The Alarming Rise of “Wrench Attacks”

The cryptocurrency world is facing a disturbing trend: an increase in so-called “wrench attacks”, which are physical assaults and abductions targeting Bitcoin and crypto holders in an attempt to steal their private keys. According to Alena Vranova, the founder of SatoshiLabs, at least one Bitcoiner is kidnapped every week somewhere in the world. Speaking at the Baltic Honeybadger 2025 conference, Vranova issued a stark warning to the crypto community. She emphasised that this is not a problem confined to wealthy “Bitcoin OGs”, but a threat that has now expanded to encompass individuals with even modest holdings.

Vranova cited alarming cases where criminals have targeted people for as little as $6,000 worth of crypto, and tragically, others have been murdered for holdings of just $50,000. This disturbing trend shows that physical attacks against Bitcoiners are on track to double the worst year on record in 2025. This rise in violence is prompting a renewed focus on personal safety countermeasures from investors, developers, and industry executives who are now recognising the severity of the threat.

Centralised Data Leaks Magnify the Threat

The rise in wrench attacks is being exacerbated by data leaks from centralised platforms, with over 80 million Bitcoin and crypto user identities leaked online, with 2.2 million containing home addresses. These leaks, often from centralised crypto exchanges, provide violent criminals with a database of potential targets and their locations.

Large-scale data and password leaks from centralised software providers like Apple, Facebook, and Google have exposed databases containing over 16 billion leaked user login credentials. This data exposure makes crypto holders vulnerable to various malicious activities, including physical attacks, phishing, social engineering, hacking, and identity theft. The confluence of these leaks creates a highly dangerous environment, allowing criminals to use one piece of information to find another, ultimately leading to a target’s home and crypto holdings.

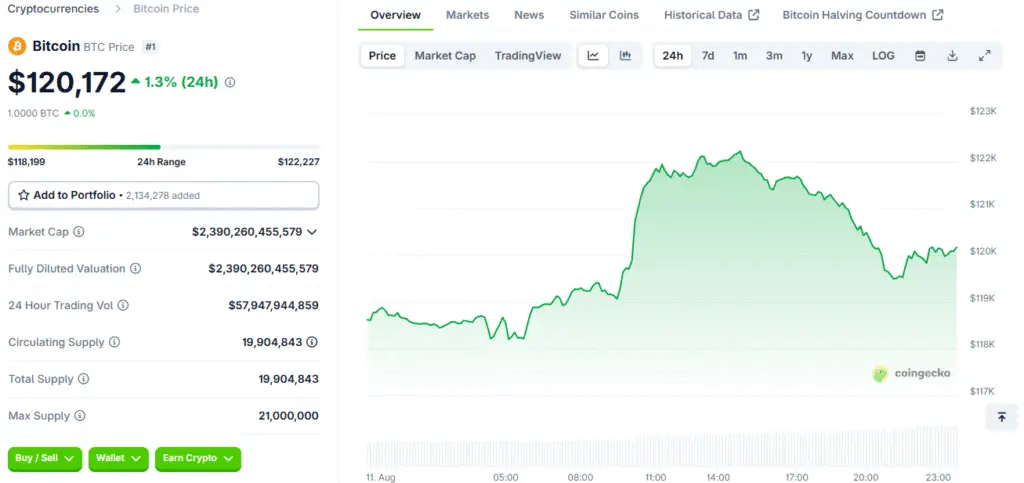

The Correlation Between Price and Attacks

The frequency of wrench attacks is strongly correlated with Bitcoin’s price, with attacks increasing during bull markets as criminal rewards increase. As Bitcoin’s price rises, even small crypto holdings become attractive targets, highlighting the dark side of crypto’s success. The correlation highlights that the value of digital assets also increases the incentive for violent crime.

This creates a unique security challenge for the crypto community, as the success of their assets can put them at physical risk. This reality prompts investors to consider a new layer of security, going beyond firewalls and private keys, to ensure personal safety and physical security.

Physical Safety: A New Security Concern for Bitcoin Holders

Bitcoin and crypto investors should not ignore personal safety measures due to the rise in physical attacks. This includes being discreet about crypto ownership, using hardware wallets to secure private keys offline, and being vigilant about data privacy. Many investors are turning to centralised custodians to mitigate the risk of wrench attacks, but this approach introduces risks as it centralises control of funds with a third party, which can be vulnerable to hacks or digital compromises.

The crypto community faces a complex trade-off between decentralisation’s security and the physical safety offered by centralisation. This trend highlights the need for a holistic approach to security that includes digital protections, heightened awareness of physical threats, and real-world countermeasures.

Read More: Bitcoin Investment El Salvador’s New Bank Law

The Broader Context of Password Leaks

The data leaks from centralised exchanges and other platforms, as highlighted by Vranova, are a serious threat that extends beyond just physical attacks. In May, for instance, crypto exchange Coinbase disclosed a data breach that leaked the information of a small subset of its customers, which included home addresses and other identifying information. Similarly, a report from Cybernews uncovered databases containing more than 16 billion leaked user login credentials from platforms like Apple, Facebook, and Google.

For crypto holders, this level of exposure is particularly dangerous, as a successful phishing, social engineering, or hacking attack can lead to the complete loss of funds without any recourse. These leaks are a reminder that in the digital world, every piece of information is a potential vulnerability, and crypto holders are a prime target for criminals who can use a password from one site to gain access to another.

The Dilemma: Centralisation vs. Decentralisation

The rise of wrench attacks has created a new dilemma for the crypto community, forcing a re-evaluation of the core principles of decentralisation. The ideal of a decentralised, self-custodial wallet is built on the premise that users have full control over their funds and are not subject to the risks of a centralised third party. However, this model also requires users to physically secure their private keys, which now exposes them to a physical threat.

As a result, some investors are opting for the security of centralised custodians, which shifts the risk from a physical threat to a digital one. This trade-off between physical and digital security is a complex issue that the crypto community needs to address. It highlights the need for new, innovative solutions that can provide both the security of decentralisation and the physical safety that is now a critical concern for investors. The future of crypto security may well be a hybrid model that balances these two needs.

A Holistic Approach to Security

The disturbing rise of wrench attacks, fuelled by centralised data leaks and the increasing value of digital assets, is a critical issue that the crypto industry needs to address. Vranova’s warning serves as a powerful call to action for investors, developers, and executives to prioritise not just digital security but also physical safety. This requires a holistic approach that includes using secure hardware wallets, being discreet about crypto ownership, and being vigilant about data privacy.

The industry also needs to develop new, innovative solutions that can provide both the security of decentralisation and the physical safety that is now a critical concern for investors. As the crypto market matures and its value grows, the security challenges will only become more complex, and a failure to address the physical threat to its participants could have a lasting impact on its long-term viability and mainstream adoption. The safety of investors and their families is becoming a critical issue that the entire crypto industry needs to address.