Solana Holds Firm Amid Market Consolidation

Solana (SOL) continues to demonstrate resilience in a volatile crypto landscape, trading steadily near the $183 mark. The blockchain network, known for its unmatched speed and scalability, remains a leading force in decentralized finance and Web3 innovation. Despite minor pullbacks, investors view Solana’s current consolidation as a potential springboard for future gains.

Institutional Investors Reaffirm Confidence in Solana

Institutional participation in Solana has surged, driven by its expanding ecosystem and growing adoption in tokenized assets. Hedge funds and venture firms are accumulating SOL positions, citing its high throughput and efficient transaction processing as unmatched advantages. The network’s improving stability post-outages has further bolstered confidence among large-scale investors.

On-Chain Metrics Signal Growing Network Strength

Recent on-chain data shows an uptick in active wallet addresses, transaction volume, and staked tokens on the Solana network. Over 400 million transactions were processed last month alone, reflecting robust network demand. Analysts interpret these figures as indicators of strong user engagement and sustainable network activity, even during market corrections.

Recommended Article: Solana ETF Adoption Signals A Major Inflection For Institutional Crypto Allocation

Solana’s Ecosystem Expansion Accelerates

The Solana ecosystem continues to grow rapidly, with new DeFi protocols, NFT platforms, and AI-integrated projects launching weekly. Developers are drawn to its low fees and high-speed processing, making it a preferred choice for scalable blockchain applications. Partnerships with major projects have also solidified Solana’s role in cross-chain liquidity and decentralized trading.

Technical Outlook: Key Levels and Market Indicators

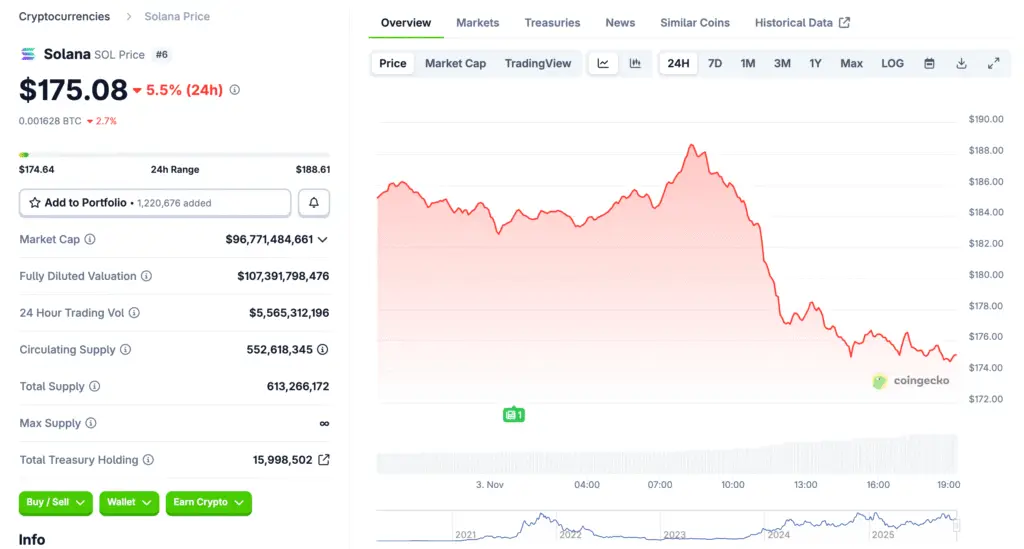

From a technical standpoint, Solana is consolidating around its 0.786 Fibonacci retracement level, between $180 and $190. Bulls are defending this range aggressively, suggesting potential for a short-term rebound toward $200 or higher. A decisive break above $200 could open the door for a rally toward $225, signaling renewed bullish momentum.

Comparison to Ethereum and Layer 1 Competitors

Compared to Ethereum and newer Layer 1 blockchains, Solana continues to lead in transaction efficiency and developer activity. While Ethereum dominates in institutional recognition, Solana’s speed and cost-efficiency have made it a preferred network for high-frequency DeFi traders and game developers. As scalability becomes a central theme in 2025, Solana’s architecture offers a clear competitive edge.

Analyst Predictions for Solana’s Next Bull Cycle

Crypto analysts remain optimistic that Solana could reclaim its all-time highs as the next bull cycle unfolds. Some forecast that SOL could surpass $250 by mid-2026, assuming continued network growth and increased institutional adoption. The combination of real-world utility, low fees, and a thriving developer base supports this long-term bullish outlook.

Conclusion: Solana Remains a Powerhouse in Crypto’s Next Phase

As 2025 progresses, Solana stands out as one of the most reliable and technologically advanced blockchains in the market. Its balance of scalability, efficiency, and developer adoption positions it for sustained growth. For investors seeking exposure to next-generation blockchain infrastructure, Solana remains a cornerstone asset poised to lead the industry’s next evolution.