Bitcoin Consolidates as Traders Evaluate Market Trends

Bitcoin continues to trade within a controlled range, maintaining stability near the $92,000 level as traders closely monitor sentiment across global markets. While short-term momentum remains muted, the price behavior suggests that buyers and sellers are currently balanced, keeping volatility contained during consolidation.

Market conditions in recent weeks reflect cautious optimism as investors respond to mixed ETF flows and broader macroeconomic signals. Despite subtle pullbacks, Bitcoin’s ability to sustain support levels has encouraged long-term participants to continue accumulating throughout moments of uncertainty.

ETF Flows and Market Liquidity Drive Short-Term Sentiment

ETF activity remains one of the strongest influences on Bitcoin’s immediate performance, with institutional flows shaping much of the market’s short-term narrative. Shifts in ETF inflows and outflows have directly affected liquidity, contributing to sideways trading patterns rather than decisive breakout movements.

Even with fluctuating ETF momentum, institutional desks appear confident in Bitcoin’s long-term trajectory. Their consistent accumulation near dips reinforces the belief that Bitcoin remains a strong hedge within a volatile economic landscape, especially as adoption strengthens across global financial markets.

Technical Structure Shows Stabilization Above Key Support Zones

Bitcoin currently trades below major EMA indicators, signaling a softening of bullish strength while maintaining an overall neutral short-term trend. Support around the $90,000 area has held firmly, with recurring buyer interest preventing deeper pullbacks and supporting the consolidation structure.

Resistance remains strongest around the $92,000 to $92,500 range, where multiple retests have encountered temporary exhaustion. However, continued pressure at this zone suggests that an eventual upward break is possible if volume increases alongside renewed interest from market participants.

Recommended Article: Bitcoin Set for Potential December Rally Toward One Hundred Eleven…

Bitcoin Price Forecast for December 2025 Points Toward $111K

Current predictive models indicate that Bitcoin could rise approximately 22 to 23 percent by December 2025, reaching an estimated target of $111,500. This projection is supported by factors such as improving global liquidity, strengthened demand from institutions, and declining available supply across major exchanges.

Market analysts emphasize that adoption trends, macroeconomic support, and maturing market infrastructure continue to position Bitcoin for long-term appreciation. With broader investor confidence returning, conditions appear favorable for a sustained upward trajectory through late 2025.

Long-Term Trend Strengthens as Market Recovers From Prior Volatility

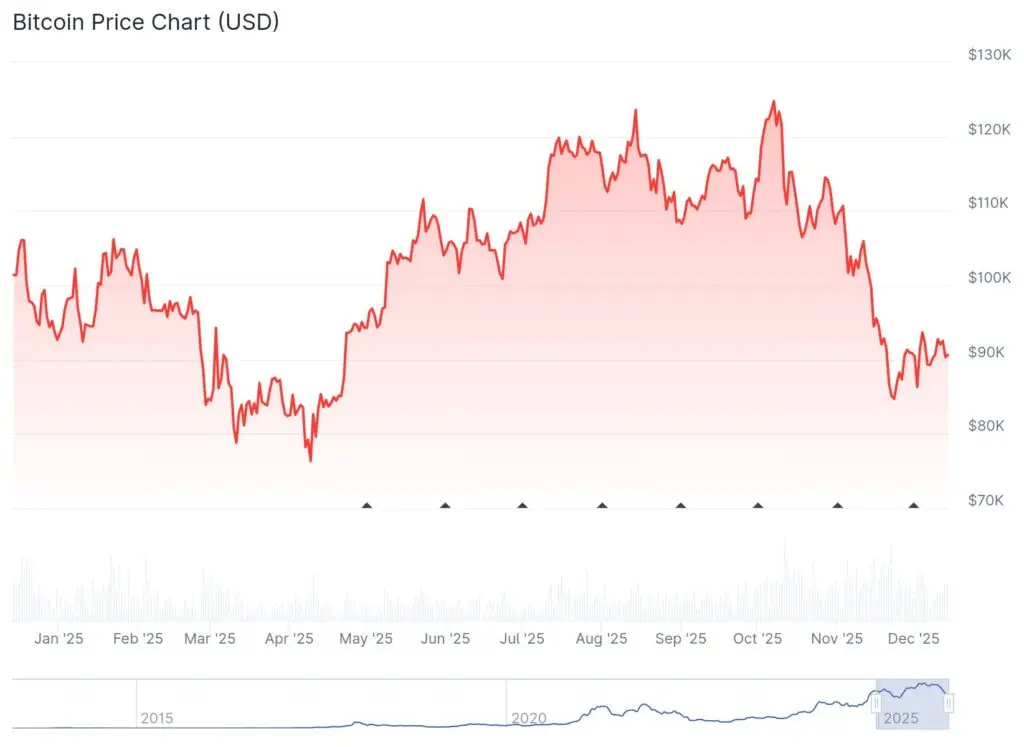

Despite strong fluctuations in October 2025, where Bitcoin surged to new highs near $126,000 before correcting below $100,000, long-term market fundamentals remain constructive. Analysts interpret the correction as a healthy reset within a larger expansion cycle, supported by stable on-chain metrics and durable buying interest.

If ETF demand rebounds in the coming months and global economic conditions stabilize, Bitcoin could potentially revisit the $130,000 to $140,000 range by the end of 2025. These projections highlight the resilience of Bitcoin’s ongoing cycle despite episodic volatility.

Short-Term Price Predictions Show Gradual Growth Potential

Short-term models suggest that Bitcoin could rise by approximately 1.2 percent within the next 24 hours, targeting a move toward the $92,300 level. This forecast is based on steady market sentiment, stable volume patterns, and improving indicator trends that support mild upward movement.

Weekly forecasts present a more optimistic scenario, predicting a potential rise of nearly 3.8 percent if buyers regain momentum. A successful move toward the $94,700 range would reinforce Bitcoin’s emerging recovery phase and support efforts to reclaim higher resistance levels.

Long-Term Forecasts Through 2030 Indicate Expanding Growth Trajectory

Price projections for Bitcoin from 2025 to 2030 show increasing confidence in long-term appreciation, driven by adoption, supply constraints, and institutional maturation. Forecasts indicate that Bitcoin could average $95,000 in 2025, rising steadily to $250,000 by 2030 under favorable conditions.

These long-term models highlight expected growth across multiple time horizons, with potential ranges widening as macroeconomic factors evolve. While volatility remains a defining characteristic of the asset, its expanding role in global finance continues to reinforce strong expectations for upward momentum.