Bitcoin’s Decade of Explosive Growth Sets the Stage for More

Over the past 10 years, Bitcoin has surged more than 41,200%, evolving from a niche concept into a globally recognized asset. Despite periods of volatility, its consistent long-term rise has established it as the most successful investment of the digital era. Analysts now believe that the next decade will define Bitcoin’s ultimate role in the world’s financial system.

Bitcoin’s position as digital gold is growing stronger as institutional adoption accelerates and supply remains limited, fueling long-term demand. Experts suggest that if Bitcoin continues its current growth trajectory, it could approach $1 million per coin by 2035.

Major Headwinds: Regulation, Quantum Computing, and Competition

Bitcoin still faces several challenges that could shape its future. Regulatory uncertainty remains one of the biggest concerns, as governments worldwide implement differing rules for digital assets. A harsher regulatory stance could restrict capital flows and slow innovation across the crypto industry.

Another emerging threat is quantum computing. If future technological advances render current encryption systems vulnerable, Bitcoin’s security model could face theoretical risks. Developers, however, are already researching advanced cryptographic upgrades to safeguard the network from these potential threats.

Stablecoins and New Cryptocurrencies Add Competitive Pressure

Competition from stablecoins and alternative blockchains continues to grow as users demand faster and cheaper global payment options. Stablecoins already process billions of dollars in daily transactions, appealing to individuals and businesses wary of volatility.

Meanwhile, new blockchain networks experimenting with modular architecture and enhanced interoperability may divert liquidity away from Bitcoin in the near term. Despite these challenges, Bitcoin’s brand recognition, network security, and decentralized structure remain powerful defensive advantages.

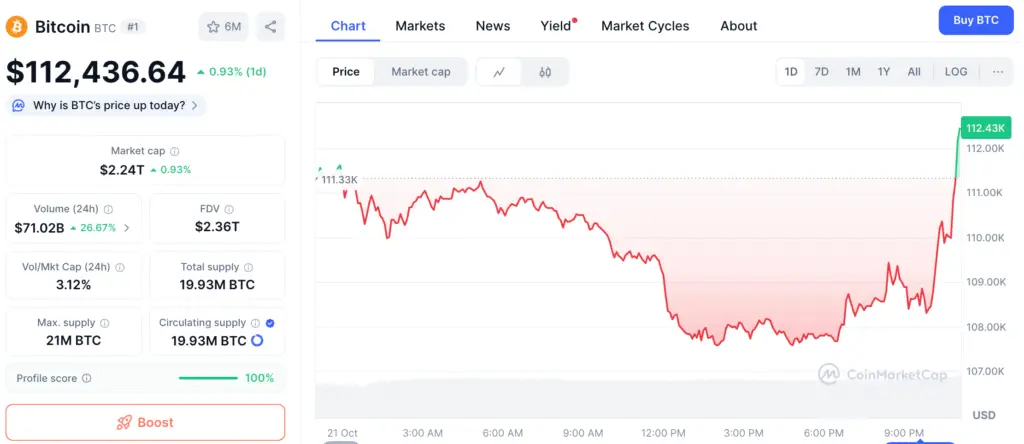

Recommended Article: Bitcoin Price Tests $112K as Traders Watch Key Breakout Zone

Bitcoin’s Hard-Capped Supply Fuels Long-Term Scarcity

A central pillar of Bitcoin’s investment appeal is its hard-capped supply of 21 million coins. The halving event, which occurs roughly every four years, reduces block rewards and tightens issuance rates. This deflationary system ensures a limited supply that strengthens Bitcoin’s scarcity narrative.

As global demand increases, Bitcoin’s inability to expand supply reinforces upward price pressure. Analysts compare this to gold, which can increase production when prices rise, whereas Bitcoin’s supply remains permanently fixed.

Why Bitcoin Could Approach Gold’s Market Value

Bitcoin’s current market capitalization sits around $2.2 trillion, less than one-tenth of gold’s $30 trillion valuation. Analysts believe Bitcoin could narrow that gap significantly over the next decade as adoption spreads among institutions and individuals.

Unlike gold, Bitcoin is fully digital, divisible to eight decimal places, and transferable across borders within minutes. In a rapidly digitizing economy, these attributes make it a more flexible and accessible store of value for the modern era.

Institutional Adoption Reinforces Long-Term Confidence

Institutional adoption continues to grow as corporations, asset managers, and even sovereign wealth funds allocate portions of their portfolios to Bitcoin. Many view it as a hedge against inflation, currency devaluation, and macroeconomic instability.

Experts predict that more nations may follow El Salvador’s example by integrating Bitcoin into national financial strategies. By 2035, these cumulative moves could make Bitcoin one of the most widely held and influential financial assets globally.

Bitcoin’s Path to $1M Hinges on Decentralization and Global Adoption

Bitcoin’s long-term success will depend on maintaining decentralization, enhancing network security, and scaling efficiently. Although regulatory and technological uncertainties persist, global demand for an inflation-resistant, borderless asset continues to strengthen.

If adoption rates sustain and market conditions remain favorable, Bitcoin could multiply tenfold from its current price, potentially surpassing $1 million per coin. With its blend of scarcity, utility, and institutional credibility, Bitcoin is poised to anchor the next generation of global finance.