Ethereum Slides Amid Broader Market Caution

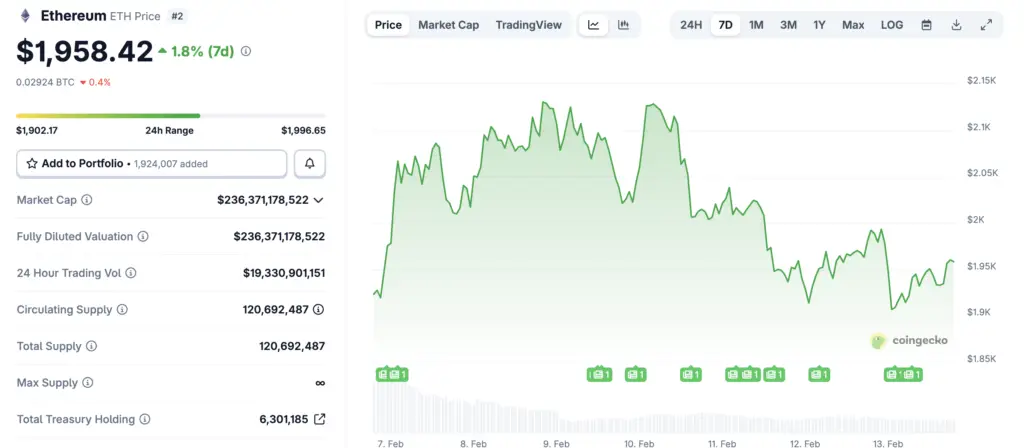

Ethereum retreated modestly in recent trading sessions, reinforcing a pattern of hesitation that has defined much of the crypto market this year. Although the decline was not dramatic, it reflected a fragile environment in which investors remain reluctant to take aggressive positions without clearer economic direction.

The pullback comes as digital assets increasingly respond to global financial developments rather than purely blockchain-specific catalysts. Rising yields, persistent inflation concerns, and shifting expectations around monetary policy have contributed to a more defensive investment climate.

CoinDesk Data Highlights Mixed Technical Signals

Market analytics cited by CoinDesk reveal a complex technical landscape for Ethereum, with indicators pointing neither toward a decisive breakout nor an imminent collapse. The relative strength index has hovered near neutral territory, suggesting that buying and selling pressures remain largely balanced.

Meanwhile, trend measurements indicate weakening directional momentum, a hallmark of consolidation phases. Traders often interpret such conditions as a sign that markets are waiting for a catalyst before committing to a stronger trajectory.

Institutional Investors Show Measured Restraint

Large asset managers appear to be approaching Ethereum with calculated patience, scaling back leverage and focusing on risk management. This shift marks a contrast from earlier crypto cycles characterized by rapid inflows and speculative enthusiasm.

Such restraint does not necessarily imply a loss of confidence in Ethereum’s long-term prospects. Instead, it reflects a broader institutional strategy that prioritizes capital preservation during periods of macroeconomic ambiguity.

Recommended Article: Ethereum Slides Below $2,000 as Volatility Surges

Trading Volume Suggests Waiting Game

Recent volume trends indicate participation below historical averages, reinforcing the perception that many investors prefer observation over action. Lower activity levels often accompany transitional markets where participants seek confirmation before reentering.

When conviction eventually returns, volume typically expands quickly, amplifying price movements in either direction. Until then, subdued trading may help contain volatility while the market searches for equilibrium.

Support and Resistance Levels Define Near-Term Risk

Technical analysts have identified several price zones that could shape Ethereum’s short-term outlook. Holding above key support thresholds is viewed as critical to preventing deeper losses that might undermine sentiment further.

On the upside, reclaiming major moving averages would likely signal renewed strength and attract momentum-driven traders. These levels therefore function as psychological battlegrounds that influence positioning decisions across the market.

Macro Environment Continues to Exert Pressure

Ethereum’s performance increasingly mirrors developments in traditional finance, underscoring crypto’s integration into global capital flows. Expectations surrounding policy decisions from the Federal Reserve remain particularly influential, as tighter financial conditions often reduce appetite for speculative investments.

Geopolitical tensions and uneven economic data have added another layer of uncertainty. Together, these forces have encouraged investors to adopt a more selective approach toward high-volatility assets.

Long-Term Forecasts Still Point to Recovery Potential

Despite near-term caution, many strategists maintain that Ethereum retains meaningful upside over extended horizons. Historical cycles demonstrate the asset’s capacity to recover strongly following consolidation periods, especially when institutional adoption expands.

Ultimately, Ethereum’s trajectory may hinge on the return of liquidity and confidence across risk markets. Until a clearer catalyst emerges, the cryptocurrency appears poised to trade within a defined range, balancing resilient fundamentals against persistent macro headwinds.