Ripple Strengthens Its Institutional Infrastructure

Ripple, the company behind XRP, continues to expand aggressively despite the token’s recent drop below $2.30. Through a string of high-profile acquisitions and new financial services, Ripple is positioning itself as a leading crypto-native infrastructure provider catering to institutional clients.

Ripple Prime Launches for Institutional Trading

Ripple unveiled its latest offering, Ripple Prime, a digital asset prime brokerage platform designed for institutional investors. The platform provides over-the-counter (OTC) trading for digital assets including XRP and RLUSD, alongside forex, derivatives, and fixed-income products. The goal is to deliver a seamless trading environment that bridges traditional and digital finance.

Cross-Margining Capabilities Enhance Client Efficiency

Ripple Prime’s cross-margining feature allows clients to offset OTC exposure against CME futures and options holdings. This integration enables institutions to manage liquidity more effectively while minimizing collateral requirements—a capability that aligns Ripple with top-tier financial service providers.

Recommended Article: XRP Hits Yearly Profit Low as New Investors Fuel Hopes of Recovery

Strategic Acquisitions Bolster Ripple’s Ecosystem

In parallel with the launch of Ripple Prime, the company acquired crypto wallet provider Palisade. The acquisition enhances Ripple Custody, integrating secure multi-asset wallet management and DeFi compatibility. This follows Ripple’s previous purchases of Metaco, Hidden Road, and Rail, collectively valued at over $1.5 billion.

Global Reach and Regulatory Strength

Ripple’s acquisition strategy complements its extensive regulatory footprint. The firm now holds more than 75 licenses across global markets and maintains partnerships with major institutions like BBVA, DBS, and Société Générale’s crypto division. These licenses support Ripple’s ambition to facilitate compliant institutional adoption worldwide.

Growing Buzz Around Potential XRP ETF Launch

Industry speculation continues to mount regarding an imminent XRP spot ETF. Canary Capital’s recent S-1 filing, along with Bitwise and Grayscale’s disclosed ETF fees near 0.35%, points to an approaching launch window. Market observers predict potential approval by mid-November, which could ignite renewed institutional demand.

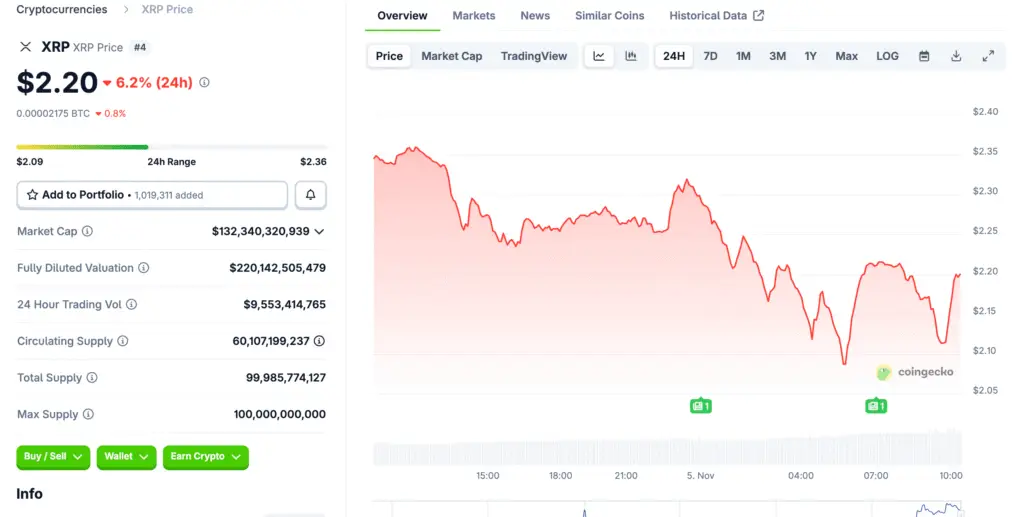

Technical Outlook: XRP Faces Resistance Ahead

XRP’s recent decline to $2.30 reflects broader market weakness. Analysts identify $2.20 as near-term support and $2.50 as initial resistance. Should ETF optimism translate into actual launches, XRP could swiftly rebound toward $2.80 or higher. Conversely, regulatory delays might keep prices subdued through the end of November.

Outlook: Ripple Positions for the Next Institutional Wave

Despite short-term price pressure, Ripple’s strategic acquisitions and infrastructure growth reinforce its long-term vision. By merging traditional financial efficiency with blockchain scalability, Ripple is establishing itself as a cornerstone of next-generation institutional finance. As the market stabilizes, XRP could benefit significantly from the company’s expanding ecosystem and anticipated ETF catalysts.