China’s Slowing Growth Masks a New Competitive Phase

China’s economy is entering a complex transition phase where slower domestic growth coincides with a more aggressive export strategy. While headline indicators suggest deceleration, Chinese manufacturers are expanding global market share at an accelerating pace, intensifying competition across Asia.

This apparent contradiction reflects the limits of China’s long-standing growth model. High investment, strong state coordination, and suppressed household consumption can no longer deliver the expansion rates of previous decades, forcing policymakers to seek external demand as a substitute.

Export Dependence Grows as Consumption Lags

Household consumption remains structurally weak in China, accounting for a far smaller share of national income than in advanced economies. Despite repeated policy pledges to boost spending, wages have not risen fast enough to meaningfully shift purchasing power toward households.

As a result, excess industrial capacity continues flowing outward. Beijing’s export-led adjustment allows factories to stay active, employment to remain stable, and growth targets to be met, but it also deepens trade imbalances and external friction.

Asian Manufacturers Feel the Immediate Impact

The short-term consequences are most visible in Asia’s industrial heartlands. South Korean firms face direct competition from Chinese exporters in automobiles, semiconductors, petrochemicals, and consumer electronics, sectors once dominated by Korean conglomerates.

China’s scale advantage, combined with heavy state support, enables aggressive pricing strategies that squeeze margins across regional supply chains. Even technologically advanced producers struggle to maintain differentiation when confronted with rapid Chinese upgrading.

Recommended Article: Canada Slips Toward Recession as Growth Stalls and Policy Tools…

Industrial Policy Accelerates Competitive Pressure

China’s export surge is not purely market-driven. Coordinated industrial policy continues to channel capital toward strategic sectors such as electric vehicles, batteries, advanced manufacturing, and green technology. These priorities align closely with global demand trends, amplifying competitive overlap.

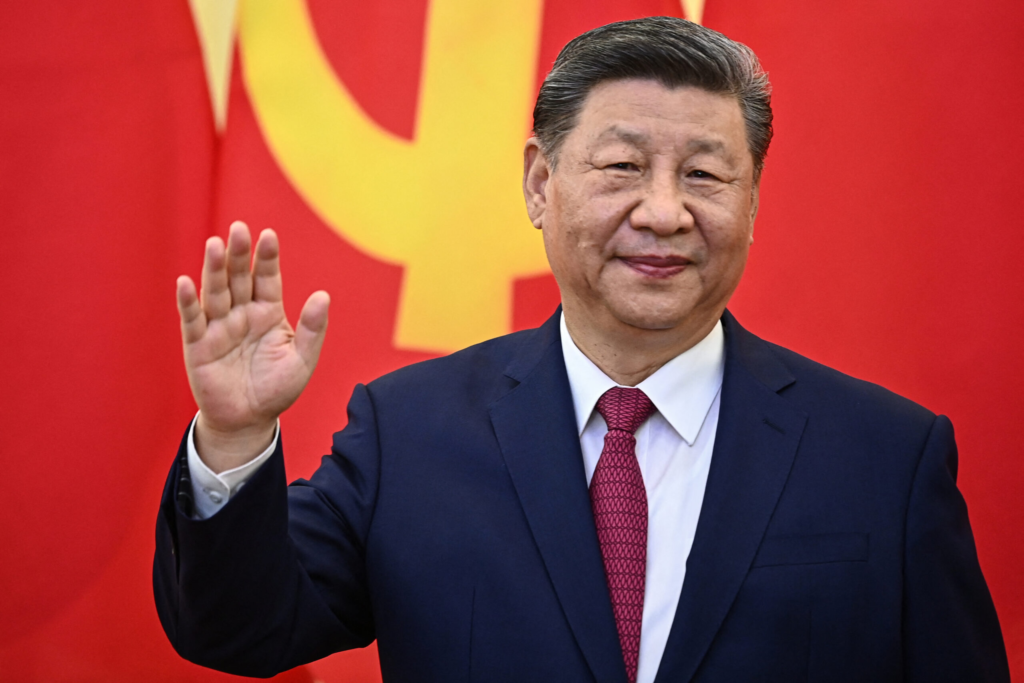

Under the leadership of Xi Jinping, Beijing has emphasized technological self-sufficiency and industrial resilience. This approach reinforces export strength while delaying politically sensitive reforms aimed at boosting household income.

Rebalancing Is Inevitable but Politically Sensitive

Chinese policymakers recognize that long-term stability depends on raising consumption, not exports. However, redistributing national income toward households would require reducing the relative share of state enterprises, local governments, or favored industries, a politically delicate undertaking.

Consumption-led rebalancing is therefore unfolding slowly. In the interim, exports function as a pressure valve, preventing sharper downturns but exporting China’s adjustment costs to trading partners.

Global Trade Frictions Likely to Intensify

As Chinese exports expand, trade tensions are likely to rise. Governments across Asia, Europe, and North America face growing pressure to protect domestic industries without violating multilateral trade rules.

Some countries are turning to targeted subsidies, industrial policy, and strategic tariffs framed within World Trade Organization frameworks. Others are accelerating supply chain diversification to reduce exposure to Chinese competition.

Long-Term Upside After the Adjustment Phase

Despite near-term disruption, China’s rebalancing could ultimately benefit the global economy. If household consumption rises meaningfully, China would transition from exporting excess supply to importing more goods and services, easing competitive pressure worldwide.

For economies like South Korea, this future scenario offers renewed opportunity. Stronger Chinese domestic demand would support exports, innovation investment, and regional growth, but only after a difficult adjustment period.

The challenge for Asian economies is navigating the transition without sacrificing industrial capacity or long-term competitiveness. China’s economic shift is far from over, and its final shape will influence global trade for decades to come.