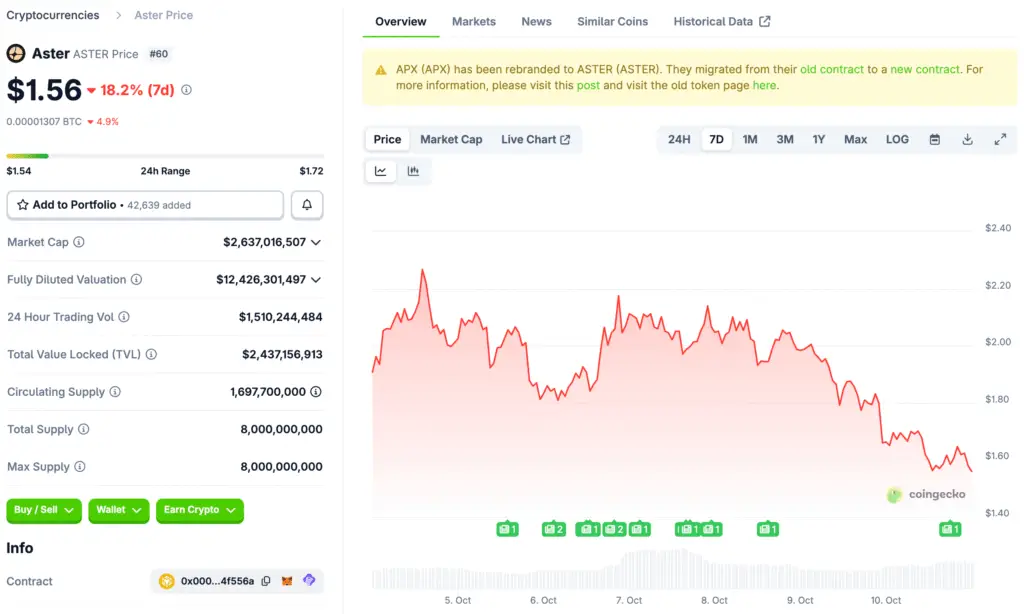

Aster Faces Steep Decline After DeFiLlama Removal

Aster (ASTER) has experienced a significant decline after its unexpected removal from DeFiLlama, attributed to questionable trading-volume inconsistencies. The analytics platform removed Aster from its listings on October 5 after identifying matching volume data with Binance’s perpetual markets.

The announcement of the delisting sparked significant investor anxiety and hastened the outflow of capital. Concerns arose among traders regarding the credibility of Aster’s earlier growth metrics, resulting in a significant price decline and a deterioration of investor confidence.

Whale Wallets Slash Holdings as Selling Pressure Builds

Data from Nansen indicates that whale wallets with over $1 million in ASTER have decreased their positions by 12%. Investors with keen insight have mirrored this trend, reducing their exposure by 37% since the confirmation of the delisting.

Experts view these reductions as initial indicators of waning confidence among institutions. The exits of large holders have intensified selling pressure, causing retail traders to be wary of the token’s short-term trajectory.

Aster Hovers Above Critical $1.77 Floor After 4% Daily Decline in Market Value

Currently, Aster is trading within the range of $1.86 to $2.03, having experienced a decline of nearly 4% in the last 24 hours. The token is currently positioned above a delicate ascending-triangle support zone around $1.77, which has successfully held back declines up to this point.

The loss of this essential floor may undermine the bullish configuration and create a potential route to $1.50. On the other hand, a bounce back above $1.92 and $2.10 could indicate a resurgence of momentum and attract buyers who have been waiting on the sidelines.

Recommended Article: ASTER Token Faces Sell-Off After DeFiLlama Delisting Shock

Technical Indicators Reveal Neutral Momentum Zone

The Relative Strength Index (RSI) remains in the range of 45–50, suggesting a state of balanced momentum, with no definitive signs of being overbought or oversold. Market participants anticipate a surge in volatility as soon as either boundary is decisively breached.

At this point, the 50-period moving average near $1.92 serves as a key resistance level. A consistent advance beyond this level may validate a short-term positive outlook and draw in momentum traders looking for rapid gains.

Aster Targets $2.88 if Breakout Gains Volume but Faces Risk Below the $1.50 Support Zone

Chart analysis reveals two possible directions based on whether volume validates a breakout. A move past $2.15 with robust involvement could drive ASTER to $2.88, indicating a potential 56% increase.

Should support falter, the downside target is projected to be between $1.50 and $1.55, with analysts cautioning about a potential liquidity vacuum in that range. Falling beneath $1.50 may set off a wave of sell-offs as stop-loss orders are triggered on prominent exchanges.

On-Chain Metrics Show Weakening Network Confidence

Recent blockchain data indicates a downward trend in activity, with daily transaction counts and the number of active wallets showing a decline. The 37% reduction in smart money highlights a waning confidence among knowledgeable investors keeping an eye on liquidity risk.

These changes in behavior frequently signal a period of prolonged consolidation or additional declines in price. In the absence of significant holders returning or fresh investments coming in, Aster might find it challenging to regain its bullish momentum in a market that is currently risk-averse.

Aster Awaits Market Rebound as Bitcoin and Ethereum Consolidate Near Key Levels

Bitcoin recently reached $126,000 before pulling back to $122,000, while Ethereum is trading around $4,450 as the market undergoes general consolidation. Experts observe that Aster’s immediate trajectory is heavily influenced by the overall mood of the market.

A rebound in key cryptocurrencies might enhance Aster’s perspective and assist in regaining previously lost technical levels. Nonetheless, ongoing weakness in key assets could intensify current pressures, bringing ASTER nearer to its $1.77 support level.