XRP Outpaces Bitcoin and Ethereum in September

XRP has shown strong momentum in September, gaining 5% compared to Bitcoin’s 2.5% and Ethereum’s 4%. This outperformance positions XRP as the top gainer among the three largest cryptocurrencies by market capitalization. Traders and analysts are increasingly watching XRP’s charts for signs of a continuation into October.

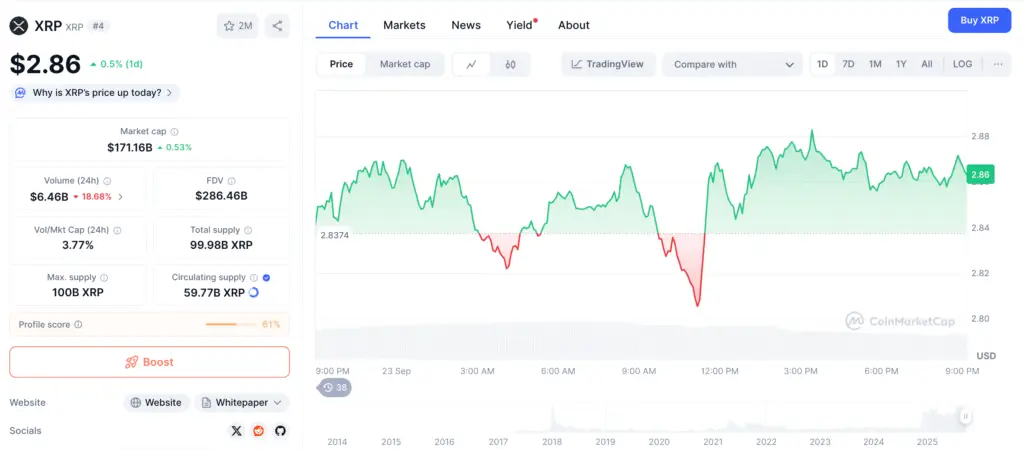

The mid-September U.S. inflation report triggered volatility in Bitcoin, but XRP held steady. Ethereum also saw renewed on-chain activity, though it struggled with early September outflows. Against this backdrop, XRP has quietly built a stronger performance base. Now, XRP is currently trading at $2.86.

Technical Signal: A Bullish 40-Day Falling Wedge

One of the strongest bullish signals for XRP is the recent falling wedge pattern. This technical setup began in late July and lasted through September 1, when trendlines converged to suggest a breakout. Following this, XRP’s price climbed to $3.12 before consolidating near $3.03.

Historically, falling wedges often precede bullish reversals, especially when accompanied by declining volume. XRP’s last wedge earlier this year led to a 93% rally in just over three months. If history repeats, a sustained breakout could power another sharp move higher.

Breaking Psychological Resistance at $3

The $3 price level has long been a psychological barrier for XRP traders. Markets often react strongly at round-number levels, creating clusters of trading activity. When XRP broke above $3.12 on September 13, it showed bulls were prepared to push beyond resistance.

As analysts from Fidelity note, these psychological levels influence trader behavior as much as traditional supply-and-demand dynamics. Holding above $3 in the coming weeks would provide a solid foundation for further gains. If sustained, this could trigger renewed momentum and a stronger October rally.

Recommended Article: Over $1.7B Liquidated as Crypto Prices Slide; XRP Loses Third Spot to USDT

Macro Environment Favors Risk Assets

Beyond technical indicators, macroeconomic forces could serve as fuel for XRP’s next move. The U.S. Federal Reserve’s quarter-point rate cut on September 17 added liquidity to financial markets. Historically, looser monetary policy supports risk assets, including altcoins.

Bitcoin’s larger market cap and more diverse investor base may have already priced in this news. However, XRP could benefit more directly as additional capital flows into smaller, higher-beta assets. For traders looking at Q4 opportunities, macro tailwinds could combine with technical strength to boost XRP.

Investor Sentiment Aligns With Bullish Outlook

In addition to charts and macro trends, investor sentiment plays a crucial role in price action. On-chain data shows that XRP holders have maintained strong conviction, with limited selling despite volatility. This resilience signals confidence in long-term prospects.

Prediction markets and trading desks are also leaning bullish, with increased call option activity suggesting expectations for higher prices. The combination of technical patterns, macro liquidity, and investor psychology makes October a potentially pivotal month for XRP.

October Could Be a Defining Month for XRP

With three bullish signals in play—a confirmed wedge breakout, a decisive push through $3 resistance, and favorable macro conditions—XRP is entering October with strong momentum. Analysts note that while no outcome is guaranteed, the setup aligns with historical patterns that often precede major rallies.

If XRP can hold above $3 and continue attracting liquidity, October could mark the beginning of a new upward cycle. For investors and traders alike, watching these signals may help identify the next big move in the altcoin market.