On-Chain Data Highlights Avalanche’s Network Resilience

Avalanche (AVAX) demonstrates strong resilience even within a quiet market environment. Recent data shows total network fees surpassing 4.9 million AVAX, underscoring steady user engagement across its C-Chain. Experts note that this consistent fee growth reflects genuine on-chain activity, a solid indicator of organic demand.

Blockchain researcher M. Talha Altınkaya highlights that Avalanche’s ecosystem represents one of the most sustainable models among layer-1 networks. With 4.8 million AVAX generated from C-Chain fees alone, the platform continues to prove its growing role in decentralized applications and DeFi systems, showcasing lasting adoption and functional utility.

Indicators Point to a Potential Breakout on the Horizon

Analysts tracking Avalanche’s charts now recognize a promising consolidation stage that may precede a breakout. Trader Razz notes that the prolonged stagnation has created notable compression beneath resistance, often signaling an approaching major move.

Price action reveals a series of higher lows, suggesting accumulation by long-term investors. Once AVAX achieves a breakout above the dotted trendline, experts expect a rally toward $50, with buying pressure likely to strengthen as volume increases near resistance.

AVAX Technical Analysis: Buyers Uphold Crucial Support Levels

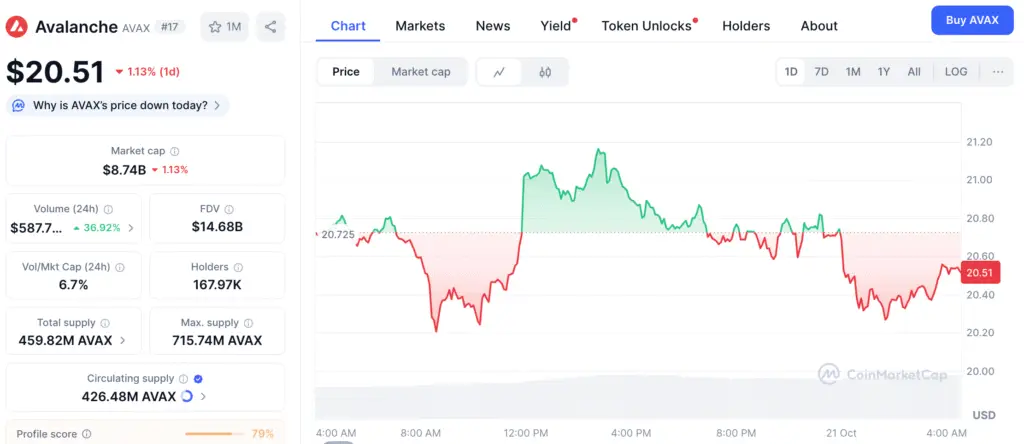

Avalanche’s chart shows solid support between $19 and $21, where gradual recovery signs are emerging. Technical analyst Emirhan identifies this price zone as a pivotal inflection point that could determine the asset’s next direction.

If AVAX pushes beyond short-term resistance around $25 to $27, renewed optimism may attract traders seeking trend validation. The formation of higher lows reflects a shift toward bullish control, reducing short-term downside risk and reinforcing investor confidence.

Recommended Article: Avalanche Price Holds Key Support With Breakout Move Ahead

Historical Q4 Performance Strengthens Optimistic Outlook

The fourth quarter has historically been favorable for Avalanche. In Q4 2023, AVAX surged from $9 to $50 within two months following an extended accumulation phase. This pattern provides a benchmark for traders looking to capture similar upside potential in the current cycle.

Analyst Viktor points out that the recurring structure of compression, recovery, and breakout is forming once again. If macro conditions remain stable and liquidity improves, Avalanche could follow its familiar recovery path, aligning with the broader bullish momentum seen in major layer-1 assets.

Increasing Energy and Strengthening Blockchain Trust

Avalanche’s steady network fees and consistent validator engagement have helped sustain investor trust as the year closes. Rising on-chain liquidity and stable transaction counts highlight that AVAX price movements are driven by tangible utility rather than short-term speculation.

The strong rebound from previous lows and continued increase in transaction volume suggest that strategic accumulation is underway. Experts indicate that expanding network usage could lift AVAX toward the $30 to $35 range before testing its next major resistance near $50.

AVAX Aims for $50 as Framework Strengthens

Avalanche is currently valued at $21.02, recording a daily gain of 5.11%. The token remains above key moving averages on daily charts, signaling renewed upward momentum. Maintaining a price above $20 could significantly improve the odds of an advance toward $30.

If historical fourth-quarter trends persist, Avalanche might experience a multi-stage rally beginning with stabilization above resistance and evolving into momentum-driven gains. This setup aligns with the classic accumulation-to-expansion model often preceding strong market recoveries.

Q4 2025 Could Mark Avalanche’s Next Breakout Cycle

Avalanche’s combination of robust technicals, growing on-chain metrics, and seasonal strength supports a positive forecast heading into late 2025. Its expanding user base and real-world adoption underline a thriving layer-1 network built for sustainability.

With dependable support zones and rising network activity, Q4 2025 may represent a turning point for Avalanche’s long-term trajectory. If the current momentum holds and resistance is broken decisively, analysts agree that a move toward the $50 level could soon materialize, reaffirming Avalanche’s leadership among the top-performing layer-1 blockchains.