Bitcoin Declines Sharply Following Renewed Tariff Dispute

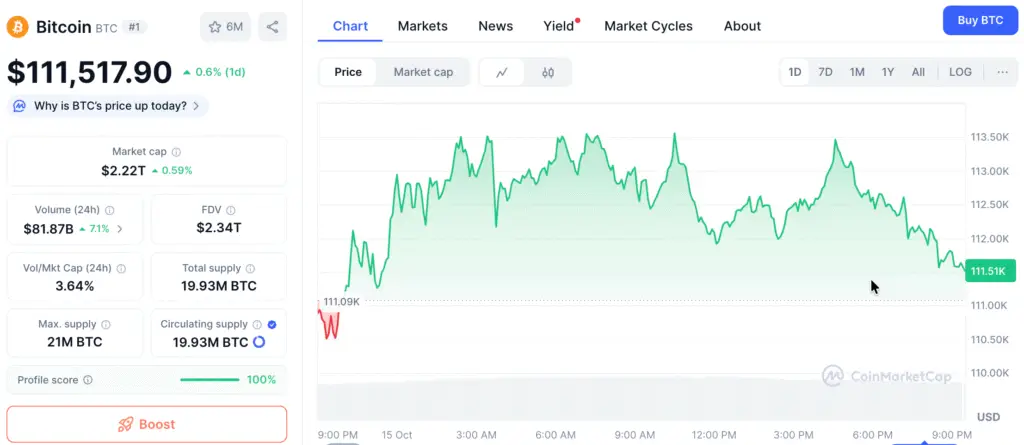

This week, Bitcoin’s upward momentum took a significant hit as prices fell to $109,945, following a resurgence of trade tensions between the U.S. and China that sparked caution among investors. The cryptocurrency saw a brief surge to $116,000, only to decline once more, wiping out the majority of its gains from earlier in the week.

The downturn followed China’s imposition of sanctions on U.S.-manufactured components utilized by South Korean companies, intensifying an already precarious economic impasse. Experts indicated that this action heightened risk-averse sentiment, compelling traders to lessen their involvement in cryptocurrencies.

A Broad Market Decline Results in a Loss of $210 Billion

The resurgence of the tariff conflict led to a swift withdrawal from risk assets, reducing the overall crypto market capitalization from $3.96 trillion to $3.75 trillion in just 24 hours. Bitcoin, representing about 50% of the market, experienced the majority of the sell-off.

Altcoins like Ethereum and Solana experienced slight recoveries, yet Bitcoin’s technical configuration continued to exhibit bearish tendencies. Traders observed that the $110,000–$112,000 support zone has emerged as a crucial level to protect against further declines.

Experts Caution About Extended Weakness

Juan Perez, the trading director at Monex USA, noted that the relationship between global equities and cryptocurrency continues to be strong. He observed that Bitcoin generally shows stronger performance during periods of stability in traditional assets and when liquidity conditions are advantageous.

“While U.S.-China relations stay unpredictable and investments are heavily focused on technology, cryptocurrencies such as Bitcoin will likely encounter challenges,” Perez noted in a market update on Tuesday.

Recommended Article: Strategy Expands Bitcoin Holdings With $27.2 Million Purchase

U.S. Seizes $15 Billion in Bitcoin From Scam Network

In a significant enforcement operation, authorities from the U.S. and U.K. confiscated over $15 billion in Bitcoin associated with a large-scale fraud scheme originating in Cambodia. Authorities claim that the criminal organization deceived victims worldwide, taking advantage of trafficked labor to run fraudulent operations.

Joseph Nocella, the U.S. Attorney for Brooklyn, characterized the operation as one of the most significant recoveries from investment fraud ever recorded. This action highlights advancements in blockchain forensics and reflects a wider governmental initiative aimed at enhancing regulation in the cryptocurrency sector.

Tightening Oversight Adds Uncertainty to Crypto Markets

The retrieval of billions that were taken unlawfully Bitcoin has sparked a revival of investor trust in regulatory effectiveness, while simultaneously bringing to light worries regarding future compliance obligations. Heightened scrutiny could exert pressure on unregulated exchanges and assets that prioritize privacy.

Market analysts indicate that although enhanced security offers advantages to users, too much oversight might diminish the attractiveness of decentralized ecosystems. The equilibrium between regulation and innovation is crucial for the upcoming growth phase of cryptocurrency.

Bitcoin Price Outlook Remains Cautious but Stable

Bitcoin is presently trading within the range of $110,000 to $116,000, stabilizing following a series of turbulent trading sessions. Technical resistance is positioned at $116,000, as moving averages indicate a bearish crossover pattern that may limit short-term rallies.

Should the price surpass $116,000, a shift toward $120,000 could be on the horizon. On the other hand, a decline beneath $110,000 could result in tests around $105,000. Projections indicate a positive turnaround is likely as macroeconomic pressures ease over time.

Investors Diversify Into New Bitcoin-Layer Projects

With Bitcoin in a phase of consolidation, attention from investors is now turning to smaller, yet innovative blockchain initiatives like Bitcoin Hyper. A layer-2 solution has successfully secured $23.8 million in presale funding, drawing interest with over 450 million token sales.

Bitcoin Hyper seeks to improve Bitcoin’s scalability and transaction speed by integrating with the Solana Virtual Machine. This initiative offers minimal gas fees, impressive throughput, and comprehensive backing for DeFi and NFTs, which could broaden Bitcoin’s functionality across various ecosystems.