XRP Takes Center Stage Ahead of Ripple Swell 2025

The annual Ripple Swell conference has once again captured investor attention, with analysts calling it a pivotal moment for XRP. Following the resolution of Ripple’s long-standing legal dispute with the SEC, the 2025 event in New York City marks a potential turning point for mainstream XRP adoption. Enthusiasm is building amid rumors of major announcements and institutional engagement.

BlackRock’s Possible XRP Trust Sparks ETF Speculation

A central focus of this year’s Swell event is the potential unveiling of an iShares XRP Trust by BlackRock. Although the investment giant has remained silent, its attendance at the conference alongside Nasdaq, Citi, and BNY Mellon executives has fueled optimism. BlackRock’s prior success with Bitcoin and Ethereum ETFs suggests that an XRP-backed product could catalyze unprecedented institutional demand.

SEC Delays Open Window for New ETF Filings

The ongoing U.S. government shutdown has stalled formal ETF approvals, yet it has also opened an unexpected window for strategic filings. Under the SEC’s new Generic Listing Standards, BlackRock could introduce an XRP ETF without undergoing the usual lengthy review. Market observers believe this regulatory shift could fast-track new listings once government operations resume.

Recommended Article: XRP Catalysts: OCC Verdict, Senate Moves, and ETF Hopes

Ripple’s Institutional Partnerships Drive Utility Growth

Beyond ETF speculation, Ripple’s corporate collaborations continue expanding. Financial institutions across Asia and Europe are integrating RippleNet and On-Demand Liquidity to streamline cross-border settlements. The network’s growing adoption underscores XRP’s evolution from a speculative asset into a cornerstone of modern fintech infrastructure.

Technical Outlook: Key Levels To Watch

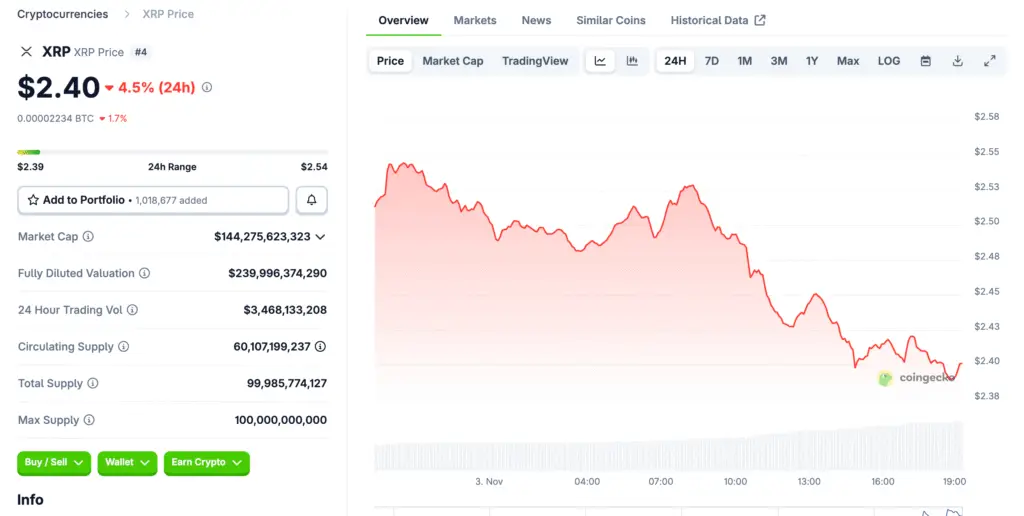

From a technical perspective, XRP has stabilized near $2.52, recovering slightly after an 11% October decline. Analysts are monitoring support at $2.35 and $2.20, while resistance remains near $2.62 and $3.00. A confirmed breakout above $2.80 could reignite bullish sentiment and open the door to retesting the $3.66 all-time high.

Bullish Catalysts: Reopening, ETF Filings, and Regulation

If the U.S. government reopens and the SEC resumes full operations, XRP could benefit from renewed institutional inflows. A confirmed iShares XRP Trust would likely spark major price momentum, especially if large corporations begin holding XRP as part of their treasury diversification strategies. Supportive crypto legislation and Ripple’s application for a U.S. banking license further strengthen the long-term outlook.

Bearish Scenarios Remain Possible

Despite optimism, downside risks persist. A prolonged shutdown, regulatory gridlock, or delayed ETF filings could pressure XRP below $2.35. Market fatigue or lack of institutional follow-through may trigger short-term corrections, especially as traders react to uncertain policy developments.

Outlook: Long-Term Confidence in Ripple’s Vision

Despite potential short-term volatility, XRP’s broader trajectory remains promising. Ripple Swell 2025 could mark the beginning of a new institutional era for the token, driven by regulatory clarity, global partnerships, and the potential entry of BlackRock. With its utility expanding beyond speculation, XRP stands ready to reclaim its position among the market’s top digital assets.