Bitcoin Recovers as Inflation Data Surprises Markets

Bitcoin staged a strong recovery after US inflation data came in lower than expected, easing pressure across risk assets. The move reversed losses from the previous trading session, when uncertainty around interest rates triggered widespread selling. Investors interpreted the inflation figures as a sign that monetary conditions may loosen sooner than feared.

The rebound reflected renewed confidence that inflation is cooling without triggering aggressive tightening. For crypto markets, which are highly sensitive to liquidity expectations, the data provided immediate relief. Bitcoin’s recovery highlighted how closely digital assets remain tied to macroeconomic indicators.

Softer CPI Numbers Shift Investor Sentiment

The latest Consumer Price Index report showed headline inflation rising at a slower pace than economists had projected. Core inflation, which excludes volatile food and energy prices, also undershot forecasts. Together, the figures suggested that price pressures may be stabilizing rather than accelerating.

Markets had been bracing for hotter inflation after preliminary surveys hinted at stronger price growth. When official data contradicted those expectations, traders quickly adjusted positions. Lower inflation reduced fears that the Federal Reserve would delay or reverse potential rate cuts, lifting sentiment across equities and cryptocurrencies.

Bitcoin Price Action Reflects Risk-On Momentum

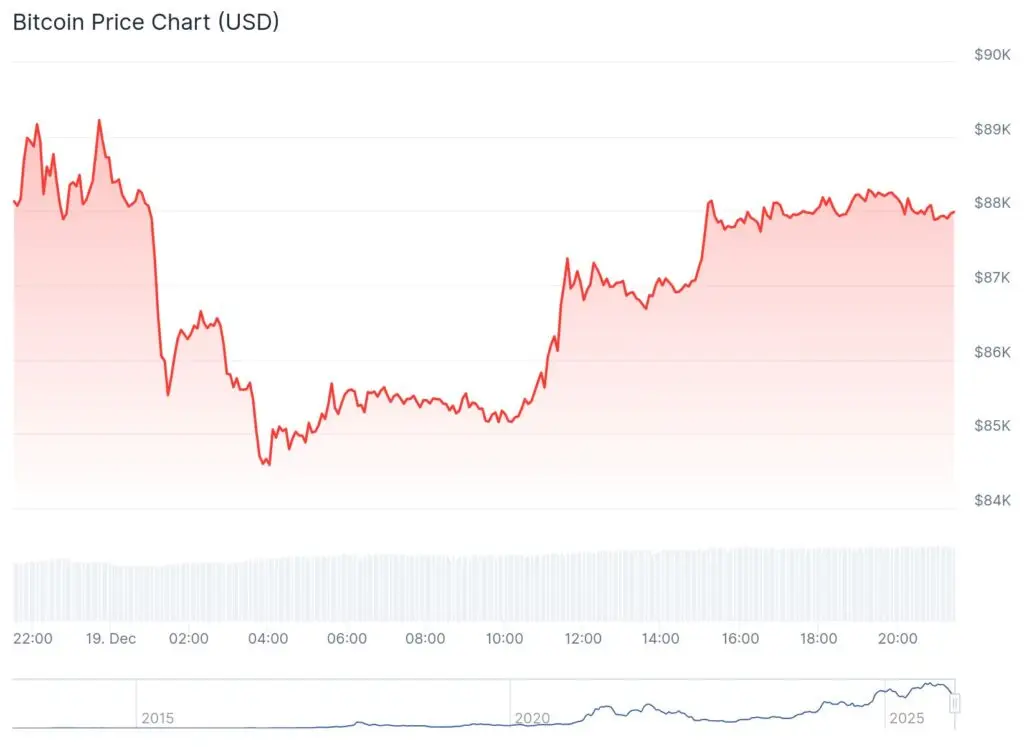

Following the report, Bitcoin climbed sharply from recent lows, recovering ground lost during the prior day’s sell-off. The move was fueled by renewed buying interest as traders unwound defensive positions. Stop-loss levels that had been triggered during the decline were reclaimed, reinforcing short-term bullish momentum.

The bounce demonstrated how quickly sentiment can shift when macro expectations change. While Bitcoin remains volatile, the speed of the recovery suggested that underlying demand remains resilient whenever policy fears ease. However, analysts cautioned that sustained gains will depend on follow-through from broader markets.

Recommended Article: Bitcoin Faces Supply Wall as Selling Pressure Caps Price Recovery

Liquidations Amplified the Prior Decline

The previous day’s sell-off was intensified by leveraged liquidations across crypto derivatives markets. As Bitcoin fell below key technical levels, forced selling accelerated losses. This dynamic is common during periods of heightened uncertainty, when traders reduce exposure simultaneously.

Once prices stabilized, the absence of continued forced liquidations allowed buyers to regain control. The recovery underscored how leverage can exaggerate both downside and upside moves, particularly when markets are reacting to economic data.

Federal Reserve Policy Remains Central to Outlook

Attention is now firmly focused on how the Federal Reserve will interpret the inflation trend. Softer data strengthens the case for eventual rate cuts, but policymakers are likely to remain cautious. Markets will continue to scrutinize upcoming employment and inflation reports for confirmation that price stability is taking hold.

For Bitcoin, expectations around interest rates are critical. Lower borrowing costs and improved liquidity conditions historically support risk assets. Conversely, renewed inflation pressure could quickly reverse recent gains.

Leadership Changes Add Another Layer of Uncertainty

Additional uncertainty comes from speculation surrounding the next Federal Reserve chair. With potential candidates holding differing views on monetary policy, markets are attempting to price in future leadership shifts. Any indication that the next chair favors tighter policy could weigh on risk assets.

Until more clarity emerges, traders are likely to remain sensitive to political developments as well as economic data. This environment reinforces Bitcoin’s role as both a speculative asset and a macro hedge.

Short-Term Optimism Meets Long-Term Caution

While the inflation report provided short-term relief, analysts emphasized that volatility is unlikely to disappear. Structural factors such as global growth risks, fiscal policy shifts, and geopolitical tensions continue to influence markets. Bitcoin’s rebound does not eliminate these challenges, but it does show how quickly sentiment can recover when conditions improve.

As 2025 draws to a close, Bitcoin’s trajectory will depend on whether cooling inflation translates into tangible policy easing. For now, the rally reflects renewed optimism, tempered by awareness that macro risks remain unresolved.