AVAX’s Price Fluctuations Disrupt Payroll Consistency

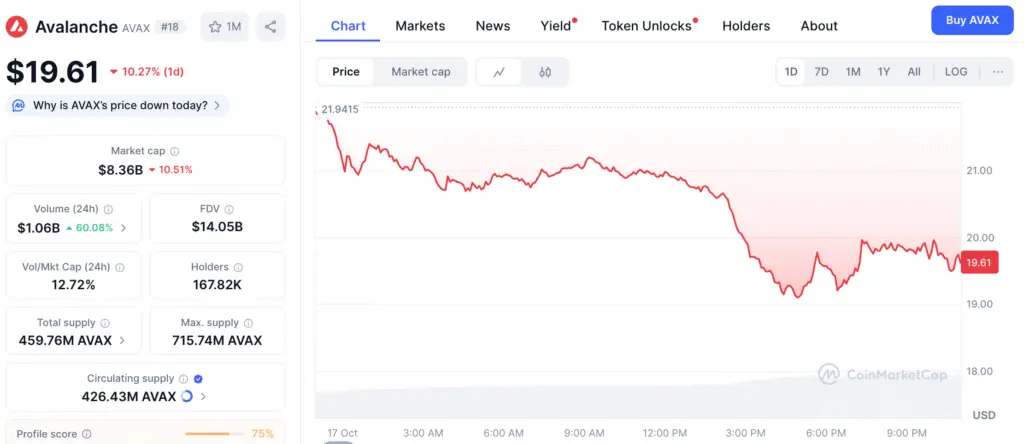

Avalanche (AVAX) is at the forefront of the changing crypto payroll landscape, yet its fluctuating price dynamics present a challenge for widespread adoption. In the past few months, AVAX has experienced significant fluctuations, ranging from $15 to $30, leading to uncertainty for businesses handling payroll budgets.

For companies utilizing AVAX for employee compensation, significant price fluctuations can swiftly impact salary values—creating challenges in accounting, compliance, and employee satisfaction. As the token approaches critical support levels, the prevailing market sentiment plays a pivotal role in determining whether companies opt to retain, convert, or hedge AVAX for payroll purposes.

SMEs Face the Toughest Road in AVAX Integration

Small and medium-sized enterprises (SMEs) continue to face significant risks due to AVAX’s fluctuations. In contrast to major corporations that have financial reserves, small and medium-sized enterprises encounter significant liquidity challenges when token values decline after transactions. This may result in unequal compensation and possible dissatisfaction among employees.

The lack of clear regulations introduces an additional challenge. Numerous regions continue to operate without definitive guidelines for cryptocurrency payroll, compelling small and medium-sized enterprises to allocate additional resources towards compliance and tax advisory services. Nonetheless, the minimal transaction costs and rapid settlement periods of Avalanche present a compelling option for smaller enterprises aiming for enhanced cross-border efficiency.

Effective Approaches to Mitigate AVAX Fluctuations

To address these challenges, experts suggest implementing hybrid payroll models and utilizing stablecoin hedging strategies. Certain companies divide their compensation structure, allocating a segment in AVAX to harness growth potential, while the remainder is distributed in USDT, USDC, or fiat to ensure stability. This method harmonizes creativity with consistent value provision.

Some individuals depend on automated systems that convert AVAX to stablecoins prior to payout, securing real-time rates and reducing exposure. Informing team members about the unpredictable nature of cryptocurrencies aids in alleviating concerns and setting realistic expectations, especially in rapidly changing market environments.

Recommended Article: Avalanche 2025 Outlook Points to Price Recovery Toward $120

Exploring New Avenues in Crypto Payroll

Despite its challenges, AVAX remains a driving force behind innovative payroll solutions that circumvent conventional banking intermediaries. Companies implementing cryptocurrency salary systems experience enhanced speed, transparency, and cost efficiency, especially beneficial for remote and international teams.

Additionally, compensating employees in AVAX or other digital currencies can draw in talent familiar with the crypto space, establishing companies as innovative leaders in the industry. If AVAX increases in value, it has the potential to enhance a company’s financial standing, transforming payroll from a liability into a possible driver of growth.

The Future of AVAX in Decentralized Payroll Solutions

With the ongoing integration of blockchain technology, Avalanche stands out due to its scalable infrastructure and minimal fees, positioning itself as an ideal choice for enterprise payroll solutions. The token is expected to see better performance as the adoption of decentralized finance grows and market volatility stabilizes.

Innovative companies that embrace risk-reduction measures and clear communication approaches may gain advantages from being early adopters in this financial evolution. With appropriate measures in place, AVAX could connect conventional payroll systems with decentralized finance, paving the way for the next evolution in crypto-salary advancements.