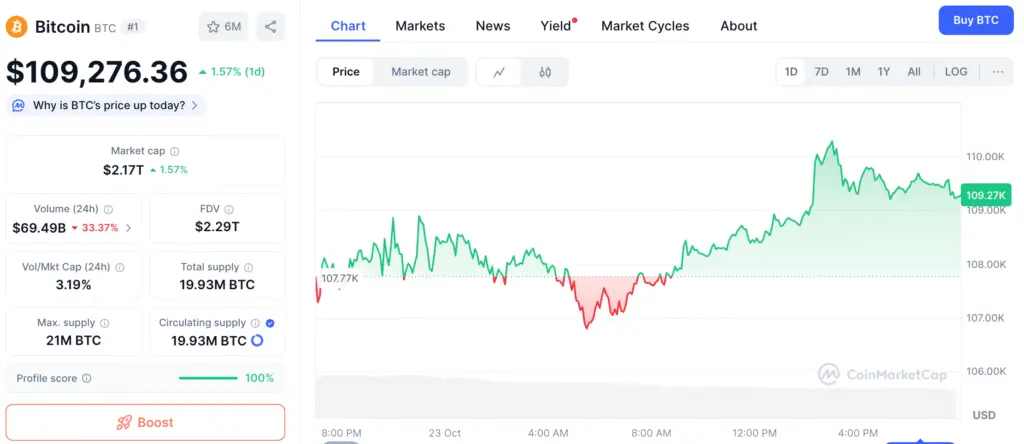

Bitcoin (BTC-USD) has gone up more than 2% in the last 24 hours, trading above $109,200 as investors get ready for the US consumer price index (CPI) data. Because of the government shutdown, most official economic data is on hold. This CPI announcement is the most important thing for the market this week.

Analysts say that the inflation numbers will have a big impact on what people expect from monetary policy in the near future. The outcome might decide if Bitcoin’s short-term rise continues or if it becomes volatile again as traders respond to changing interest rate predictions.

Analysts See CPI as a Key Catalyst for Bitcoin’s Next Move

According to a report from QCP Capital, experts said that Friday’s CPI reading is “the only release the Fed will see before policy rhetoric resumes.” The company said that a milder reading of about 0.2% might support the “soft landing” story, which would be good for risky assets like Bitcoin.

The research comes after gold fell the most in one day since 2020 because of a stronger US currency. Earlier this week, Bitcoin quickly rose to $114,000 before falling again, which showed that people were starting to speculate again before the inflation figures came out.

Geopolitical Developments Ease Market Tensions

Reports that Chinese president Xi Jinping and US president Donald Trump would talk about trade have given global markets a little bit of a boost. The two leaders are likely to meet at the Asia-Pacific Economic Cooperation (APEC) conference in South Korea later this month.

Investors are hopeful that the summit will help reduce rising trade and security tensions, which would be good news for risk-sensitive assets like cryptocurrencies. Any breakthrough in talks might boost Bitcoin’s current rise by making the market more confident as a whole.

Recommended Article: Bitcoin 2035 Outlook Sees Path to $1M Price Target

Bitcoin Consolidates After Record High Above $126,000

Bitcoin is still significantly behind its all-time high of $126,270, which it set on October 6, even though it has bounced back. Since then, prices have slowly gone down as people took profits and the whole crypto market became less excited because of worries about the economy.

John Glover, Ledn’s chief investment officer, said that the bull run for Bitcoin may have already ended. “We have finished the five-wave move up,” he added. He thought the bear phase may last until late 2026.

Bitcoin May Hit $124K Short Term but Faces Weak Structural Demand

Glover thinks that there will be a big drop in the price of Bitcoin before the next big rebound since the pricing patterns are cyclical. He said, “I expect that during the bear market we will trade down to $70,000 or less.”

He also said that Bitcoin may hit $124,000 again in the short term, but the overall trend is still weak until structural demand comes back. The prediction fits with what other analysts have said, which is that the market will become more volatile after the CPI release.

Optimists Highlight Institutional Demand and ETF Flows

Not all analysts agree that the market is going down. If more institutions get involved, Matt Hougan, Bitwise’s chief investment officer, thinks Bitcoin might do as well as gold did earlier this year. “If the number of sellers goes down, institutional demand could start a new rally,” Hougan added.

He said that gold prices went up 57% in 2025, mostly because central banks bought a lot of it. He said that Bitcoin’s future relies on whether fresh money coming in from exchange-traded funds (ETFs) can make up for the selling pressure from short-term traders.

Bitcoin Balances Between Caution and Opportunity

Even if a lot of money is coming into US-based Bitcoin ETFs, the market is still quite cautious. Many traders are still cautious about pushing prices beyond $110,000, so they sell after making 10% to 15% profits instead.

Still, the fact that Bitcoin has held up well despite a high dollar and unstable global markets shows how useful it is as a hedge against inflation uncertainty. Analysts say that if Friday’s CPI report shows that price increase is slowing down, Bitcoin might keep going up until it reaches the $115,000–$120,000 range by the end of the year.