XRP Breaks Through Multi-Week Resistance Level

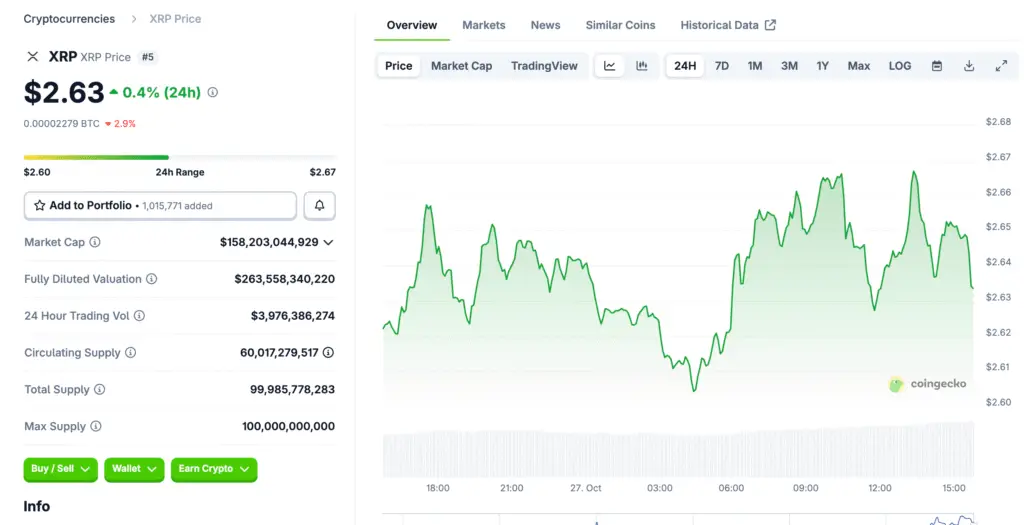

XRP has officially broken above its multi-week resistance level of $2.63, gaining 3% during a single trading session. The breakout came on one of the highest daily trading volumes seen in October. This surge confirms a strong bullish structure forming within the market. Traders and analysts are now watching closely to see whether the token can sustain this momentum above key support zones.

Institutional Inflows Drive Renewed Market Confidence

Recent data suggests that institutional investors have played a key role in XRP’s rally. Fund managers report hundreds of millions of dollars flowing into XRP-linked products over the past week. This influx of capital indicates growing confidence in Ripple’s underlying technology and regulatory progress. Institutions appear to be positioning themselves early in anticipation of favorable ETF developments.

Technical Indicators Confirm Breakout Strength

From a technical standpoint, XRP’s breakout above $2.63 was validated by a strong spike in volume. RSI and MACD indicators remain bullish, showing clear upward momentum and strong market structure. Support has now been re-established between $2.61 and $2.63, offering a foundation for further growth. Analysts believe that sustained buying at these levels could propel the asset toward the $2.80 resistance zone.

Recommended Article: Analysts Warn XRP May Be Overvalued at $2.50 Despite 355% Rally

Volume Surges Point to Institutional Accumulation

Trading volume spiked by 147% compared to the prior 24-hour period, confirming institutional participation. Large-scale buying followed by consolidation suggests strategic accumulation rather than speculative hype. This disciplined accumulation pattern is often seen before major continuation moves in high-cap assets. If volume remains high, XRP could enter a new growth phase similar to previous breakout cycles.

On-Chain Data Supports Long-Term Bullish Outlook

Blockchain analytics indicate increased wallet activity among long-term holders. The number of wallets accumulating XRP continues to climb steadily, signaling conviction from experienced investors. This activity aligns with expectations of broader adoption following Ripple’s legal clarity and partnership expansion. Such network engagement reinforces the bullish case for sustained appreciation.

Regulatory Progress and ETF Speculation Add Tailwinds

The ongoing clarity around XRP’s regulatory standing has improved investor sentiment significantly. The SEC’s admission of XRP as a utility token has removed a major source of uncertainty. Market participants now speculate that ETF approval could arrive within months, unlocking a new wave of institutional inflows. This environment creates a favorable setup for XRP to test higher resistance levels near $2.80 and beyond.

Key Levels Traders Are Watching Now

Immediate resistance lies between $2.70 and $2.75, with $2.80 identified as the next major target. A successful retest of $2.63 as support would further validate the breakout structure. Traders are also monitoring for volume confirmation during any retracement phases. A sustained close above $2.70 could trigger the next leg of upward movement, drawing in new buyers.

Outlook: XRP Positioned for Sustained Growth in Q4

XRP’s clean technical breakout, rising institutional demand, and improving regulatory climate suggest a strong Q4 performance. The asset’s ability to hold above $2.63 will be key in maintaining bullish momentum. If volume and sentiment remain aligned, XRP could rally toward $2.80 or even $3.00 in the coming months. The convergence of technical and fundamental factors places XRP among the top-performing altcoins heading into 2026.