Ethereum Price Stabilizes Amid Market Noise

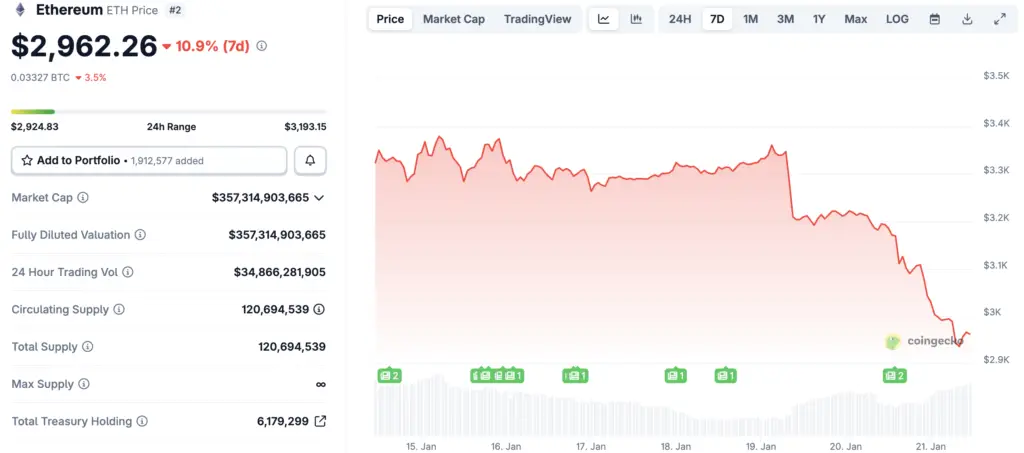

Ethereum entered January 20, 2026, trading within a relatively narrow range after weeks of volatility across crypto markets. While price action has lacked strong directional momentum, the absence of sharp sell-offs suggests growing resilience among long-term holders.

This stabilization comes as broader crypto sentiment remains cautious, shaped by macroeconomic uncertainty, fluctuating risk appetite, and mixed signals from traditional financial markets.

On-Chain Activity Signals Underlying Strength

Despite muted price movement, Ethereum’s on-chain metrics continue to trend higher. Daily transaction volumes, active wallet addresses, and smart contract interactions have all increased steadily since the beginning of the year.

These indicators suggest that Ethereum’s utility is expanding independently of speculative price action, reinforcing its role as core infrastructure for decentralized finance, tokenization, and digital asset settlement.

Layer-Two Adoption Accelerates Across the Ecosystem

Layer-two scaling solutions are playing an increasingly important role in Ethereum’s growth. Rollups and sidechains are now handling a significant portion of network activity, easing congestion and reducing transaction fees on the main chain.

This expansion has improved accessibility for users and developers alike, enabling applications to scale without compromising security or decentralization.

Recommended Article: Ethereum’s Scaling Push Faces Market Test as Adoption Outpaces Price…

Institutional Interest Remains Measured but Persistent

Institutional engagement with Ethereum remains steady even as capital flows fluctuate. Asset managers, hedge funds, and infrastructure providers continue viewing Ethereum as a long-term strategic asset rather than a short-term trading vehicle.

The continued development of regulated custody services, staking products, and compliance-friendly tools has further lowered entry barriers for institutional participants.

Staking and Supply Dynamics Support Long-Term Thesis

Ethereum’s proof-of-stake model continues to reshape supply dynamics. A growing share of ETH remains locked in staking contracts, effectively reducing circulating supply and aligning incentives around network security.

At the same time, periodic token burns tied to transaction activity help offset issuance, contributing to a more disciplined and predictable supply profile than in earlier market cycles.

Competitive Pressure Highlights Ethereum’s Network Effects

Competition from alternative layer-one blockchains has intensified, particularly from networks offering faster execution or lower fees. However, Ethereum’s ecosystem depth remains difficult to replicate.

Developer activity, liquidity, tooling, and enterprise adoption continue clustering around Ethereum, reinforcing network effects that favor durability over short-term performance advantages.

Ethereum’s Outlook for Early 2026

Looking ahead, Ethereum’s trajectory will depend on continued adoption, successful execution of its scaling roadmap, and broader market conditions. Price volatility may persist, but strengthening fundamentals provide meaningful downside support.

For investors, Ethereum’s current phase reflects a broader shift away from speculation and toward utility, positioning the network as a foundational layer in the evolving digital economy.