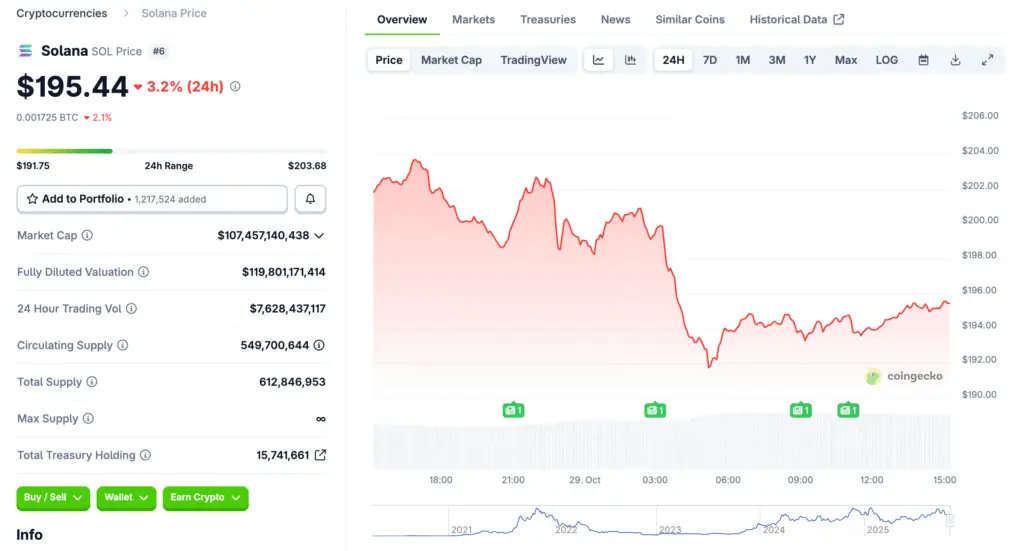

Solana Pulls Back After Failing to Hold Above $200

Solana’s price has retreated below the $200 mark following an earlier attempt to sustain gains. The decline came after the asset encountered strong resistance near $205, where buyers lost momentum. This correction follows several weeks of strong performance driven by rising network activity. Despite the pullback, analysts believe the trend remains constructive if key support levels hold.

Market Structure Shows Short-Term Consolidation

The SOL/USD pair is now trading below $198 and the 100-hourly moving average. A break below the $198 bullish trend line confirmed weakening short-term momentum. The correction aligns with normal market rotation as traders secure profits from the recent rally. Technical charts show that Solana remains in a healthy consolidation range for now.

Support Levels to Watch at $192 and $188

Immediate support has formed near the $192 level, aligning with the 50% Fibonacci retracement zone. A failure to maintain this area could push prices toward $188, the next significant support. Holding this range is critical for preventing deeper downside toward the $180 region. Traders are monitoring these levels closely as Solana seeks to stabilize its price action.

Recommended Article: Solana Leads Blockchain Revenue as Price Targets $200 Breakou

Technical Indicators Signal Bearish Pressure

The MACD for SOL/USD is trending negatively, suggesting increasing bearish momentum in the near term. Meanwhile, the Relative Strength Index has slipped below 50, confirming a neutral-to-bearish tone. These indicators imply that short-term sentiment remains cautious among traders. However, oversold conditions could attract dip buyers if volatility subsides.

Resistance Levels Cap Recovery Attempts

Resistance now stands near $198 and $200, with $205 remaining a key inflection point. A decisive close above $205 could trigger renewed bullish momentum and a retest of the $212 level. The next upside target beyond that sits near $220, representing the upper limit of the prior rally. Sustained volume growth will be essential to validate any bullish breakout attempt.

Broader Market Context Supports Long-Term Growth

Despite short-term technical weakness, Solana’s fundamentals remain strong across DeFi, NFTs, and tokenization sectors. The blockchain continues to lead in transaction speed and ecosystem expansion. Developers remain active, and institutional interest in Solana-based projects continues to rise. These strengths provide a long-term bullish backdrop for the asset despite current consolidation.

Potential Scenarios for Price Action Ahead

If Solana fails to hold above $192, a retest of $188 could occur before stabilizing. A deeper drop below $180 would risk further bearish continuation toward $166 support. Conversely, maintaining above $192 could set the stage for renewed upward movement. Analysts maintain a cautiously optimistic view given the network’s consistent growth and adoption.

Outlook: Solana Consolidates Before Possible Recovery

Solana’s correction below $200 appears to be part of a broader consolidation phase rather than a trend reversal. Strong support zones remain intact, giving bulls an opportunity to regroup. If the asset reclaims $200 on sustained buying volume, a move toward $220 could follow. Until then, traders should expect range-bound behavior as Solana builds a new base for its next advance.